Oil Extends Gain Even as Saudi Price Cut Signals Demand Concerns

(Bloomberg) -- Oil rose for a second session even as Saudi Arabia signaled concerns over the demand outlook with cuts to its crude prices.

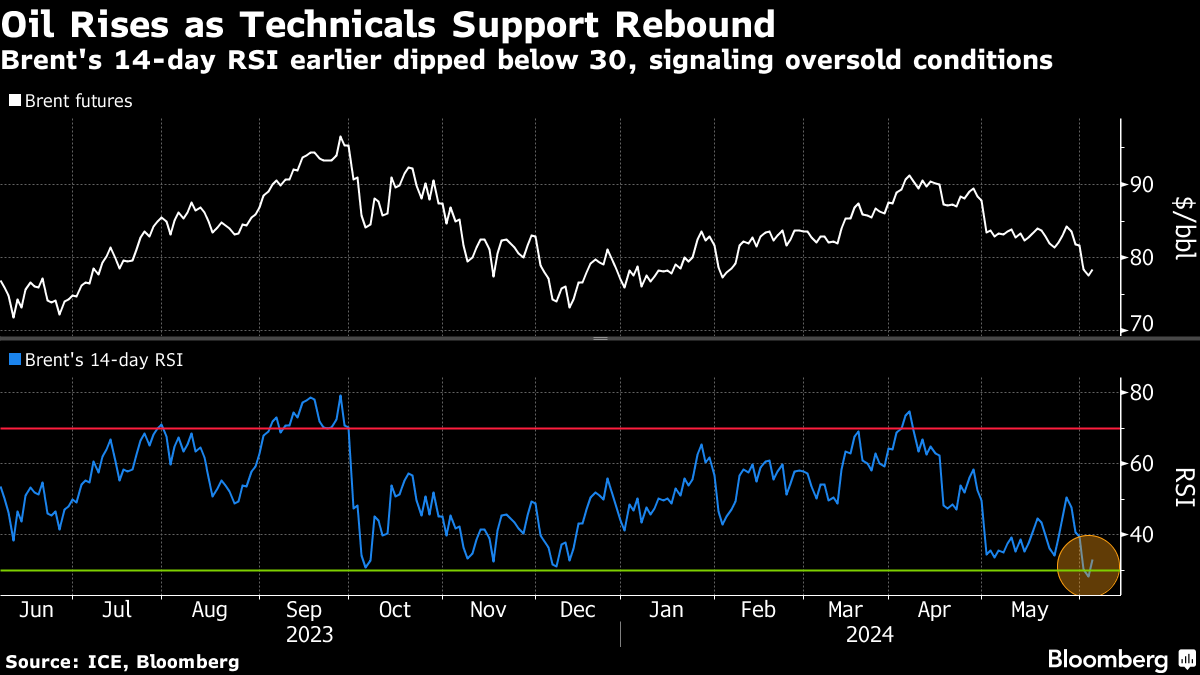

Brent climbed toward $79 a barrel and West Texas Intermediate traded near $75, extending a modest recovery following a selloff after OPEC+ flagged plans to start returning supply to the market. The price decline had pushed both benchmarks into oversold territory on the 14-day relative strength index.

However, Saudi Aramco has lowered prices for all of its oil to Asia next month — the first reduction since February — raising concerns over the strength of demand in the world’s top crude importing region.

Oil has trended lower since early April on a dour outlook from top importer China and as geopolitical tensions eased. Supply from rivals of the Organization of the Petroleum Exporting Countries and its allies has also increased, raising concerns over whether the market can absorb the extra OPEC+ barrels.

US crude inventories rose by 1.23 million barrels last week, according to government data released Wednesday, adding to the bearish outlook. Gasoline stockpiles climbed for a second week to the highest since March.

“The market is showing resilience”, despite US stockpile builds, said Charu Chanana, an analyst at Saxo Capital Markets Pte in Singapore. “Traders found technical reasons to buy.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad