Oil Extends Drop as Surge in US Crude Inventories Clouds Outlook

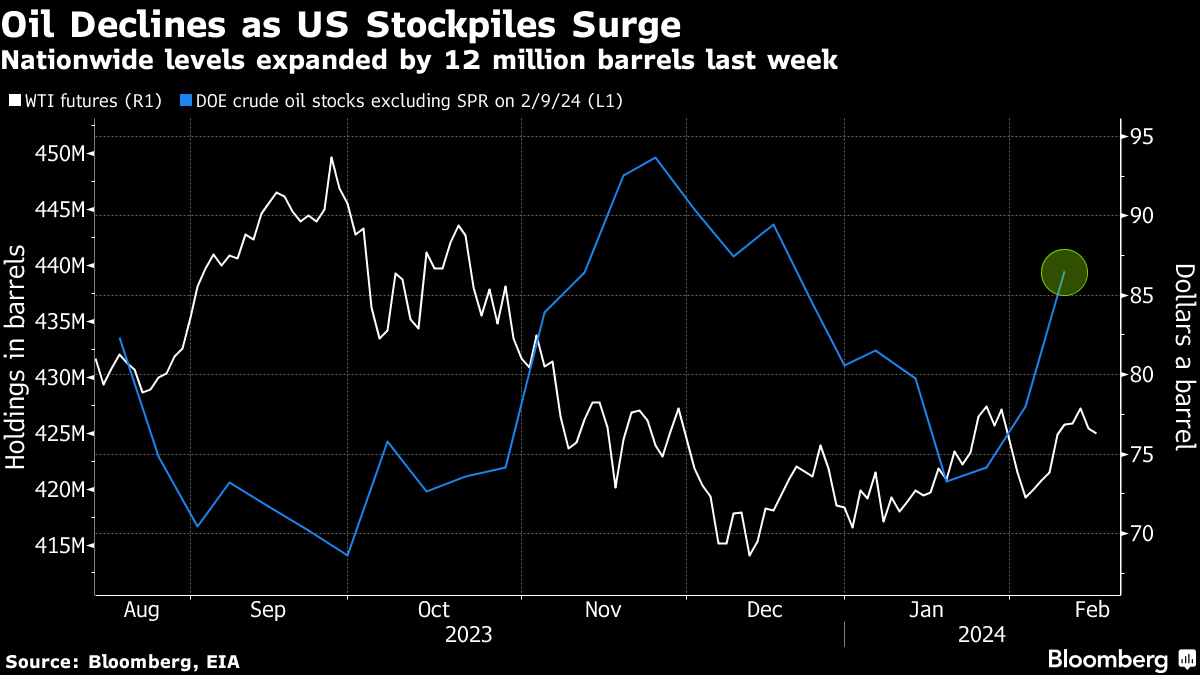

(Bloomberg) -- Oil fell for a second day after data showed US crude inventories rose by the most since November, keeping benchmarks in this year’s narrow range.

Brent crude declined toward $81 a barrel after dropping 1.4% on Wednesday, while West Texas Intermediate approached $76. Nationwide stockpiles expanded by a greater-than-expected 12 million barrels last week, with holdings at the closely watched Cushing, Oklahoma, oil storage hub also gaining. Still, stockpiles of diesel and gasoline fell amid refinery outages.

“Markets were shocked by the quantum of the increase” in crude inventories, said Han Zhong Liang, investment strategist at Standard Chartered Plc. “We expect the oil market to remain largely balanced in 2024,” with prices likely to hold around current levels for now, he said.

Crude has failed to break out of a $10-a-barrel range this year, with tensions in the Middle East and efforts by OPEC+ to curb production countered by robust supplies from drillers outside the cartel and concerns global demand growth will slow over 2024. Expectations that US interest rates could remain higher for longer as inflation persists have also been a headwind.

Still, market metrics continue to signal tight conditions, with timespreads for both major benchmarks holding in a bullish, backwardated structure despite having come off slightly. Refiners’ profits from making fuels like diesel and gasoline also remain elevated.

Later Thursday, the International Energy Agency — which India is in talks to join — will release its monthly outlook. IEA chief Fatih Birol said earlier this week that global markets should remain “comfortable” this year as more supply enters the market and demand growth weakens.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight