Oil Steady With Differing Views From IEA, OPEC Clouding Outlook

(Bloomberg) -- Oil steadied after a short-lived relief rally as the market digested differing views on the supply and demand outlook, while an industry report pointed to an expansion in US stockpiles.

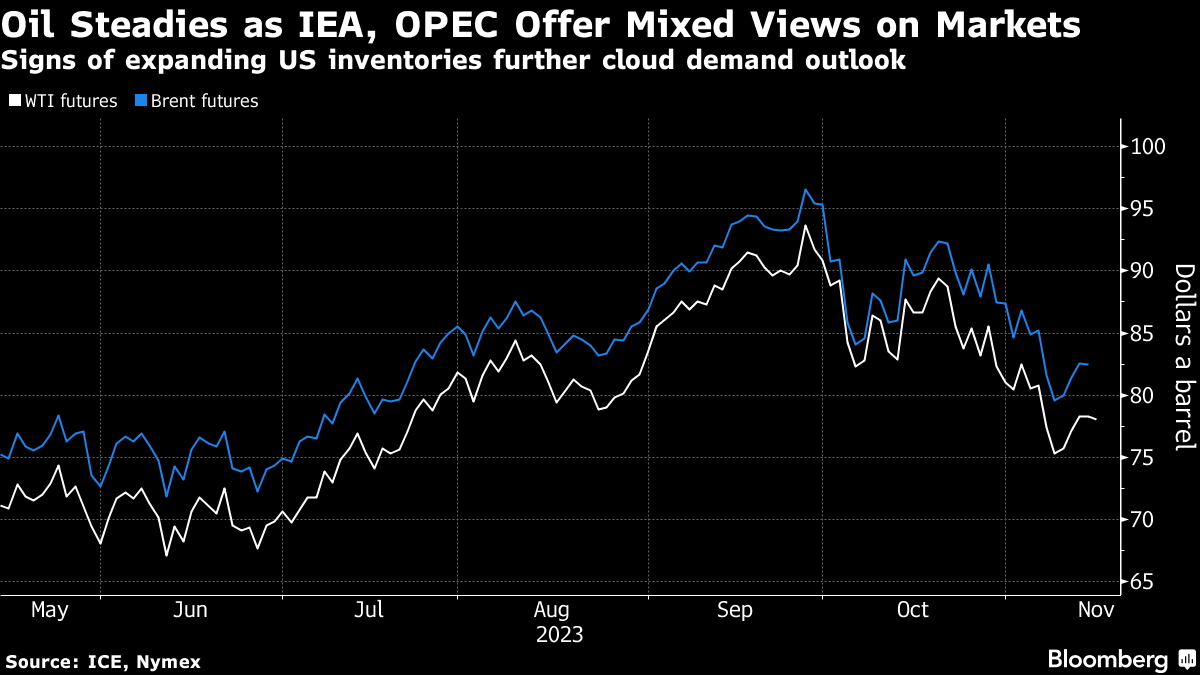

Global benchmark Brent traded near $83 a barrel, while West Texas Intermediate was above $78. The International Energy Agency said global oil markets won’t be as tight as expected this quarter, with production growth in the US and Brazil beating forecasts. That came after an assessment from OPEC that highlighted robust growth trends and healthy fundamentals.

The differing views from the two bodies “will likely keep oil markets on edge,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia. Brent will likely average $85 a barrel this quarter, and then fall to $75 by the second quarter of 2024 on demand concerns, although OPEC+ supply policy will be key, he said.

Oil has fallen sharply since mid-October as the Israel-Hamas war risk premium evaporated and doubts set in about the demand outlook, before rising in the three days through Monday. It’s lacked direction since then, with worries over the health of the global economy balanced by indicators that still show the market is in deficit.

A soft US inflation print on Tuesday spurred bets the Federal Reserve will start cutting interest rates by mid-2024, aiding the longer-term outlook for oil consumption and sending the dollar tumbling. However, data from China pointed to near-term demand weakness, with refining activity dropping to the lowest since July last month on weak margins.

The industry-funded American Petroleum Institute reported US crude inventories rose by 1.3 million barrels last week, while stockpiles at the hub in Cushing, Oklahoma increased by 1.1 million barrels, according to people familiar with the data. Figures from AlphaBBL also signaled expansion at Cushing. Two weeks of official data is due later Wednesday.

Widely watched timespreads have weakened recently, with the gap between Brent’s two nearest contracts at 27 cents a barrel in the bullish backwardation structure. That compares with $1.55 a barrel a month ago.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week