Mexico to Halt Some Oil Exports, Further Squeezing Global Market

(Bloomberg) -- Mexico’s state-controlled oil company plans to halt some crude exports over the next few months, a move that would cut supply from a tightening global market.

Petroleos Mexicanos, also called Pemex, canceled contracts to supply its flagship Maya crude oil to refiners in the US, Europe and Asia, according to people with knowledge of the situation, who asked not to be named because the information is private.

The export cut, coming at a time when OPEC and its allies are already curbing production, threatens to drive up oil prices that are at a six-month high. Physical supplies — especially heavier, sour grades such as Maya — are tightening even further with Venezuelan exports set to fall after the reinstatement of US sanctions on its oil industry. JPMorgan Chase & Co. last week warned that global benchmark Brent could reach $100 a barrel this year.

READ: Mexico oil Exports Slump as Domestic Refining Cranks Up

Pemex’s plan to suspend some exports is part of an effort to produce more domestic gasoline and diesel ahead of the June 2 presidential election, the people said. President Andres Manuel Lopez Obrador, whose term is coming to an end, won office with the promise of weaning the country off of costly fuel imports. His multi-year effort to revamp Mexico’s refining sector is finally paying off.

In February the country’s six refineries operated near the highest rates seen in more than six years. Oil use should keep rising as Pemex works to start commercial operations of the new Olmeca refinery, also known as Dos Bocas, with capacity to process 340,000 barrels of crude oil a day.

Pemex didn’t immediately return call and messages seeking comment.

The halt affects primarily exports of Maya while shipments of other grades including medium sour Isthmus should continue at reduced volumes, the people said. It’s unclear if Pemex’s trading arm PMI will be able to follow through on the export cut. In 2021 and later in 2023 the company had to shelve plans to halt oil exports after it failed to increase domestic fuelmaking.

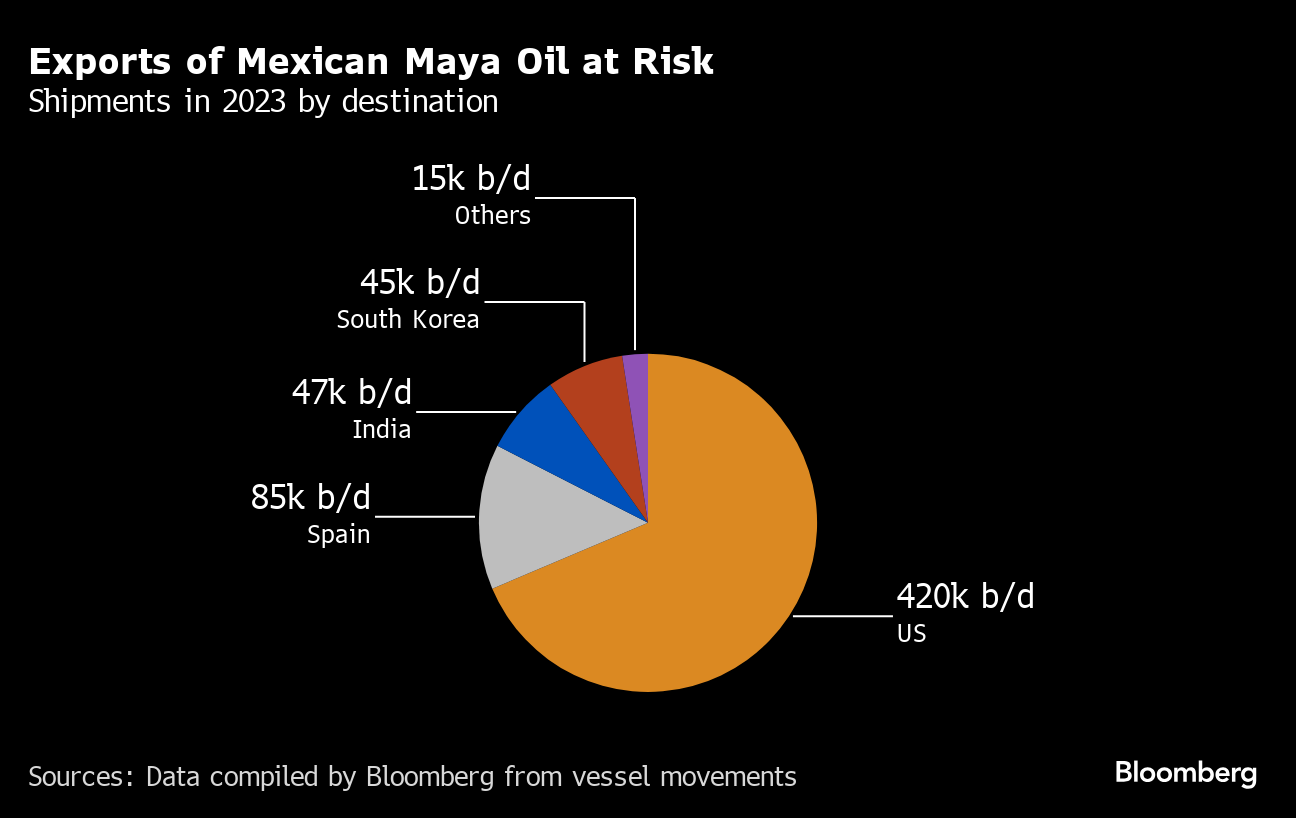

US refiners are likely to bear the brunt of the cut in Maya exports. Fuelmakers including Valero Energy Corp, Chevron Corp and Marathon Petroleum Corp import 420,000 barrels of the heavy sour variety per day. In 2023, Maya exports reached 612,000 barrels a day.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week