Oil Opens Week With Drop as Traders Await Market Balance Signals

(Bloomberg) -- Oil followed a weekly drop with further losses as traders awaited fresh clues about global demand and balances in March and beyond.

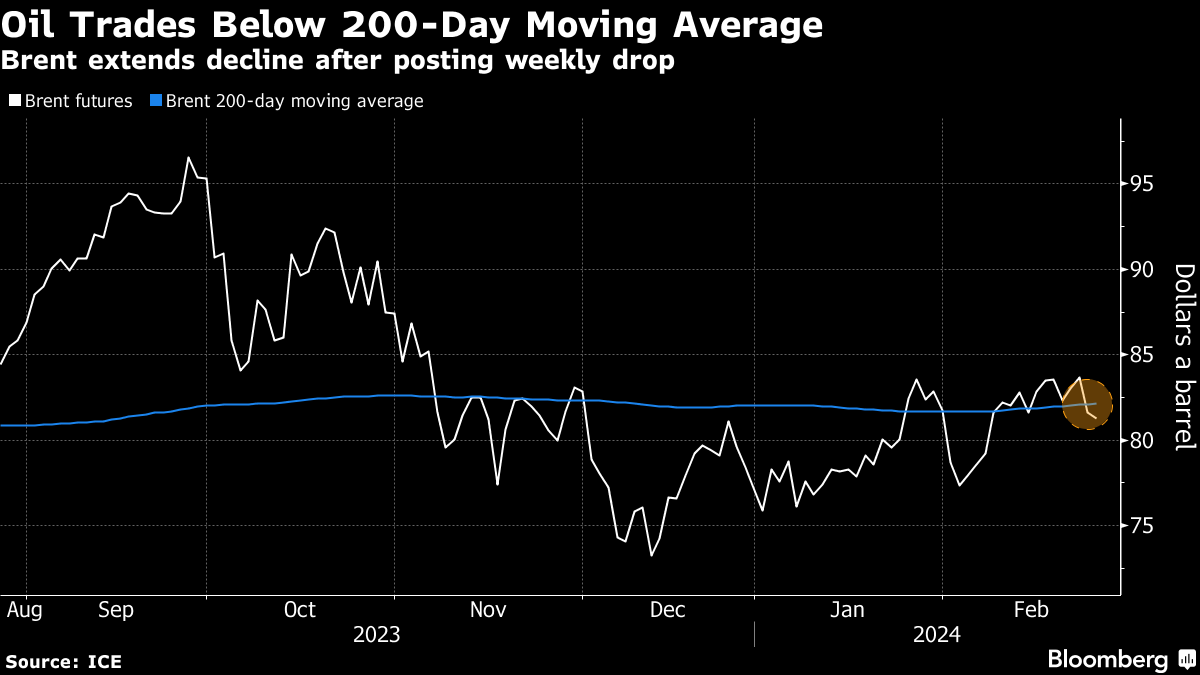

Brent fell toward $82 a barrel after shedding more than 2% last week, with US counterpart West Texas Intermediate above $76. Outlooks will come this week from International Energy Week in London, a major industry gathering. In addition, US inflation data will shape expectations for when the Federal Reserve will start cutting rates, influencing energy demand and the dollar’s path.

In wider markets, a gauge of the US currency held its ground, while most commodities including copper were weaker along with crude.

Oil has traded in a narrow band of about $3 a barrel for the past two weeks, with tensions in the Middle East and OPEC+ supply curbs offsetting the impact of higher production from outside the group, including the US. The cartel and its allies including Russia are widely expected to prolong their current cutbacks into the next quarter at their meeting early next month.

“We still expect OPEC+ to extend cuts through the second quarter of 2024, and to only gradually and partially phase out the latest package starting in the third quarter,” Goldman Sachs Group Inc. analysts including Daan Struyven said in a note. For now, the bank expects prices to remain in a $70-to-$90 range.

There are some positive signals on demand. In China, a boom in travel amid the Lunar New Year holidays has raised hopes of a more sustained recovery in consumption. Local refiners have been snapping up cargoes from across the world since the mid-February holiday, according to traders, as well as having increased term supplies from Saudi Arabia for March.

Among market metrics, timespreads have been holding in a bullish backwardated pattern, while prices of physical crude in the US have also been strengthening in recent weeks as buyers turned to American grades to avoid Red Sea shipping disruption.

In North Africa, meanwhile, there was a minor interruption to flows from Libya. Shipments from the 50,000-barrel-a-day Wafa oil field were halted on Sunday due to protests, a person familiar with the matter said.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output