Oil Options Activity Leaps With Market Awaiting Iran Retaliation

(Bloomberg) -- Oil traders are returning to options contracts to hedge against the risk of a price spike as markets brace for a possible Iranian attack on Israel.

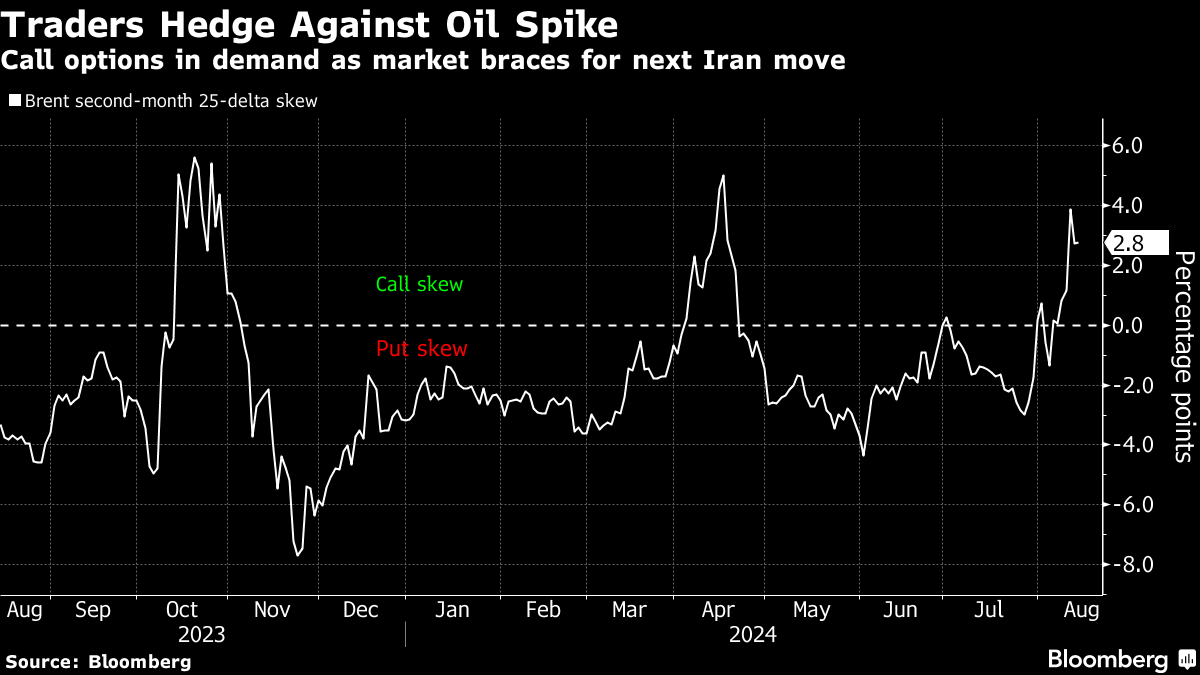

Bullish call options have been fetching a premium over bearish puts for each of the last three sessions, the longest run since Iran first attacked Israel in April. Trading volumes for calls on the global Brent benchmark also are elevated, with the 30-day average being the highest since May.

Oil options markets have seen repeated episodes of elevated activity since the conflict between Israel and Hamas started in October.

Both then, and when Iran attacked Israel in April, activity in bullish calls surged as traders sought to hedge against the risk of disruption to oil supplies in a region producing about a third of the world’s supplies.

Still, the fact that options skews haven’t spiked as much as in October and April may be a sign traders are growing calmer about the danger to supplies than during previous periods of elevated risk, said Harry Tchilinguirian, group head of research at Onyx Capital Group.

“The peak we reached on the skew is well below that of April but still sizable,” he said. “The market is still cautious, but maybe the level of angst around what comes next is lower the more time passes without Iranian action.”

US crude options have also seen higher levels of activity this week, dominated by a series of large trades of contracts that would profit a buyer from a rise toward $82 by Thursday. That pushed total activity to the highest since November. WTI was nearing $79 Wednesday.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company