Oil Holds Gains as US Stockpile Draw Counters Debt-Deal Tensions

(Bloomberg) -- Oil held a three-day gain after a big draw in US stockpiles and warning from Saudi Arabia aimed at short-sellers, with crude finding support even as tensions ticked higher over the US debt-ceiling impasse.

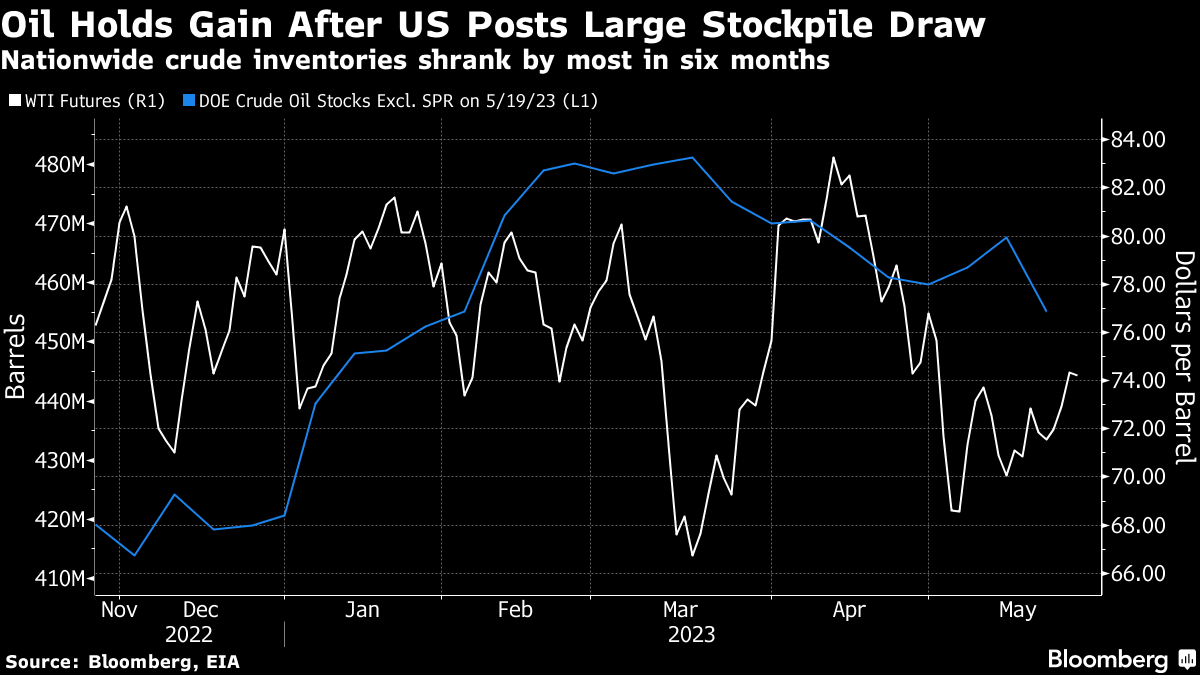

West Texas Intermediate traded above $74 a barrel after rallying by nearly 4% over the previous three days. US nationwide crude inventories plunged by more than 12 million barrels last week, the biggest drop in six months. That augmented bullishness in the market after Saudi Arabian Energy Minister Prince Abdulaziz bin Salman told speculators earlier this week to “watch out.”

Still, there’s persistent concern about the fight over raising the US federal debt limit and the potential consequences for the global economy and energy demand. Fitch Ratings said Wednesday it may downgrade US credit ratings to reflect the worsening political partisanship that’s preventing a deal.

Crude is still down more than 7% for the year as lackluster Chinese growth and tighter US monetary policy combined to subdue demand. Federal Reserve officials are leaning toward pausing rate hikes in June, though they also signaled they’re not yet ready to end their fight against inflation.

“The outlook for the oil market appears poor for now: macroeconomic drivers like the US debt-deal negotiations and tighter US monetary policy are weighing” on prices, said Sean Lim, an oil and gas analyst at RHB Investment Bank Bhd in Kuala Lumpur. Still, as China’s recovery picks up steam, prices should gain over the second half, he said.

Traders are also looking ahead to a meeting of the Organization of Petroleum Exporting Countries and allies early next month. Despite the threat against short-sellers from Riyadh this week, many traders and analysts are still expecting Saudi Arabia and its partners to keep output levels unchanged.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output