Oil Holds Rally as Hedge Funds Join Increasingly Bullish Bets

(Bloomberg) -- Oil was steady as hedge funds piled on bets that tightening supplies will see a resumption of the rally after a pause last week.

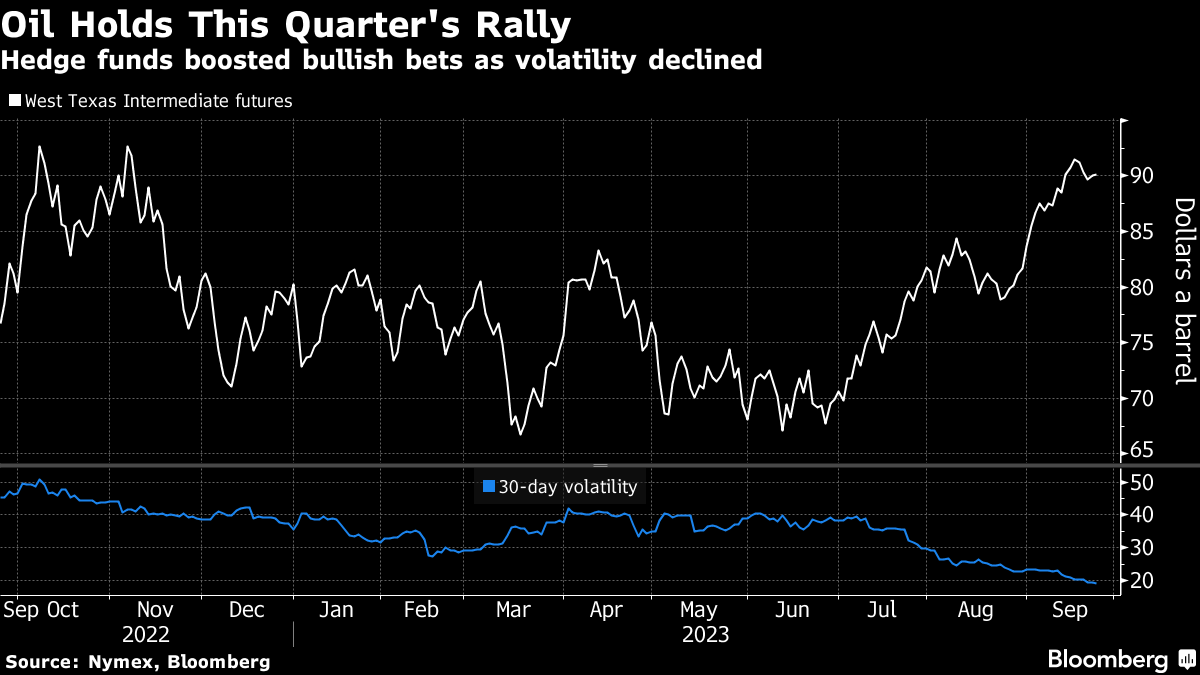

West Texas Intermediate futures rose as much as 0.7% before trading little changed above $90 a barrel. Hedge funds boosted their bullish positions on WTI to the highest since February 2022 on the back of higher prices and easing volatility, while JPMorgan Chase & Co. added to predictions of an “oil supercycle.”

Oil has soared by more than a quarter since end-June, with prices set for the biggest quarterly gain since March 2022 thanks to supply curbs from OPEC+ linchpins Saudi Arabia and Russia and brighter outlooks in the two biggest economies, the US and China. The surge has rekindled talk of the possibility of $100-a-barrel crude, while increasing price pressures in importers.

“We remain bullish, with Saudi Arabia continuing its output cuts and both China and the US showing decent demand,” said Zhou Mi, an analyst at the Chaos Research Institute in Shanghai. “We currently don’t see a trigger for a turnaround.”

There are plenty of signs of tightness in the physical market. Russia last week announced a temporary ban on diesel and gasoline exports, lifting fuel prices. In addition, US crude stockpiles fell again, and oil’s timespreads are in a backwardated structure, pointing to strong competition for near-term supplies.

China, meanwhile, is gearing up for the Golden Week holiday from Friday, with the longer-than-usual break set to boost demand for jet fuel in the biggest oil importer. More than 21 million people are expected to fly during the eight days, following record air-passenger traffic in July and August.

The policy of the Organization of Petroleum Exporting Countries and its allies has contributed to the stability of energy markets, Saudi Arabia’s Foreign Minister Faisal bin Farhan said Saturday in a speech at the United Nations.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output