Oil Gains With Focus on China’s Economy and Geopolitical Risks

(Bloomberg) -- Oil edged higher as traders gauged China’s economic outlook and geopolitical risks in Europe and the Middle East.

Brent traded above $85 after rising almost 6% last month, while West Texas Intermediate was around $82. A private gauge of China’s manufacturing activity showed an expansion in June to the highest in three years. That diverged from official data showing a contraction, clouding the outlook.

In France, Marine Le Pen’s National Rally dominated the first round of legislative elections, adding to political risk in the region, while Israel’s Prime Minister Benjamin Netanyahu said he is committed to fighting Hamas until it’s eliminated. US President Joe Biden’s disastrous performance during the presidential debate and calls for him to quit are adding to the uncertainty.

“Increasing geopolitical tensions, which could disrupt the global supply of oil from major producing regions,” are supportive of prices, said Priyanka Sachdeva, senior market analyst at Phillip Nova Pte. Still, “fears of a global slowdown are highly likely to keep any upswing in oil prices capped.”

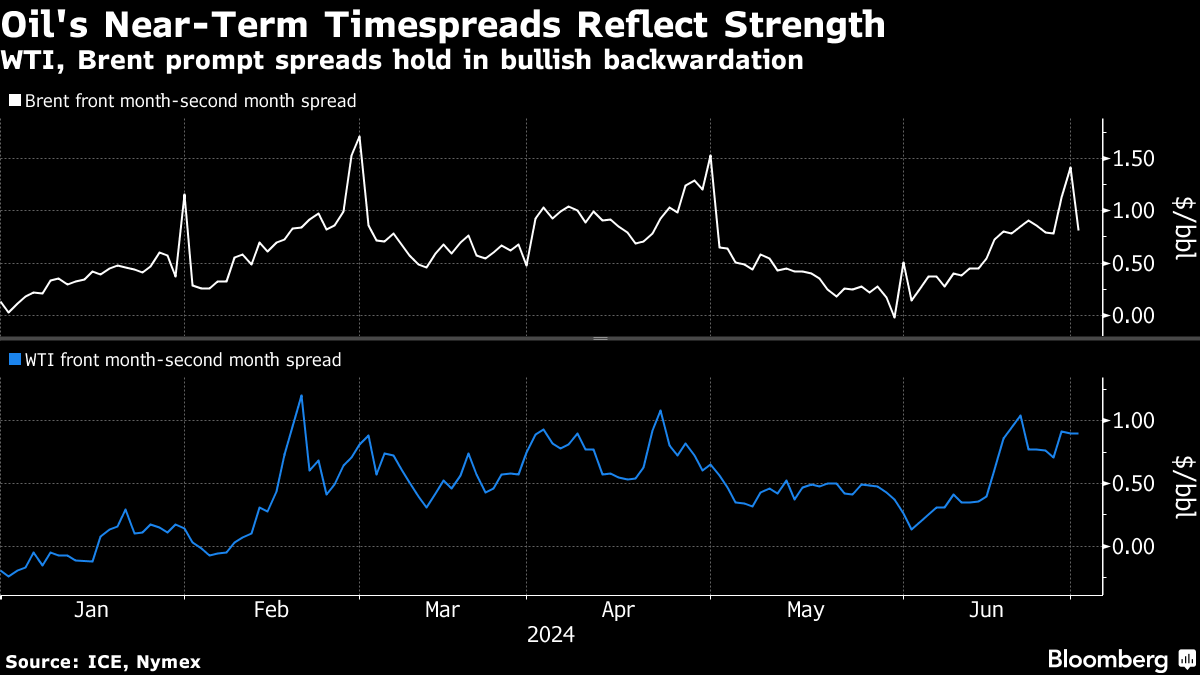

Crude remains higher this year, with the latest upward move spurred by OPEC statements that its plans to revive production depend on market conditions. While spreads for both Brent and WTI are in a backwardated structure that suggests tightness and money managers continued piling into oil, swelling US inventories have recently helped pare some of the optimism.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output