Gold Hits New Record, Oil Rises on Mideast Tension: Markets Wrap

(Bloomberg) -- Gold climbed to a fresh record and oil resumed gains as tensions in the Middle East simmered once again.

Markets are digesting a raft of news from US inflation data to the imminent start of earnings season for American companies. In addition, Iran may be close to launching missile or drone strikes on Israeli targets in response to a deadly attack on its diplomatic compound in Syria last week.

“Overall, there’s a lot of uncertainty right now for markets to deal with,” said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank in Singapore. “Spots of sticky inflation are lingering uncomfortably despite elevated global rates. Geopolitical troubles mean unwelcome energy-led shocks persist.”

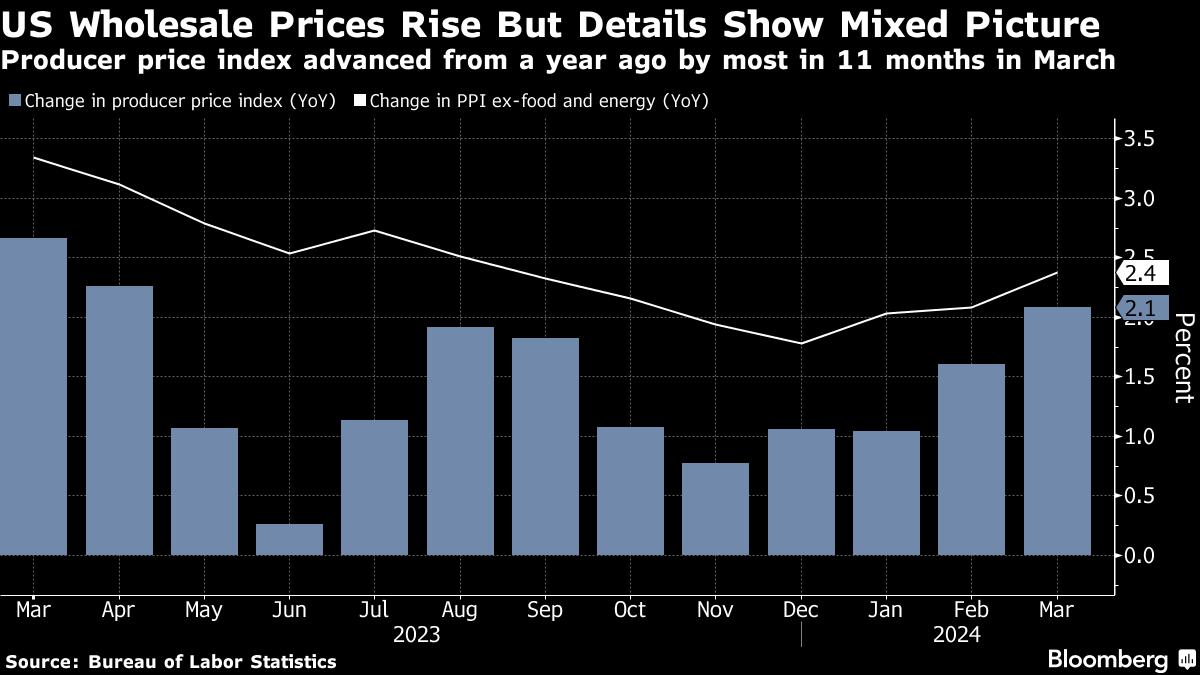

The 10-year Treasury yield fell about three basis points Friday after rising around 22 basis points in the previous two sessions. Data Thursday showed US producer prices in March increased less than forecast, after consumer-price growth came in hotter than expected earlier in the week.

Equities in Asia traded mixed. Japanese stocks rose, driven by a surging real estate sector as buybacks and higher return-on-equity targets boost investor sentiment. Australian, South Korean and Hong Kong shares traded lower.

Traders will continue to monitor the yen after Japanese authorities warned they will consider all options to combat weakness in the currency after it slumped to the weakest level against the dollar since 1990. It was little changed on Friday.

Investors will also be closely watching the offshore yuan after it advanced against the greenback for a fourth time in five trading sessions. The People’s Bank of China kept its fixing steady on Friday to maintain currency stability amid the dollar’s broader strength.

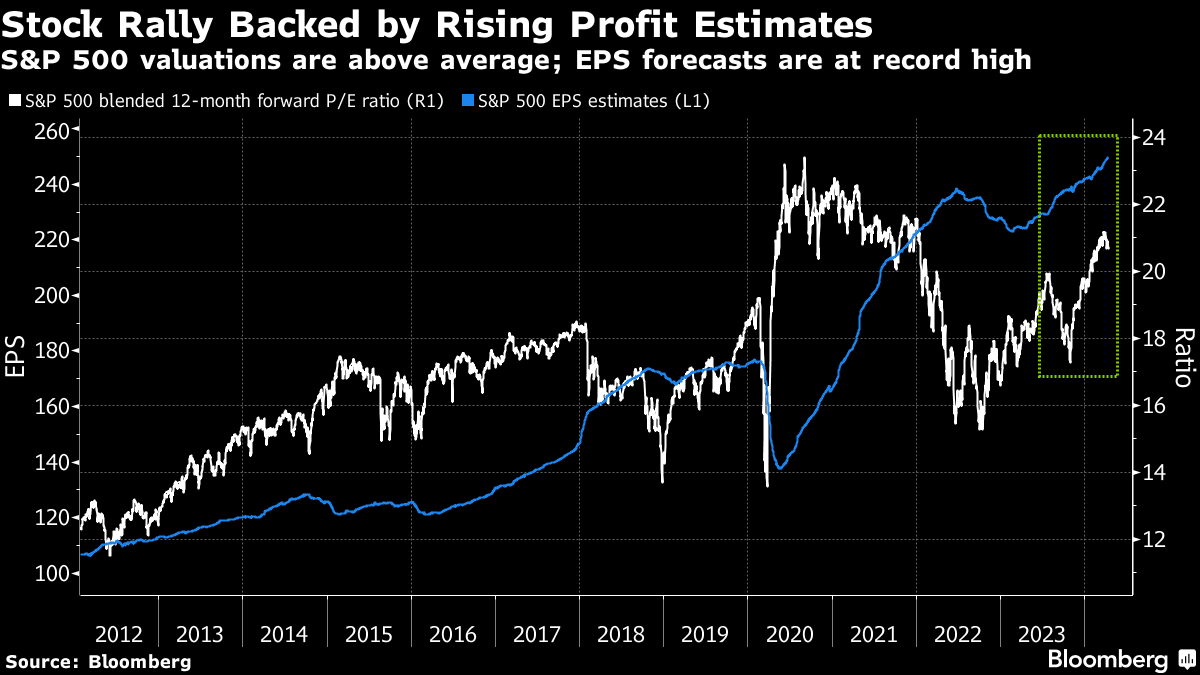

US futures were steady in Asia trading after the S&P 500 climbed Thursday, while the tech-heavy Nasdaq 100 closed over 1.5% higher. US corporate earnings are also in focus as several major banks will report on Friday, including JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc.

Wall Street projects S&P 500 members will show 3.8% annual growth in earnings per share for the first-quarter reporting period, data compiled by Bloomberg Intelligence show. Profits for the “Magnificent Seven” cohort — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Nvidia Corp., Meta Platforms Inc. and Tesla Inc. — are on course to rise 38% in the first quarter, according to BI.

“It’s not going to be Federal Reserve rate cuts that drive the market going forward, rather it’s going to be earnings,” said George Ball, chairman of Sanders Morris. “Corporate earnings are much stronger than people have anticipated even in this elevated interest-rate environment.”

Still, some sticky inflation readings have prompted market players to slash Federal Reserve rate-cut bets. Swaps traders now see around 43 basis points of cuts from the Fed in 2024 versus roughly 65 basis points before the CPI release.

The 11-month high in US producer prices may have added to worries the economy is still running hot, but did assuage some concerns about the prospect of runaway inflation, according to Quincy Krosby, Chief Global Strategist for LPL Financial.

“The PPI headline number came in a touch lower than estimates, helping markets ease fears of a broad based inflation assault on supply chain prices in addition to consumer prices,” she said.

Key events this week:

- China trade, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan and Wells Fargo due to report results, Friday.

- San Francisco Fed President Mary Daly speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:15 p.m. Tokyo time

- Nikkei 225 futures (OSE) rose 0.6%

- Japan’s Topix rose 0.5%

- Australia’s S&P/ASX 200 fell 0.2%

- Hong Kong’s Hang Seng fell 1.7%

- The Shanghai Composite was little changed

- Euro Stoxx 50 futures rose 0.7%

- Nasdaq 100 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.0717

- The Japanese yen was little changed at 153.23 per dollar

- The offshore yuan was little changed at 7.2566 per dollar

- The Australian dollar fell 0.1% to $0.6529

Cryptocurrencies

- Bitcoin rose 0.6% to $70,904.21

- Ether rose 0.3% to $3,534.45

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.57%

- Japan’s 10-year yield declined two basis points to 0.840%

- Australia’s 10-year yield advanced three basis points to 4.29%

Commodities

- West Texas Intermediate crude rose 0.7% to $85.65 a barrel

- Spot gold rose 0.5% to $2,384.39 an ounce

This story was produced with the assistance of Bloomberg Automation.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week