Oil Steadies With US Inventory Trends and OPEC+ Cuts in Focus

(Bloomberg) -- Oil steadied after a mixed US inventory report, while OPEC and the IEA offered contrasting outlooks for the global crude market.

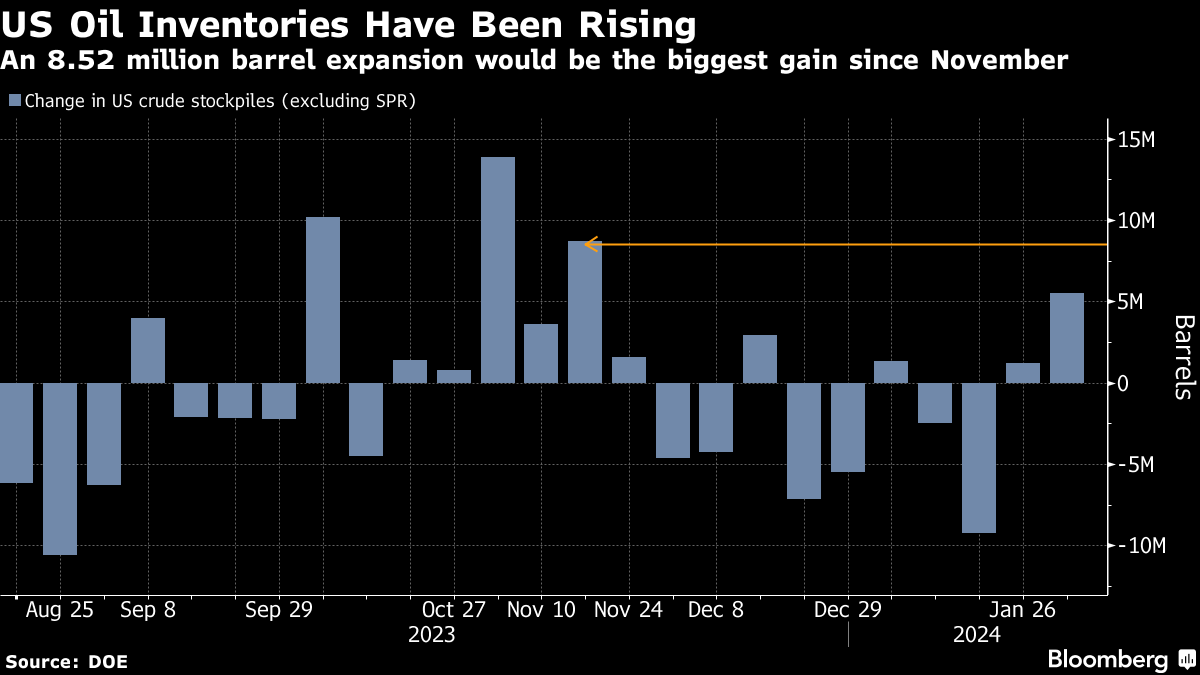

Brent crude traded near $83 a barrel after rising almost 1% on Tuesday. West Texas Intermediate was above $77 following a seven-day advance. The industry-funded American Petroleum Institute reported US crude inventories rose by 8.5 million barrels last week, according to people familiar with the data. Still, the report also flagged lower gasoline and distillate holdings.

OPEC’s top official said on Tuesday that global oil demand is set to expand strongly, while a monthly outlook from the group revealed limited compliance with the members’ latest round of supply cuts. For its part, the Paris-based International Energy Agency flagged comfortable markets this year, with expected supply growth more than satisfying worldwide consumption.

Oil has struggled to break out of a $10 range it’s been confined to this year, although WTI’s recent run points to upside momentum. Output cuts by members of the Organization of the Petroleum Exporting Countries and their allies, plus tensions in the Middle East, have supported prices. Still, higher ex-OPEC+ supplies and concerns about demand growth in China have restrained gains.

“To some extent, US economic exceptionalism amid strong consumption lends to OPEC’s view of strong demand, which is propping up oil,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. That’s “despite the IEA’s more sanguine view of the demand-supply balance,” he added.

Spreads suggests conditions have tightened. Brent’s prompt spread — the difference between its two nearest contracts — was 67 cents a barrel in backwardation, a positive pattern. That’s about twice the gap a month ago.

In related markets, refined products have been strengthening. Benchmark futures for diesel and gasoline have both advanced to the highest levels since October, posting double-digit percentage gains so far in 2024. Crude, in contrast, is about 7% higher this year.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week