Oil Steady as Market Waits for US Response to Deadly Attack

(Bloomberg) -- Oil was steady as the market waited for a US response to the deadly attack on American troops in Jordan, which could risk an escalation of tensions in a region key to global crude production.

Brent crude traded above $82 a barrel after losing 1.4% on Monday, despite the drone assault on US soldiers, which Iran sought to distance itself from. Data showing that OPEC+ appears to be making a slow start to new output cuts put downward pressure on prices. West Texas Intermediate was also steady.

The White House is seeking a response that’s tough enough to deter Iran and its proxies without sparking direct warfare with Tehran, according to officials and experts. The challenge for President Joe Biden is to project toughness without spurring a jump in oil prices in an election year.

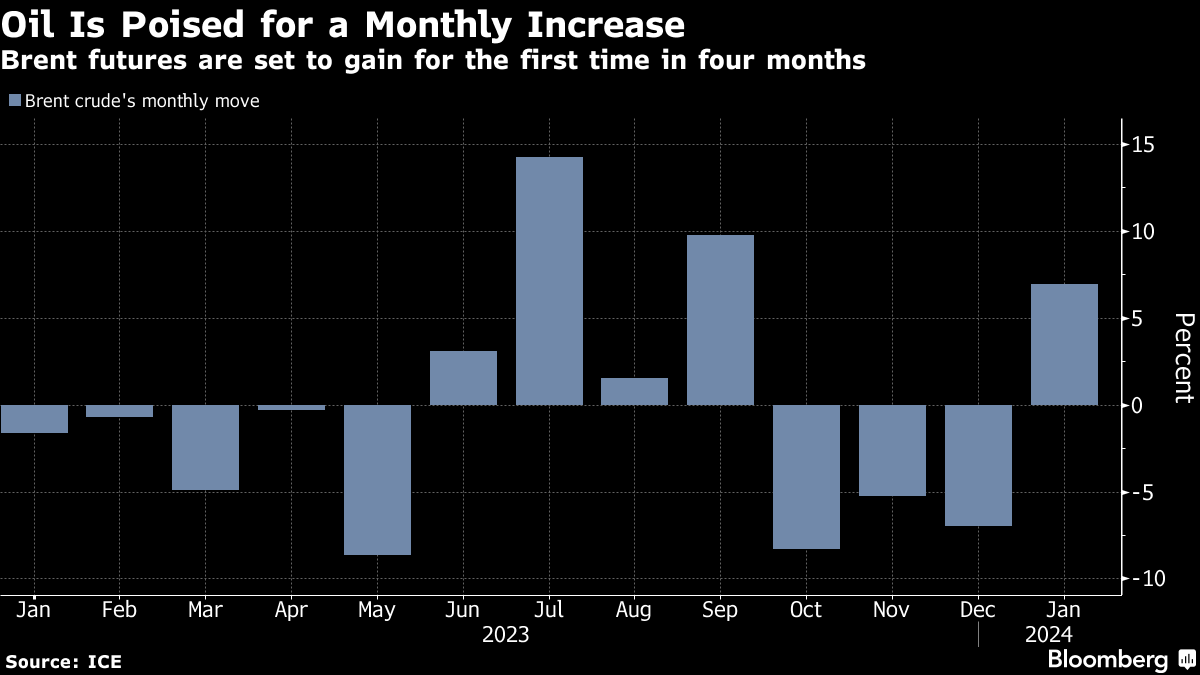

Oil is on track for a monthly gain following an escalation of hostilities by the Yemen-based Houthi rebels on commercial shipping in the Red Sea, including an attack on a fuel tanker on Friday. Still, robust supply from non-OPEC producers and concerns about demand has weighed on the outlook.

Biden is facing pressure from some Republicans to strike Iran directly, but the most likely scenario is that Iranian-aligned assets outside of the country will be targeted. John Kirby, spokesman for the US National Security Council, said that the president met with his national security team both Sunday and Monday and is “weighing the options before him.”

“The response from the US will be key,” said Daniel Hynes, a senior commodity strategist at ANZ Group Holdings Ltd. “The market’s view on risks to supply have definitely changed in recent days.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company