Russia’s Crude Shipments Slump to Lowest Since January

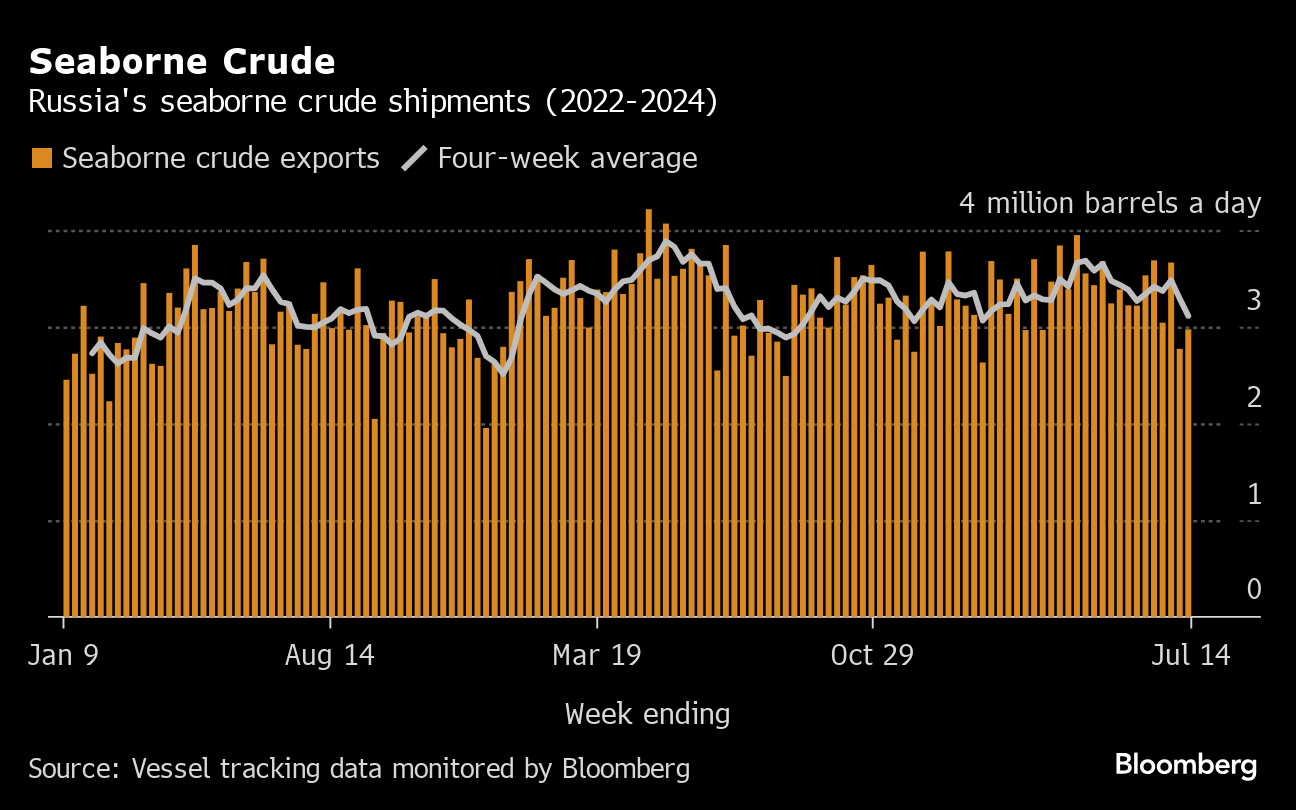

(Bloomberg) -- Russia’s four-week average crude exports fell to their lowest since January, continuing a plunge that’s seen them drop by about about 570,000 barrels a day from their recent peak in April. The fall continued despite a small recovery in the weekly flow.

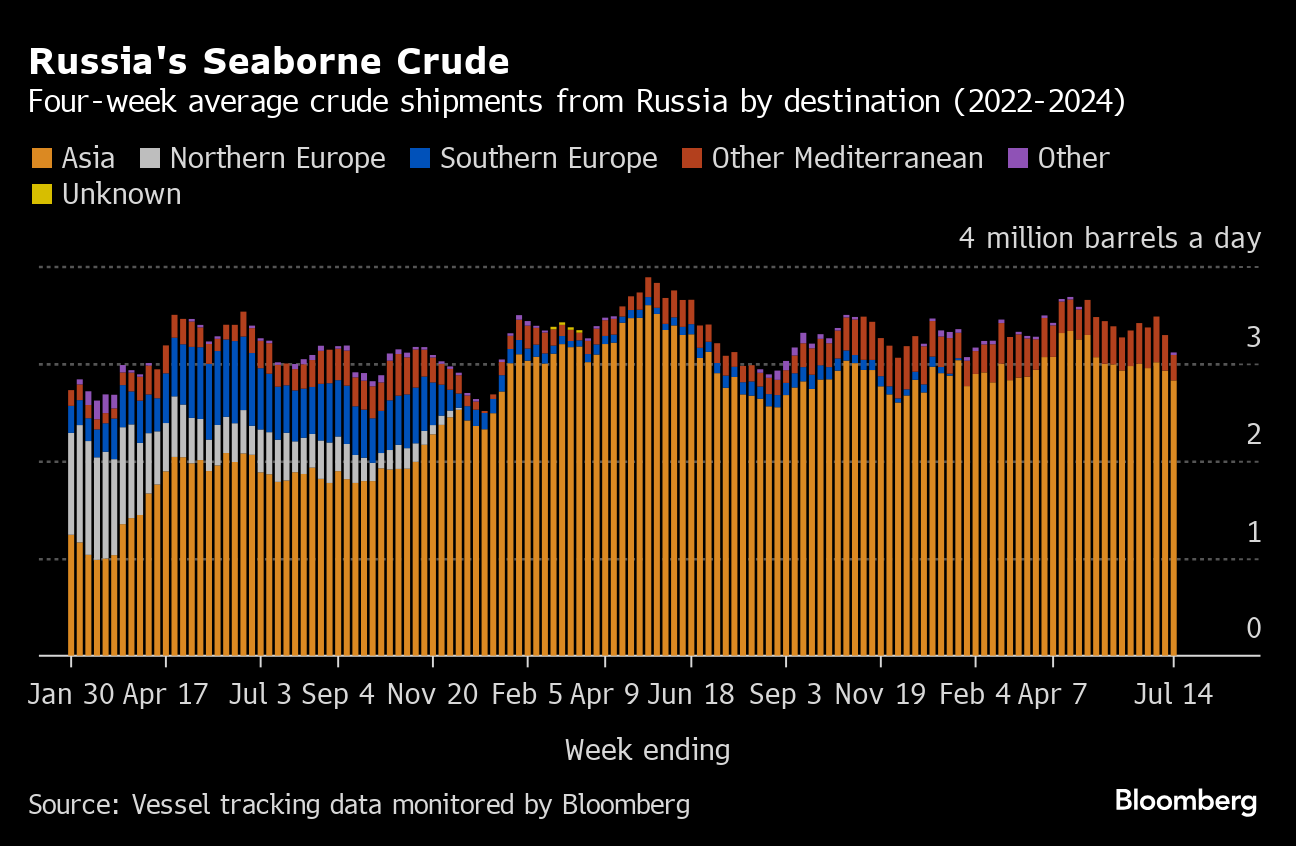

Most of the drop — 11% in two weeks — has been in shipments from the country’s Baltic ports of Primorsk and Ust-Luga, where flows are down by nearly 30% from their recent high, and the Black Sea terminal at Novorossiysk, where shipments have nearly halved. There is no evidence of maintenance work or storms to explain the slump.

The decline mostly came about because of a huge retreat last week. It likely stems from Russia’s improving compliance with an OPEC+ output target and a recovery in domestic refining.

On a week-on-week basis, there was a tiny gain in flows. That helped to boost the gross value of Russia’s crude shipments a little during a period in which the price of the nation’s barrels retreated slightly.

Separately, the UK and European nations are set to endorse a plan to coordinate responses to the risks posed by Russia’s shadow fleet ships and their facilitators. The countries are trying to make it harder for Russia to profit from its oil exports and measures could include sanctions on more of the aging tankers that Moscow relies on to haul its oil to Asia.

All but three of the 53 oil tankers sanctioned by the US, the UK or the European Union since October for their involvement in the Russian oil trade have remained idle since being designated. The first to load, the SCF Primorye, subsequently transferred its cargo onto the Ocean Hermana in the Riau archipelago in early June. The oil may have been moved onto a third ship, according to TankerTrackers.com Inc, which specializes in detecting secretive cargo movements. The other two, the Bratsk and the Belgorod, disappeared from automated tracking systems south of India last month. One has reappeared in the Gulf of Oman where it has transferred its cargo onto another supertanker, the firm says.

Crude Shipments

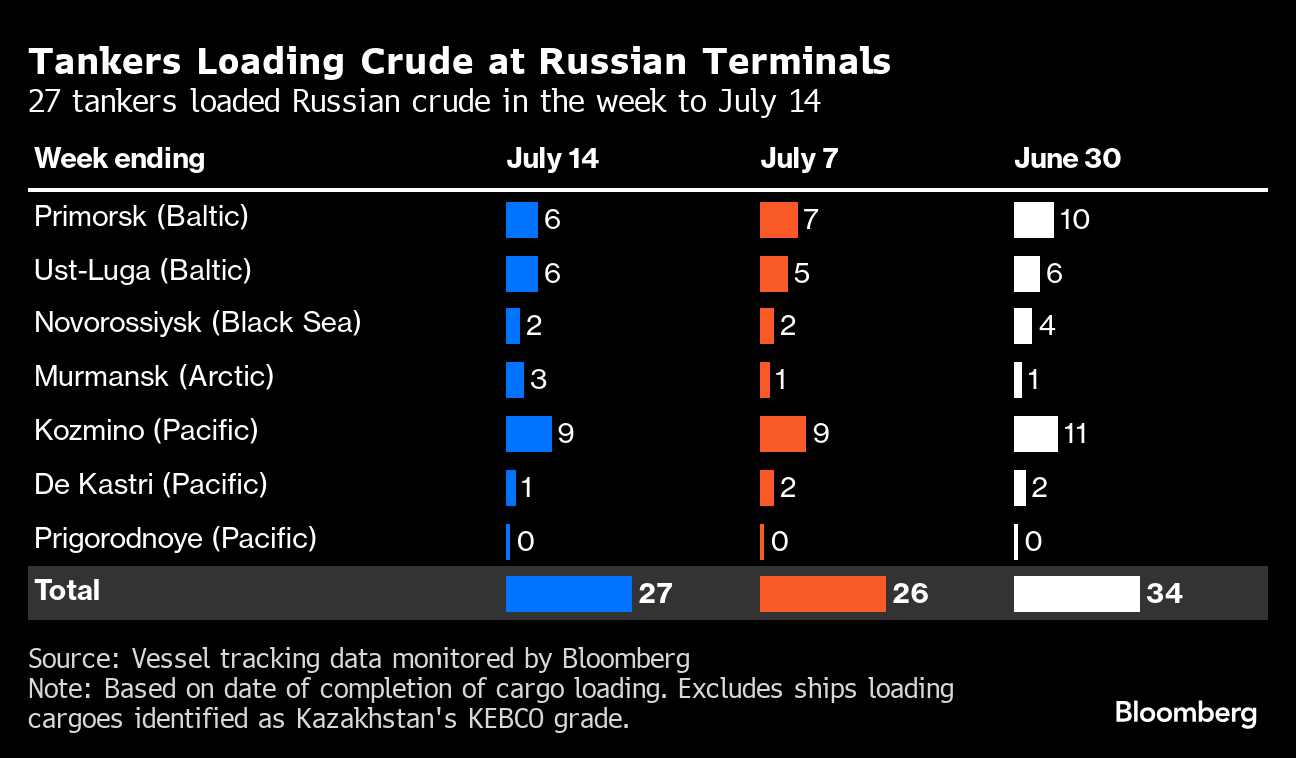

A total of 27 tankers loaded 20.8 million barrels of Russian crude in the week to July 14, vessel-tracking data and port agent reports show. That was up slightly from a revised 19.4 million barrels on 26 ships the previous week.

It means Russia’s seaborne daily crude flows in the week to July 14 rose by about 200,000 barrels to reach 2.97 million, up from a revised 2.77 million barrels the previous week. The less volatile four-week average continued to fall, down by about 180,000 barrels a day to 3.11 million, its lowest since January.

The only region to see an increase in shipments was the Arctic, with three Suezmax tankers leaving Murmansk. Flows out of the Baltic remained muted, with just 12 vessels loading at Primorsk and Ust-Luga. That’s down from 16 or 17 ships a week in April. The Sakhalin Island terminal of Prigorodnoye saw no shipments for a third week.

Crude shipments so far this year are about 10,000 barrels a day below the average for the whole of 2023.

Russia terminated its export targets at the end of May, opting instead to restrict production, in line with its partners in the OPEC+ oil producers’ group. The country’s output target is set at 8.978 million barrels a day until the end of September, after which it is scheduled to rise at a rate of 39,000 barrels a day each month until September 2025, as long as market conditions allow.

No cargoes of Kazakhstan’s KEBCO were loaded during the week.

Flows by Destination

-

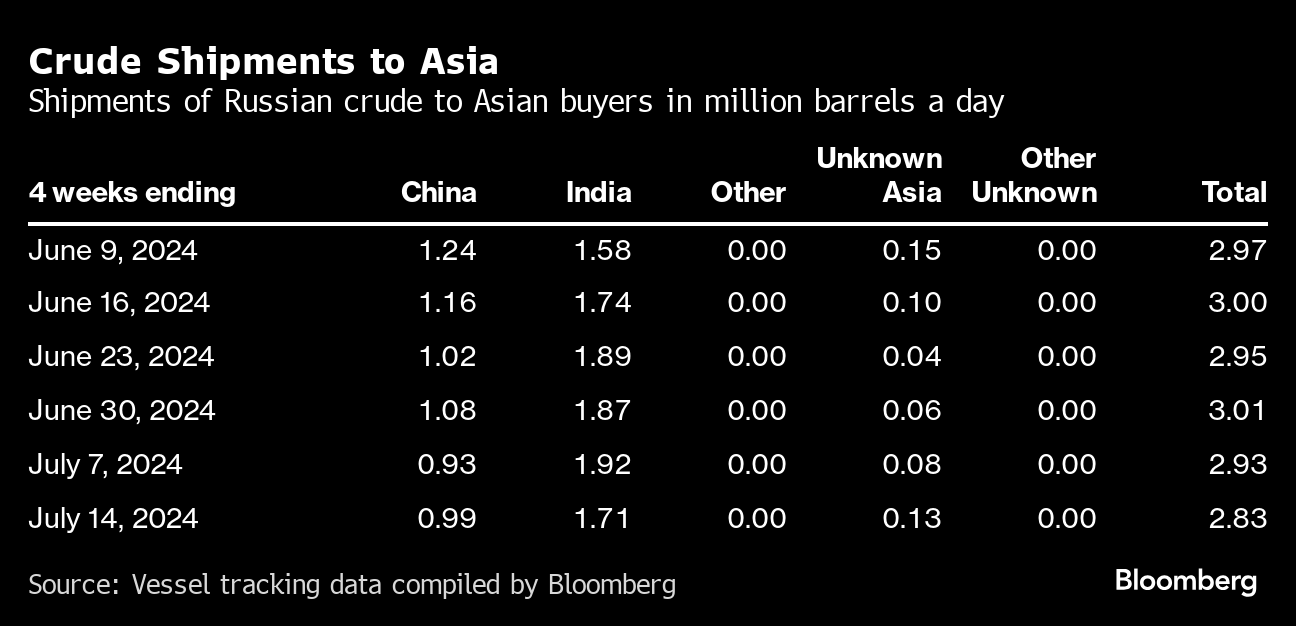

Asia

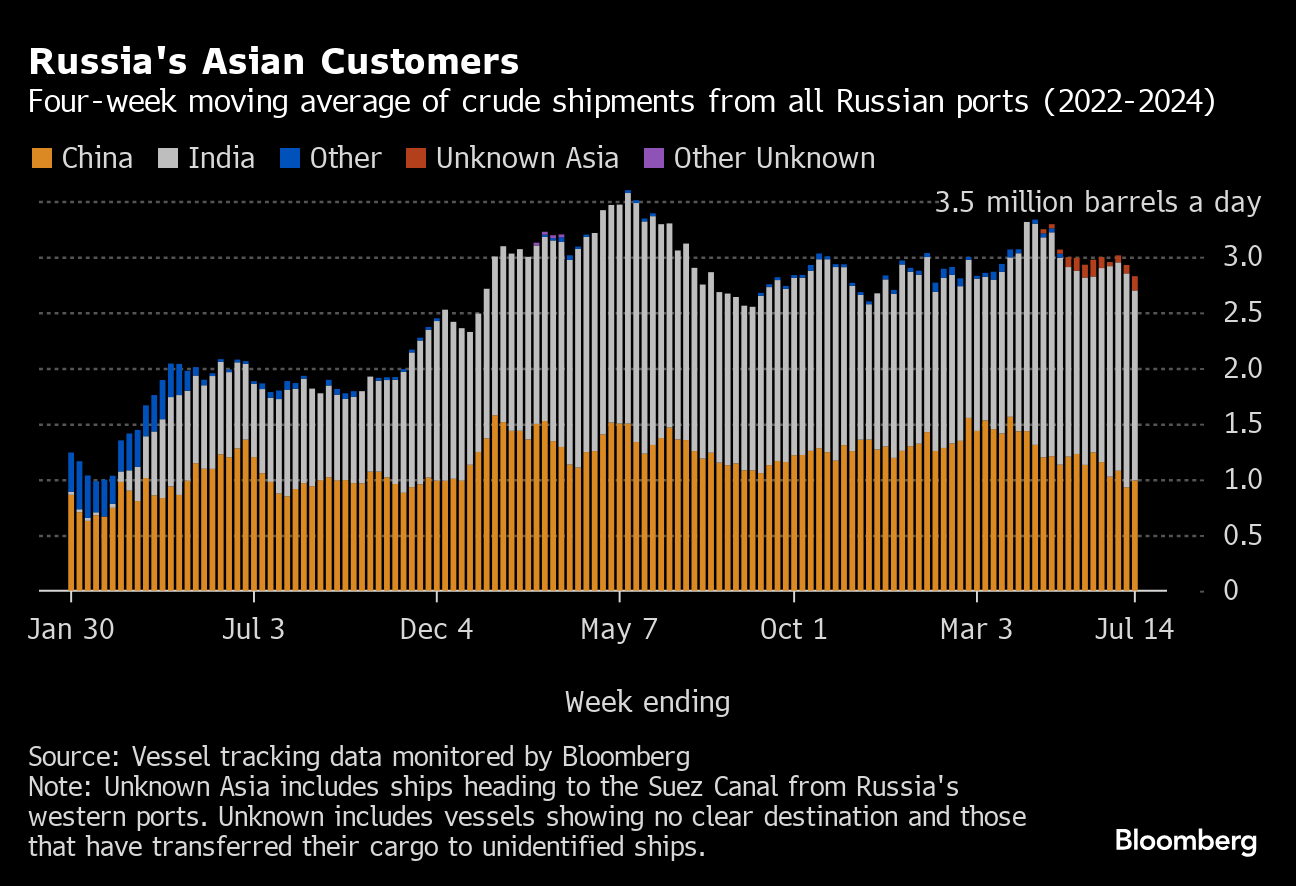

Observed shipments to Russia’s Asian customers, including those showing no final destination, fell to a five-month low of 2.83 million barrels a day in the four weeks to July 14.

About 990,000 barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.71 million barrels a day, down from the revised figure of 1.92 million for the period to July 7.

Both the Chinese and Indian figures are likely to rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 130,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up as “Unknown Asia” until a final destination becomes apparent.

Most shipments from Russia’s western ports go on to transit the Suez Canal, but some could end up in Turkey. Others may be moved from one vessel to another, with the majority of such transfers now taking place in the Mediterranean, most recently off Morocco, or near Sohar in Oman.

Russia’s oil flows continue to be complicated by the Greek navy carrying out exercises in an area that’s become associated with the transfer of the nation’s crude. These activities have now been extended to Sep. 15.

-

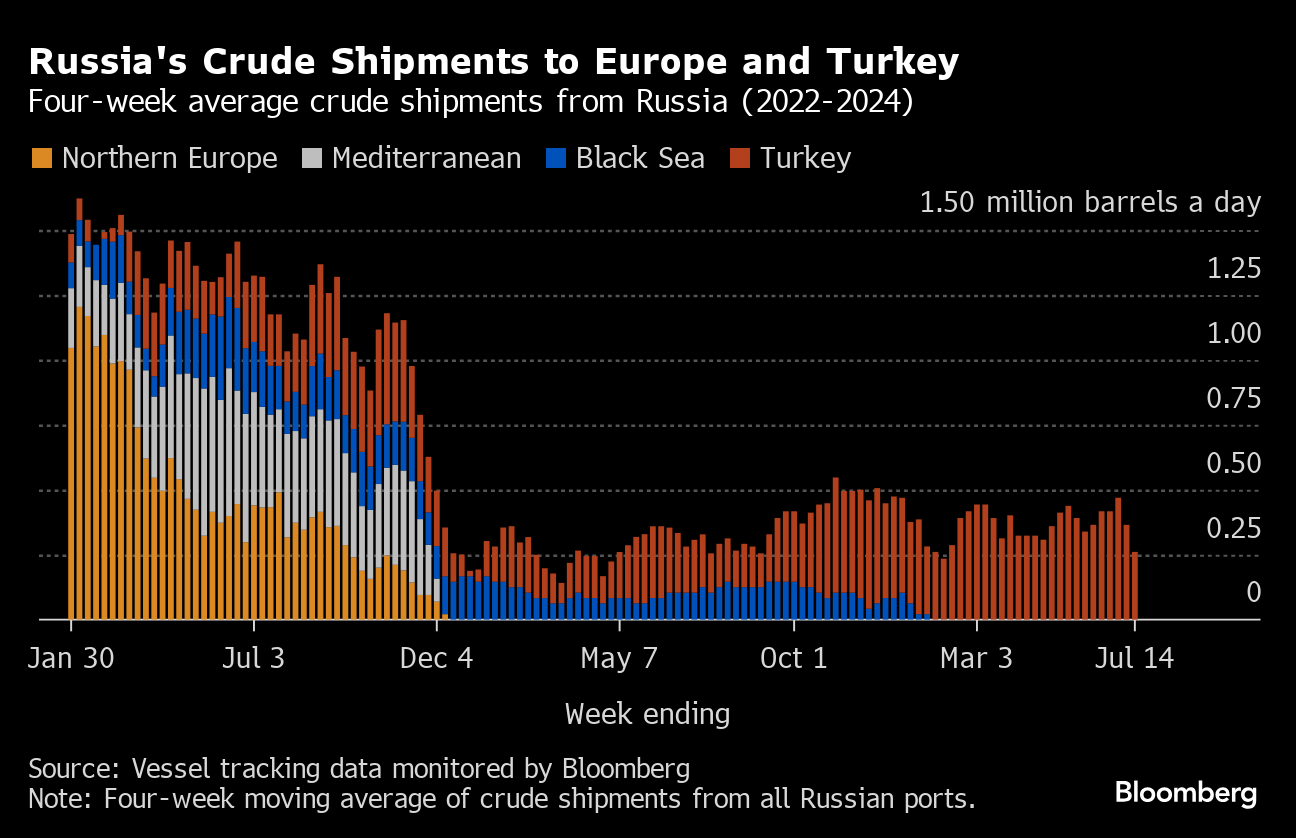

Europe and Turkey

Russia’s seaborne crude exports to European countries have ceased, with flows to Bulgaria halted at the end of last year. Moscow also lost about 500,000 barrels a day of pipeline exports to Poland and Germany at the start of 2023, when those countries stopped purchases.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows in the 28 days to July 14 falling to about 260,000 barrels a day, their lowest since February.

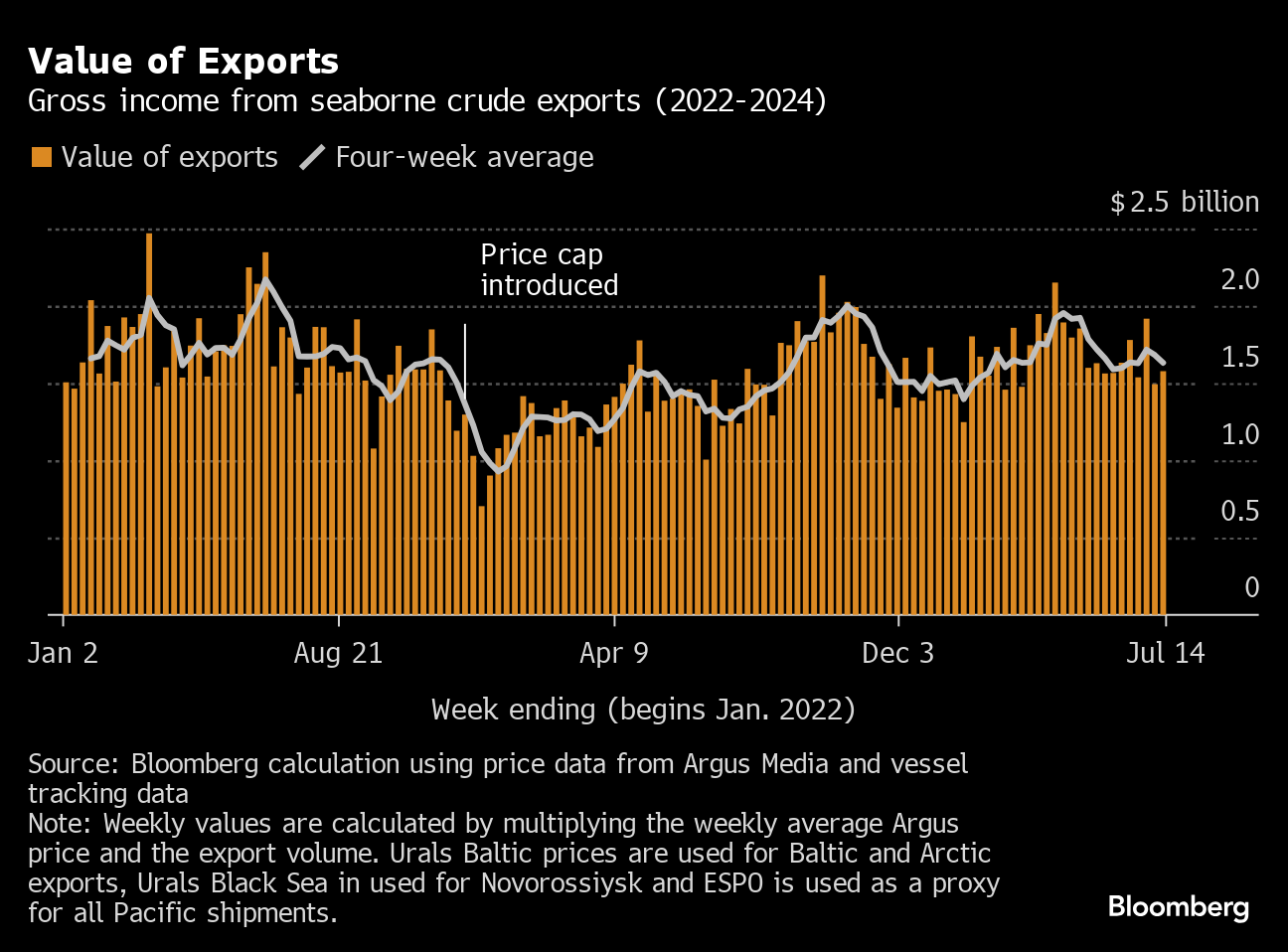

Export Value

The gross value of Russia’s crude exports edged up to $1.58 billion in the seven days to July 14, from a revised $1.49 billion in the period to July 7. The small increase in flows was partly offset by a drop in prices for Russia’s major crude streams to lessen the rise in revenues.

Export values at Baltic and Black Sea ports were down week-on-week by about 50 cents a barrel, while key Pacific grade ESPO fell by about $1.30 a barrel. Delivered prices in India also dropped, down by about $1 a barrel, all according to numbers from Argus Media.

Despite the higher weekly figure, four-week average income was down again, falling by about $50 million to $1.63 billion a week. The four-week average peak of $2.17 billion a week was reached in the period to June 19, 2022.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

NOTES

This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. The next update will be on Tuesday, July 23.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are blended with crude of Russian origin to create a uniform export stream. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.If you are reading this story on the Bloomberg terminal, click for a link to a PDF file of four-week average flows from Russia to key destinations.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week