Oil Rally Takes Breather With Israel to Pull Some Gaza Troops

(Bloomberg) -- Oil declined from a five-month high after Israel said it would remove some troops from Gaza, as traders wait for a series of market reports this week that will provide a snapshot on supply and demand.

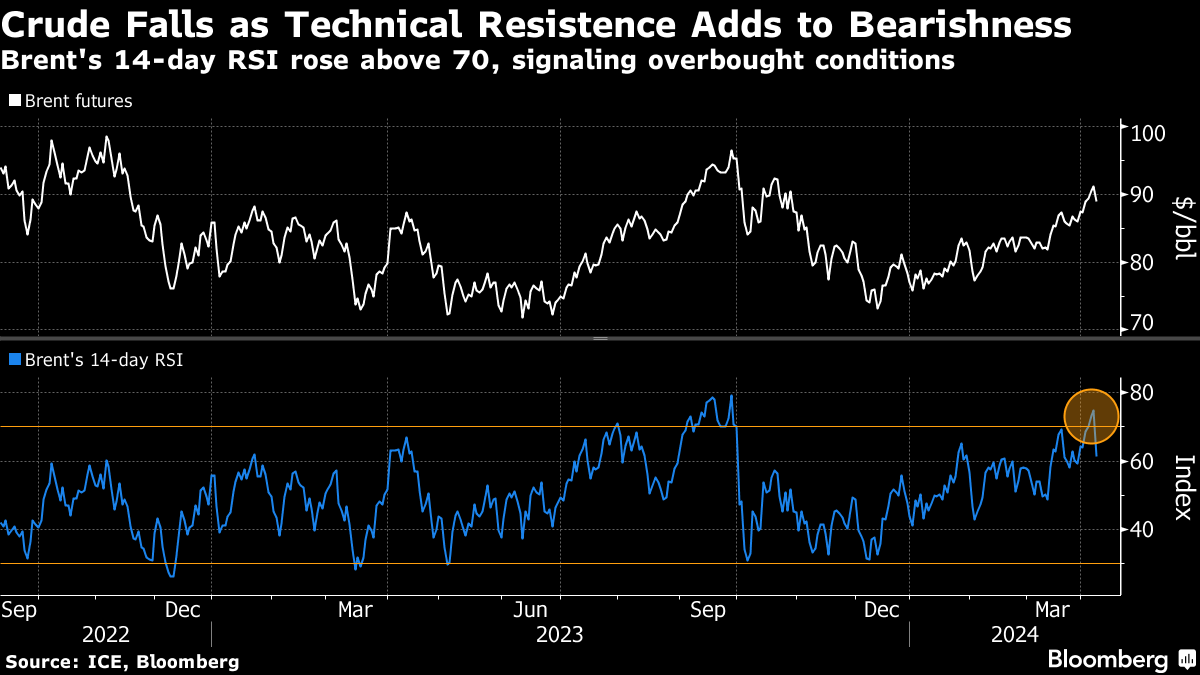

Brent futures tumbled by as much as 2.6% before clawing back some losses to trade below $90 a barrel. West Texas Intermediate was under $86. Oil has rallied recently on escalating geopolitical tensions and supply shocks, raising the prospect of the global benchmark reaching triple figures.

Israel said on Sunday that the country is pulling some troops from southern Gaza, with the forces recuperating and preparing for future operations, including an offensive on Rafah. Iran is also preparing a response to a suspected Israeli attack on its consulate in Syria, which could escalate regional tensions.

“The concession of moving troops out of Gaza is nowhere near cause to discount ongoing threats of more direct conflicts involving Iran,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. in Singapore. “Oil’s upside volatility remains very much present, and that’s to a large part thanks to geopolitics amplifying supply shortfalls elsewhere.”

Crude posted a fourth weekly gain on Friday, the best run since August, but the rapid rally higher has presented some technical resistance. Brent surged into overbought territory on the 14-day relative strength index, adding short term headwinds to the global benchmark.

The broader outlook remains bullish, with a slew of indicators pointing to an upward trend for prices. Timespreads are strong, volatility has recovered, and funds are going long on crude. Bullish oil call options — which profit when prices gain — are still trading at a premium to oppositely bearish puts.

Looking ahead, the US Energy Information Administration is scheduled to release its Short-Term Energy Outlook on Tuesday. That will be followed by reports from OPEC and the International Energy Agency later in the week.

The raft of data and commentary will aid in shaping the outlook for global oil balances. OPEC+ cuts are coinciding with supply outages from producers like Mexico and ongoing disruptions in the Red Sea due to Houthi attacks on shipping. Russian and Venezuelan flows are also in focus as the US steps up enforcement of sanctions.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week