Oil Edges Higher After Saudis and Russians Reaffirm Supply Cuts

(Bloomberg) -- Oil edged higher after Saudi Arabia and Russia reaffirmed they will stick with oil supply curbs of more than 1 million barrels a day through year-end.

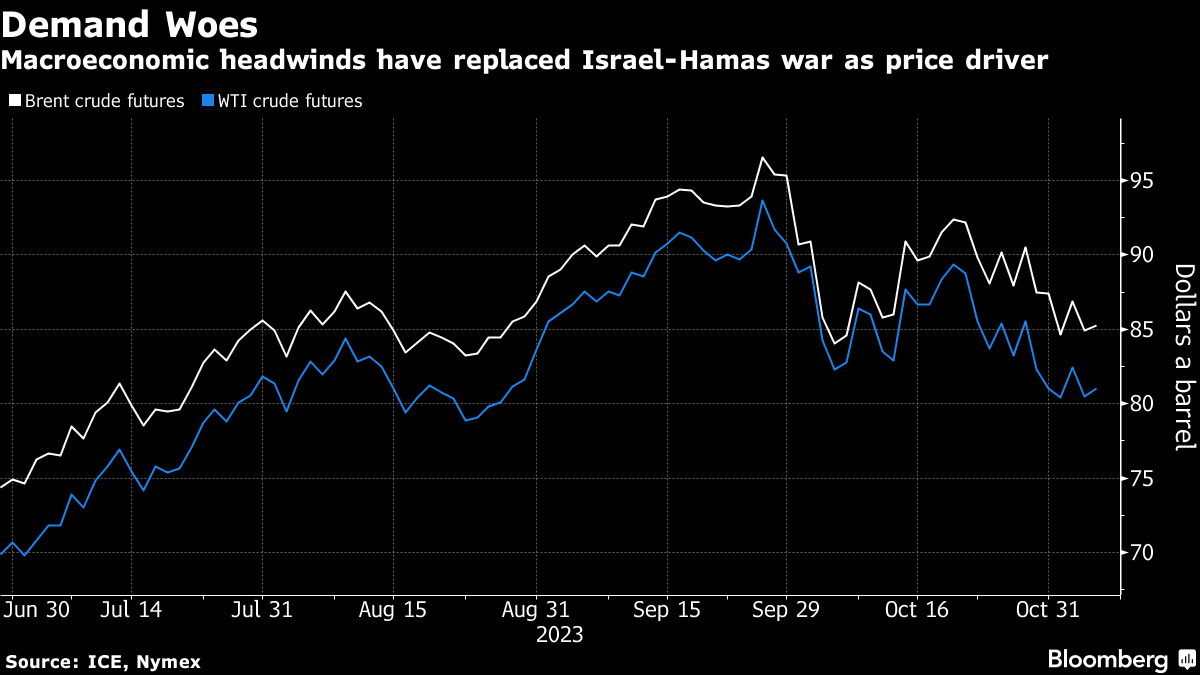

Global benchmark Brent crude traded above $85 a barrel, while West Texas Intermediate was near $81. The announcement by the OPEC+ heavyweights on Sunday comes after the fading Israel-Hamas war premium and concerns over weaker global demand pushed oil prices down by more than 6% last week.

Crude surged after the Hamas attack on Israel on Oct. 7, but those gains have now been almost entirely unwound as the war has remained contained and not disrupted supplies from the Middle East, the source of around a third of the world’s oil.

While there’s still a chance the conflict could spread across the region, a weakening global economic outlook has now now become the main price driver. A surprise contraction in Chinese manufacturing last month has raised questions about the recovery in the world’s biggest oil importer, while US stockpiles are growing. Even a falling dollar, which makes oil cheaper for most buyers, hasn’t been enough to arrest the downward slide.

“It will likely be a slow and bumpy recalibration for crude as it discards the risk premium from the Israel-Hamas conflict and recouples with economic sentiment,” said Vandana Hari, founder of Vanda Insights. “The only relative certainty is on the supply side, with OPEC+ holding output targets steady until year-end.”

In the Middle East, Israel ramped up its assault on Gaza, entirely encircling Gaza City even as Washington raced to expand its diplomatic efforts. US Secretary of State Antony Blinken, meanwhile, made an unscheduled stop in Baghdad with the goal of preventing the war from spreading, and also met with the Palestinian president in the West Bank.

Saudi Aramco, meanwhile, kept its December official selling prices for two of five oil grades unchanged to Asian customers, while increasing offer levels for a couple of varieties. It left all prices to North America unchanged, while slashing those to Europe, where demand is weakening.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week