Oil Steadies as Industry Report Points to Rising US Stockpiles

(Bloomberg) -- Oil was steady after declining on Tuesday as an industry report signaled a small build in US crude inventories ahead of official data.

Brent traded above $85 a barrel and West Texas Intermediate was near $81. The American Petroleum Institute reported crude stockpiles rose by about 900,000 barrels last week, according to people familiar with the figures. Holdings at the Cushing storage hub fell, however.

The Energy Information Administration is scheduled to release its data on inventories, refining and fuel demand later Wednesday.

Oil is on track for a monthly advance and analysts are becoming more bullish about the outlook in the next quarter on a tightening market. An escalation of geopolitical tensions from Yemen to Russia could also underpin further price gains. Later this week, traders will be watching inflation and other economic data for clues on the path forward for interest rates.

“Tightening fundamentals through the third quarter of the year leaves us supportive toward the market,” said Yeap Jun Rong, a market strategist for IG Asia Pte in Singapore. In the short term, there’s expected to be caution ahead of the release of inflation data this week, he added.

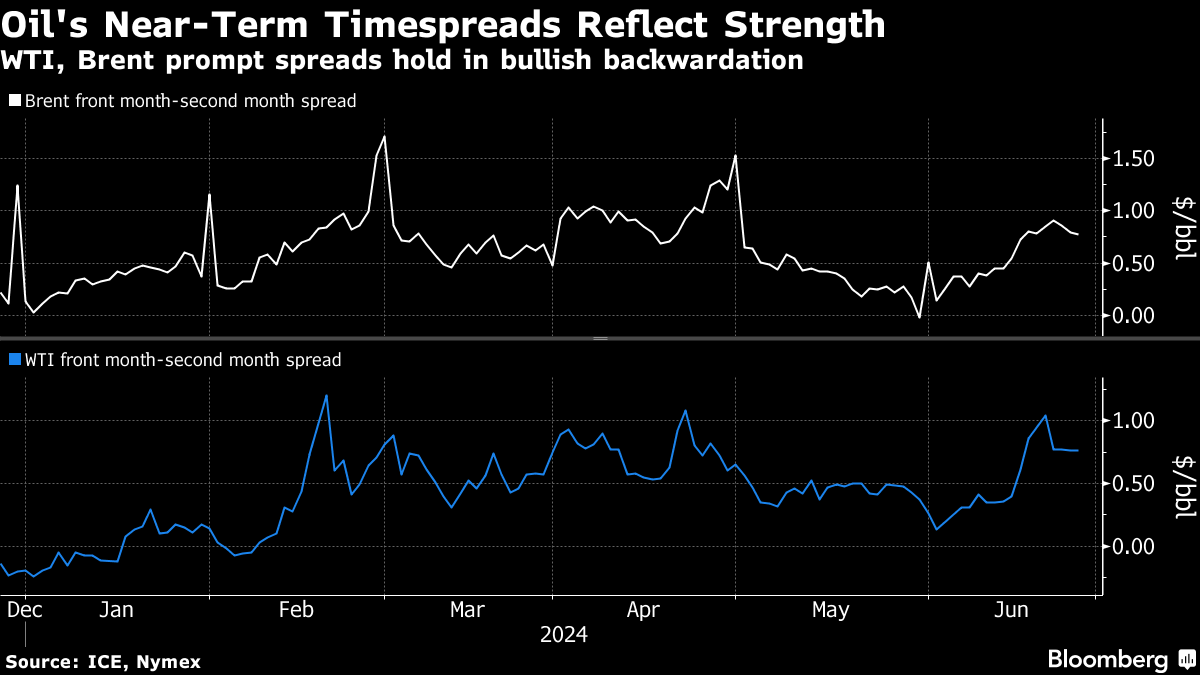

Prompt time spreads for Brent and WTI have widened in a bullish backwardation structure this month, and money managers have recently increased their bets on a range of products including ICE gasoil, Europe’s diesel benchmark.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company