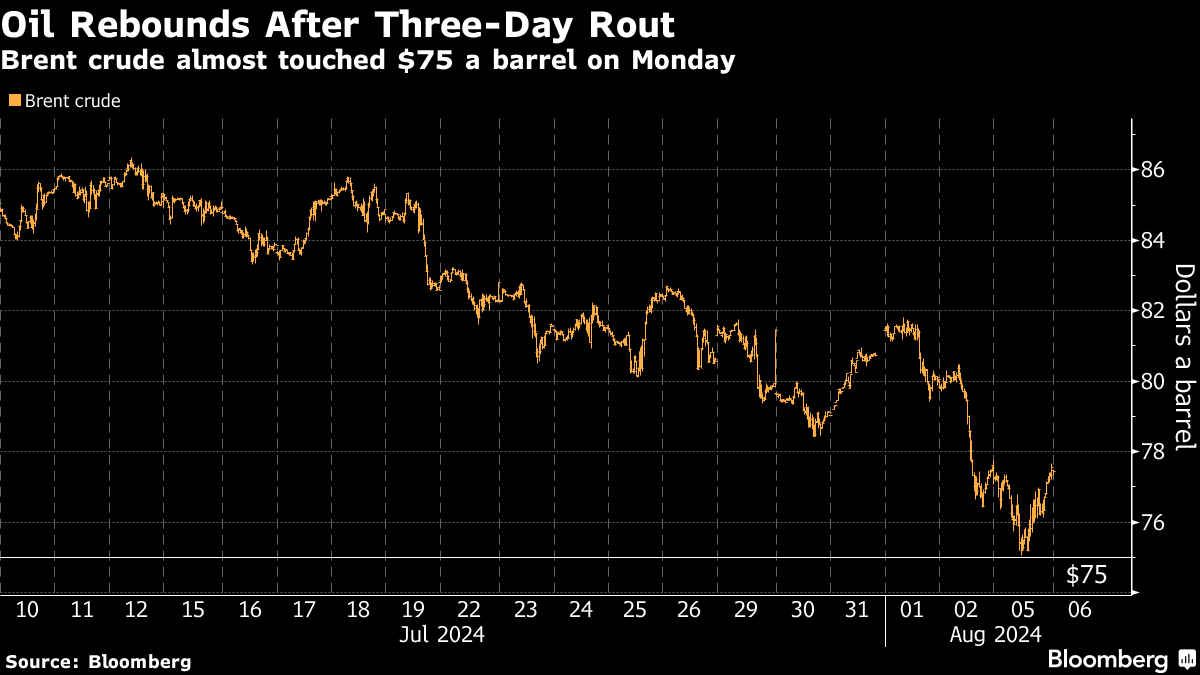

Oil Climbs From Seven-Month Low as Equities Claw Back Losses

(Bloomberg) -- Oil advanced from a seven-month low as equities rebounded and the halting of production from Libya’s biggest field refocused attention on the Middle East.

Brent rose above $77 a barrel after tumbling more than 5% over the previous three sessions, and West Texas Intermediate traded near $74, as Japanese stocks and US equity futures gained following a global rout on Monday. Output from Libya’s Sharara field stopped completely, with dueling administrations battling for control over the North African nation.

Traders are still bracing for a retaliatory attack by Iran and regional militias on Israel for assassinations of Hezbollah and Hamas officials, although Tehran has reiterated it wants to avoid all-out war.

Brent came within cents of $75 a barrel on Monday before rebounding on news of the Libyan supply loss and concerns that the conflict in the Middle East could impact production from the region. Prices have returned to near where they started the year following gains bolstered by OPEC+ supply cuts.

“The $75 floor under Brent oil prices will withstand macro fears,” Goldman Sachs Group Inc analysts including Daan Struyven said in a note. The limited risk of a US recession, resilient oil demand in developed nations and India, and an increase in speculative positioning should support prices, they said.

Investors will be looking to an industry report later Tuesday to gauge US crude inventories after five straight weeks of declines — the longest run since early 2022. Official data is due Wednesday.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week