China’s Mega-Dams Doused by Heavy Rains in Clean Energy Boost

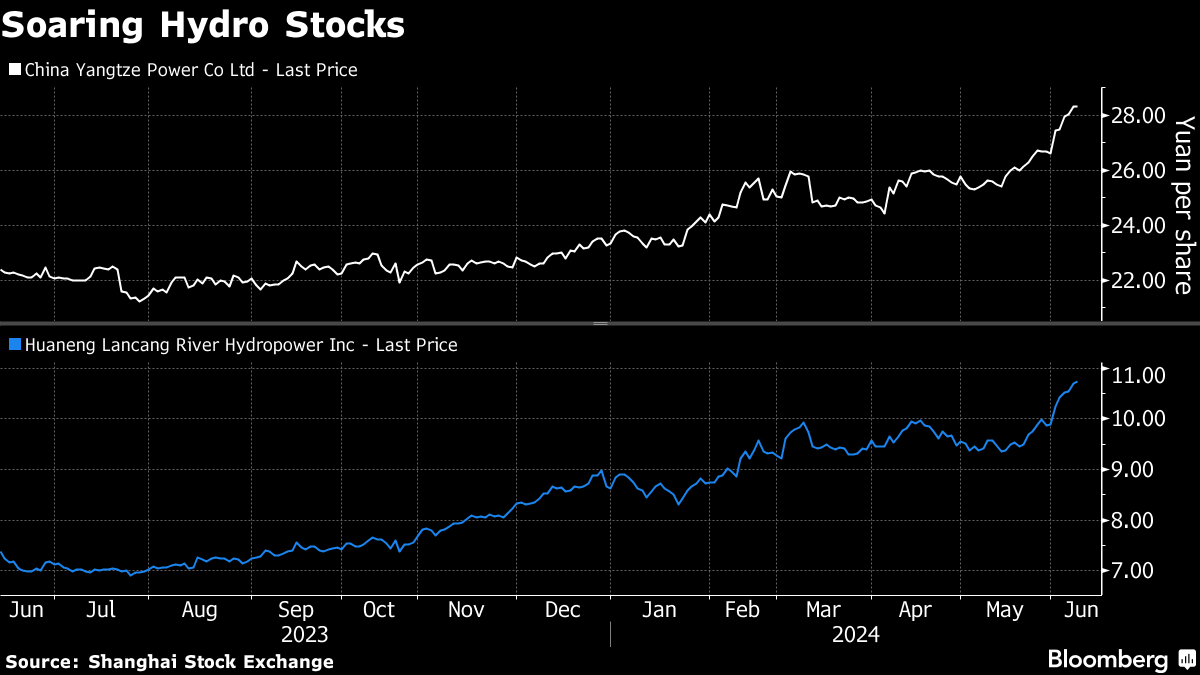

(Bloomberg) -- Deadly rains in China that have damaged farming and infrastructure are feeding a recovery in the world’s most powerful dams, boosting clean energy generation and sending hydroelectric stocks to record highs.

Hydropower generation rose 8.4% in the first four months from the previous year, and more rain than normal is expected in the Yangtze River basin this summer. China Yangtze Power Co. was among the hydro stocks that ended last week at record highs, and China’s biggest dam company is fast closing in on $100 billion in market value.

The revival follows two years of restrained output stemming from a 2022 drought that caused widespread industrial outages in hydro-reliant provinces like Sichuan and Yunnan. The rebound in China’s biggest source of clean energy is reining in fossil fuel demand and has helped put the world’s biggest polluter on course to peak emissions more than a half-decade before its own deadline.

China has by far the world’s largest hydroelectric fleet at 425 gigawatts of capacity, including the single biggest power plant at the Three Gorges dam on the Yangtze between Chongqing and Wuhan. Even during the drought, China got about 15% of its electricity from hydro in 2022, more than wind and solar combined, according to BloombergNEF data.

The drought has turned into a deluge this year. Record rainfall in Guangdong province in April led to a highway collapse that killed at least 48 people. Crops from rapeseed to rice and lychees have been damaged by the extreme weather.

But the prospect of more rains to come is benefiting companies like Yangtze Power, the listed unit of state giant China Three Gorges Corp. Its shares are up more than 20% this year and the firm is overwhelmingly a buy among stock pickers. Citigroup Inc. analysts including Pierre Lau recently raised their earnings forecasts for the company because of the improvement in water resources and ongoing power market reforms that allow it to charge higher prices for electricity.

On the Wire

China’s May price data is likely to show another month with only a faint inflation pulse, according to Bloomberg Economics.

Chile’s federation of fruit producers urged authorities in the country to avoid an escalation of trade tensions resulting from recently imposed tariffs on Chinese steel imports.

A slump in the price of natural gas and the prospect of a glut in the years ahead is spurring sales of trucks and ships powered by the fuel, hastening a long-term shift away from oil in the top importer.

This Week’s Diary

(All times Beijing unless noted.)

Tuesday, June 11:

- China to release May aggregate financing & money supply by June 15

- SNEC PV conference & exhibition in Shanghai, day 1

Wednesday, June 12:

- China’s inflation data for May, 09:30

- CCTD’s weekly online briefing on Chinese coal, 15:00

- China’s monthly CASDE crop supply-demand report

- SNEC PV conference & exhibition in Shanghai, day 2

Thursday, June 13:

- SNEC PV conference & exhibition in Shanghai, day 3

Friday, June 14:

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- SNEC PV conference & exhibition in Shanghai, day 4

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week