Oil Traders Weigh Risks of Iran-Israel Conflict in Tight Market

(Bloomberg) -- The escalating conflict between Iran and Israel will force oil traders to reevaluate the geopolitical risk premium they need to apply to a market where tight supply-demand fundamentals have already driven prices above $90 a barrel.

Iran’s attack on Israel marks a distinct escalation in hostilities by bringing the two nations into direct conflict, rather than fighting through proxies. Iran says its attack in retaliation for the bombing of its embassy in Syria has “concluded” the phase of tit-for-tat aggression, but Israel has reserved the right to strike back.

“Oil prices might spike at the opening, as this is the first time Iran struck Israel from its territory,” said Giovanni Staunovo, an analyst at UBS Group AG. “How long any bounce will last will also depend on the Israeli response.”

Trading resumes at 6pm New York time on Sunday. The risk of a direct Iranian attack on Israel was already at least partly priced in — benchmark Brent crude, up 17% so far this year, passed $90 a barrel after the strike on Iran’s embassy.

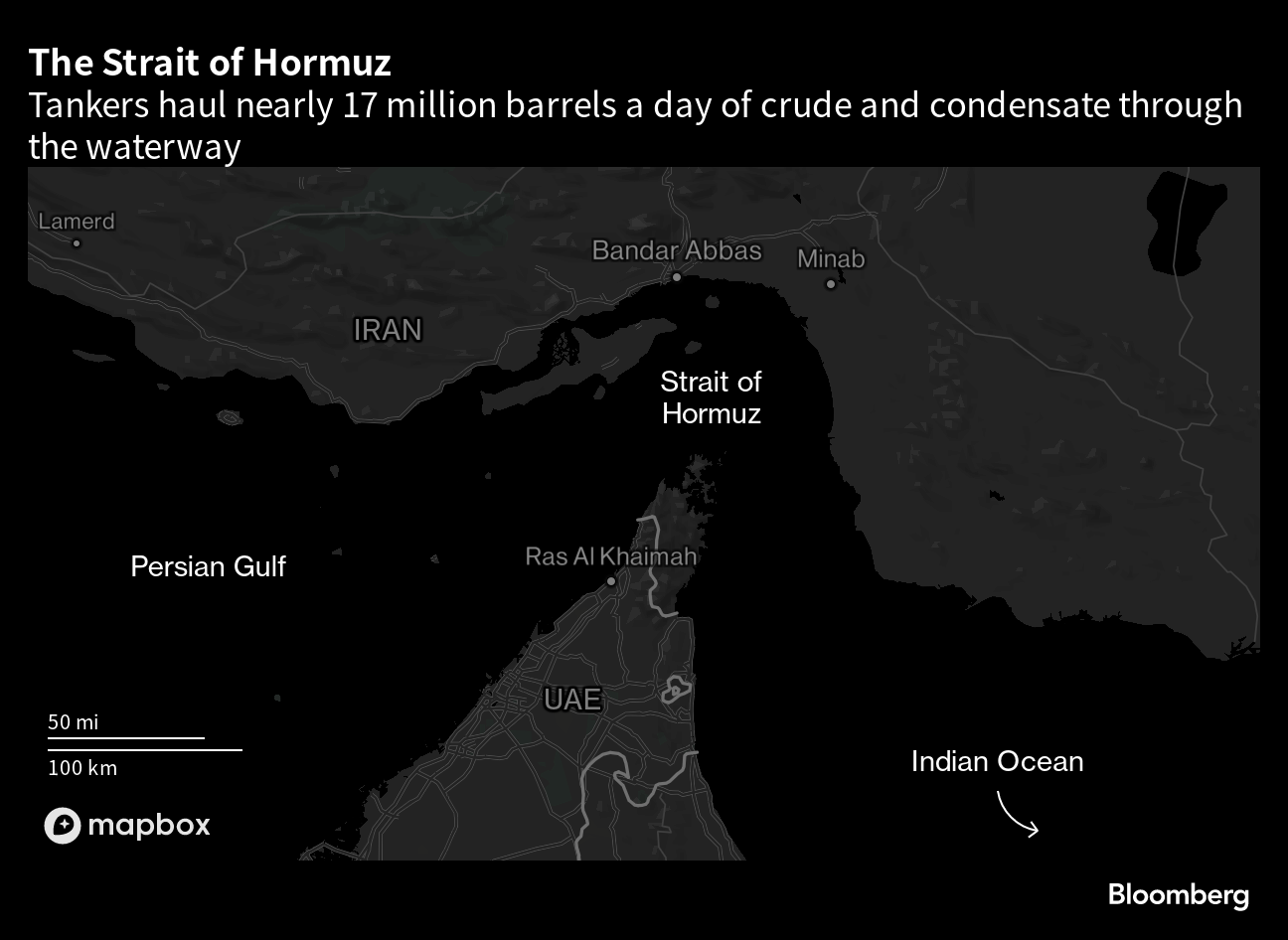

But after Iran’s foreceful response, traders will heighten their focus on flows through the Strait of Hormuz, a key chokepoint for about a fifth of the world’s oil. Tension over potential interruptions there could add to oil’s risk premium with spikes possible in the event of any attacks on tankers.

On Saturday, Iranian forces seized a container ship near the strait they said was linked with Israel. One of Iran’s allies in the region, Yemen’s Houthis, have already caused havoc in the shipping industry by attacking vessels in the Red Sea. While that hasn’t impacted oil supplies it has increased freight costs and boosted oil demand as the global fleet is foreced to make longer voyages.

Prices, which already include a risk premium of about $10 a barrel, are poised to push higher, according to Iman Nasseri, Middle East managing director at consultancy FGE. Prices could add another $2 to $5 a barrel due to concern of further Israeli reprisals or Iranian interference with shipping around the Persian Gulf, he said.

A volatile Middle East is adding a risk premium to a market where robust demand is mixing with a disciplined OPEC+ production policy to draw down global stockpiles and push prices higher.

Vitol Group, the world’s largest oil trader, said last week that demand growth is likely to outpace most forecasts this year. Meanwhile, Seb Barrack, the head of commodities at hedge fund Citadel said he expects oil market to get “extremely tight” later this year.

“Energy markets will begin to integrate more seriously the threat of the conflict expanding and a spiral of miscalculations,” said Ayham Kamel, the head of Middle East and North Africa at risk consultant Eurasia Group.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Woodside Looks to Build ‘Dream Team of LNG’ at Acquired US Plant

Eni signed exclusivity agreement with KKR for the potential sale of a minority stake in Enilive

Woodside's quarterly revenues exceed $3 billion backed by strategic milestones

Oil Rises as Biden Quits US Race, Blazes Threaten Canadian Wells

Kamala Harris Seen as Tougher Oil Industry Opponent Than Biden

PetroChina joins Oil and Gas Decarbonisation Charter

Galp reports 16% rise in Q2 2024 net profit amid higher oil prices and lower production costs

Nigeria’s Dangote Refinery Targets Output of 550,000 Barrels a Day

Oil Falls With Broader Commodity Weakness Amidst Listless Trade

Occidental Planning to Sell Bonds in Up to Five Parts

CSIS: long-term LNG demand to reshape global export capacity growth

More women in energy vital to the industry’s success

India’s energy sector presents lucrative opportunities for global companies

Oil India charts the course to ambitious energy growth

Maritime sector is stepping up to the challenges of decarbonisation

Partner content

Navigating the trading seas: exploring the significance of benchmarks

Back to the Future(s): the best commodities benchmarks are still physically settled

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape