Oil Snaps Five-Day Rally With Mideast Tensions, OPEC in Focus

(Bloomberg) -- Oil declined after a five-day advance, with a likely escalation in the Middle East conflict offset by signs of weakening global demand growth.

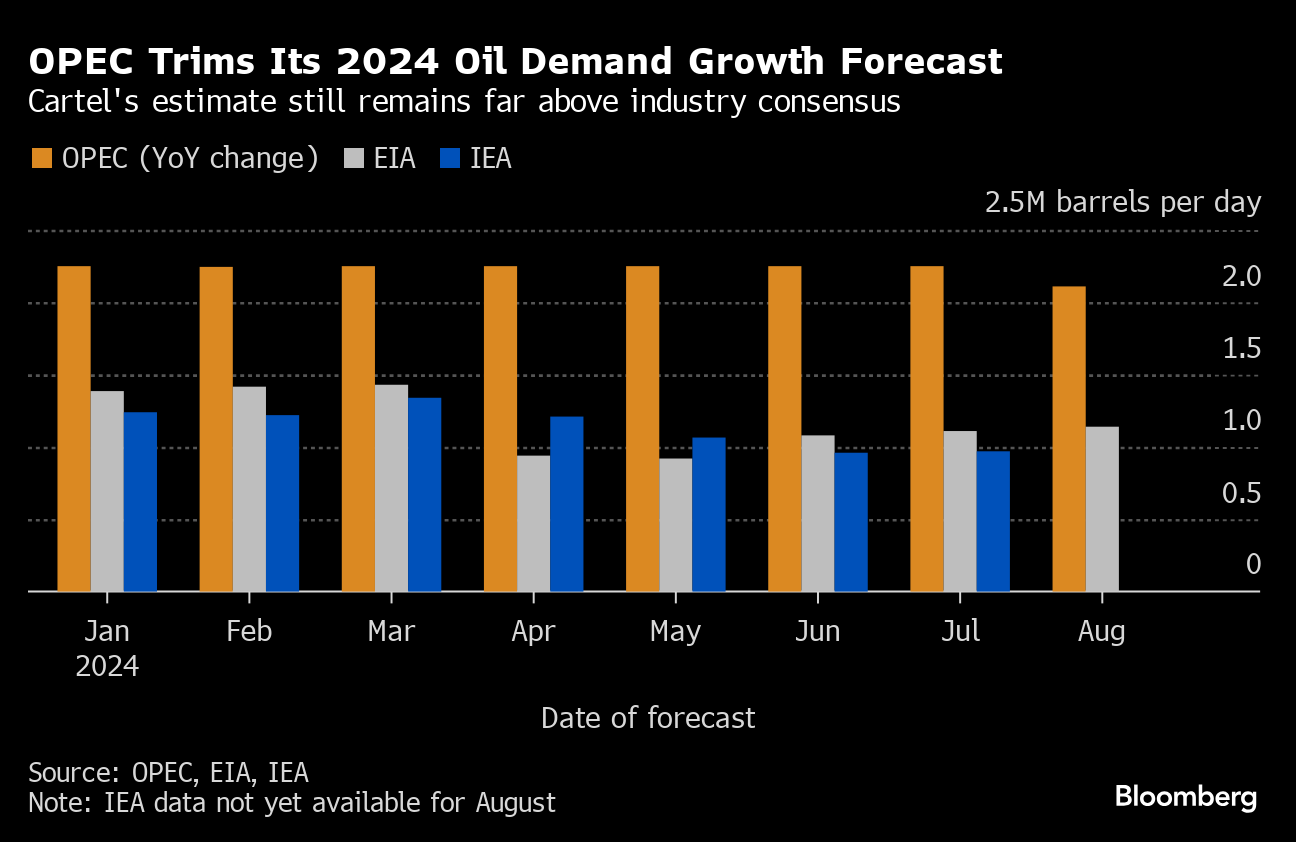

Brent fell below $82 a barrel after rising by almost 8% over the previous five sessions, with West Texas Intermediate trading around $79. While the US believes an attack by Iran on Israel has grown even more likely and may come as soon as this week, there are signs of weak consumption, which led OPEC to trim its demand forecasts for this year and next.

Crude is modestly higher for the year, supported by OPEC+ cutbacks and as equities rebounded from last week’s rout. A corresponding outlook from the International Energy Agency is due later on Tuesday, while US inflation data on Wednesday may offer clues on monetary policy in the biggest oil consumer.

“Eyes will be on the upcoming US inflation to anchor the Fed’s upcoming policy easing path,” said Yeap Jun Rong, a market strategist at IG Asia Pte. “Risks of a hard landing are not totally out of the window yet,” he said, referring to the possibility of an economic slowdown, which could spill over into oil demand.

Timespreads are signaling underlying strength in markets, with the gap between Brent’s two nearest contracts widening further in recent sessions. The measure was 92 cents a barrel in the bullish backwardation pattern, compared with 34 cents at the start of last week.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output