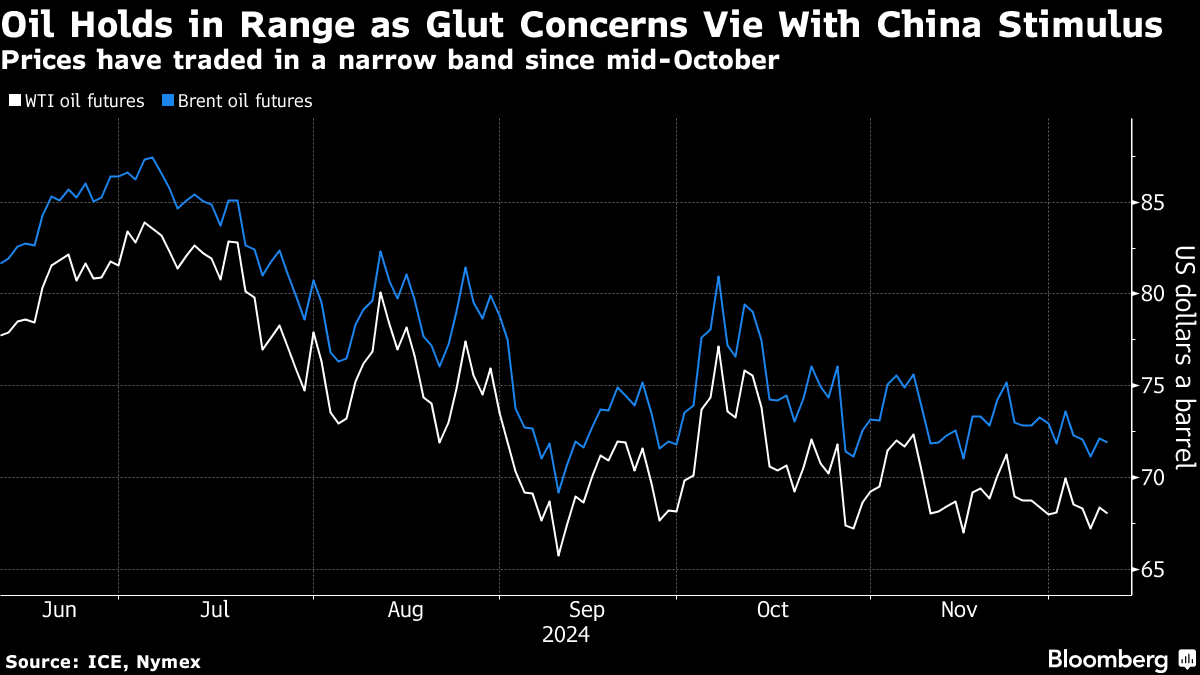

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

(Bloomberg) -- Oil declined as persistent concerns of a looming supply glut overshadowed the outlook for bolder Chinese stimulus next year.

Brent futures traded below $72 a barrel, while holding most of the previous day’s gain. China’s decision-making Politburo vowed to embrace a “moderately loose” monetary policy, the most direct language on stimulus in years from the world’s biggest crude importer.

The oil market, however, is on track for a surplus next year, which has led to OPEC+ delaying the return of idled production. Crude futures have been stuck in a tight range since mid-October, buffeted by a series of bearish and bullish factors including Middle East tensions.

“Further strength cannot be ruled out in the immediate future,” said Tamas Varga, an analyst at brokerage PVM. “Still, without a discernible improvement in the underlying oil balance, it will be a strenuous process to sustain the current rally.”

The fall of Bashar al-Assad’s Syrian regime has left a power vacuum that could lead to more turmoil as factions fight for control. The market is watching for any spillover that could reverberate through the Middle East.

A report from China’s largest oil producer said the country’s consumption may peak next year — five years earlier than expected. Rapid adoption of new-energy vehicles and the use of liquefied natural gas to power trucks have chipped away at diesel and gasoline consumption, it said.

©2024 Bloomberg L.P.