Oil Holds Gain as OPEC, US See Output Cuts Tightening Market

(Bloomberg) -- Oil steadied after rallying to a 10-month high on forecasts by OPEC and the US that output cuts will tighten the market in the months ahead.

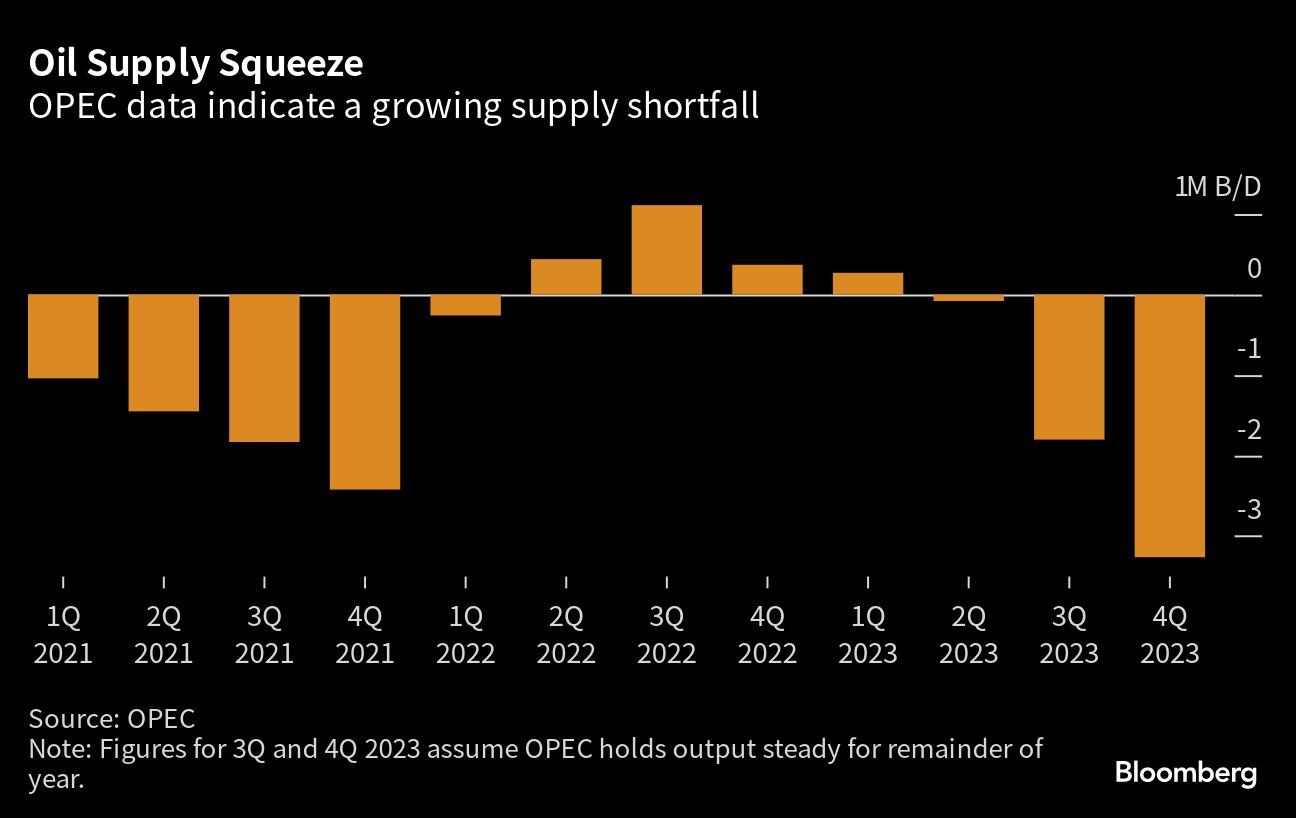

West Texas Intermediate traded near $89 a barrel, after rising 1.8% on Tuesday. The Organization of Petroleum Exporting Countries said it expects a shortfall of 3.3 million barrels a day in the fourth quarter, while the US Energy Information Administration predicted a more modest 230,000-barrel deficit.

“These numbers will cause some to question OPEC’s claims that their main objective is to keep the market balanced as their own numbers clearly do not show this,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “Some key consuming nations will be getting a bit concerned about stronger prices.”

The bullish outlooks added more impetus to a rally that’s been underway since mid-June as Saudi Arabia and Russia curbed supply and US and Chinese demand proved relatively resilient. The International Energy Agency publishes its monthly report Wednesday, offering more clues on the state of the market.

The industry-funded American Petroleum Institute said nationwide US crude inventories rose by 1.17 million barrels last week, with gasoline and distillate stockpiles also expanding. However, holdings at the key oil storage hub in Cushing, Oklahoma, declined by 2.42 million barrels. Official data will be published later on Wednesday.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad