Oil Steadies as Traders Grapple With Demand Outlook After Slump

(Bloomberg) -- Oil steadied as investors assessed a complex outlook for global crude demand after a period of volatile trading.

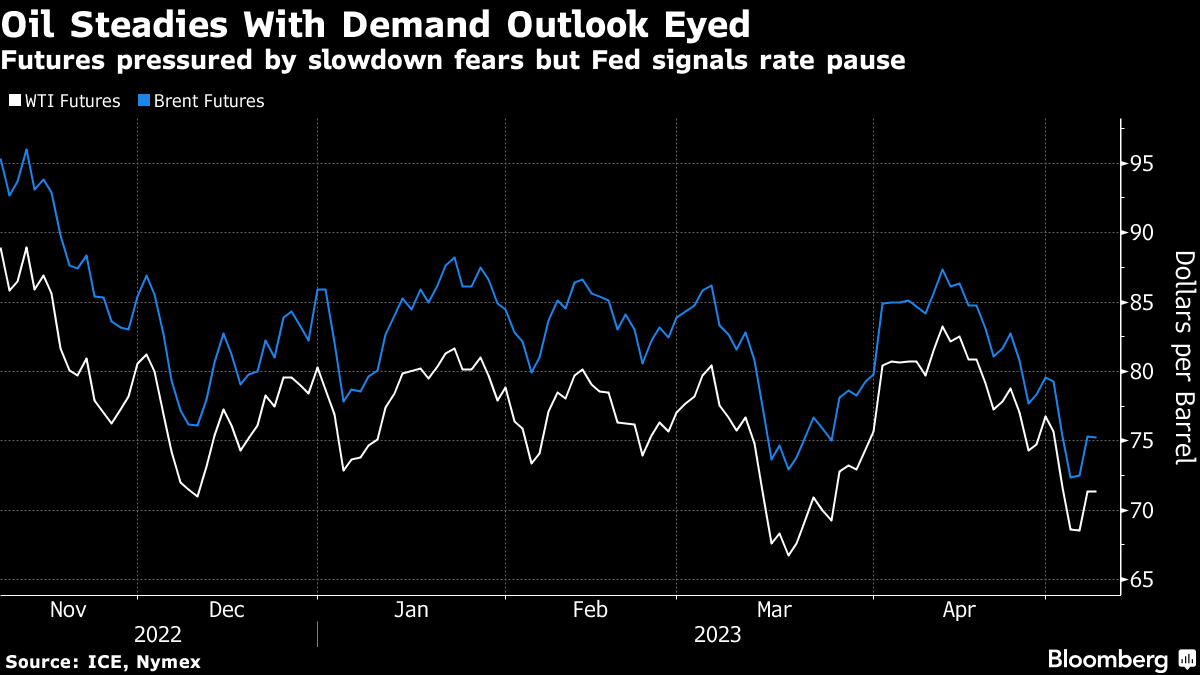

West Texas Intermediate held above $71 a barrel after surging by more than 4% on Friday, when futures pared a steep weekly loss. While fears of a US recession and bank failures have rattled markets recently, pushing crude to the lowest intraday level since late 2021, physical demand signals suggest at least some of the recent weakness in prices may have been overdone.

Traders will get a brace of outlooks this week on how the second half of the year may shape up. The Organization of Petroleum Exporting Countries issues its monthly snapshot on Thursday and, ahead of that, the US Energy Information Administration delivers its short-term outlook on Tuesday. The world’s largest oil producer, Saudi Aramco, will also disclose earnings.

Crude has dropped by about 11% this year as the Federal Reserve’s most aggressive tightening campaign in a generation spurred concerns of a US slowdown or recession, although most investors now expect that policymakers will pause rate increases. The drop has come despite a surprise production cut by OPEC and its allies including Russia. Still, there’s little evidence that Moscow has so far reduced its supply despite a vow to do so.

Oil’s recent weakness may reflect “an outsized amplification of the real economic dampening, especially given the financial linkages,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. There are now risks of a further “OPEC supply response, or at least jawboning from the group, in an attempt to backstop or shore up prices,” he said.

Speculators sharply ramped up bets against oil markets last week, data showed. Money managers posted the largest increase on record in short positions on Europe’s diesel market, while also lifting them by the most since last March on Brent. US crude and diesel markets also saw increases just weeks after the OPEC+ cut designed to stem bearishness.

Goldman Sachs Group Inc. laid the blame for oil’s drop over the past three weeks on a “mostly macro-financial selloff,” according to a note from analysts including Daan Struyven. The bank expects the global market to swing to “large deficits” in the second half, supporting its case for higher prices.

The prompt spread for global benchmark Brent — the gap between its two nearest contracts — was last at 23 cents a barrel in backwardation. The figure has been fluctuating recently, swinging between 37 cents and 15 cents a barrel in backwardation over the previous week.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week