Oil Edges Higher With Weaker Dollar and Supply Halts in Focus

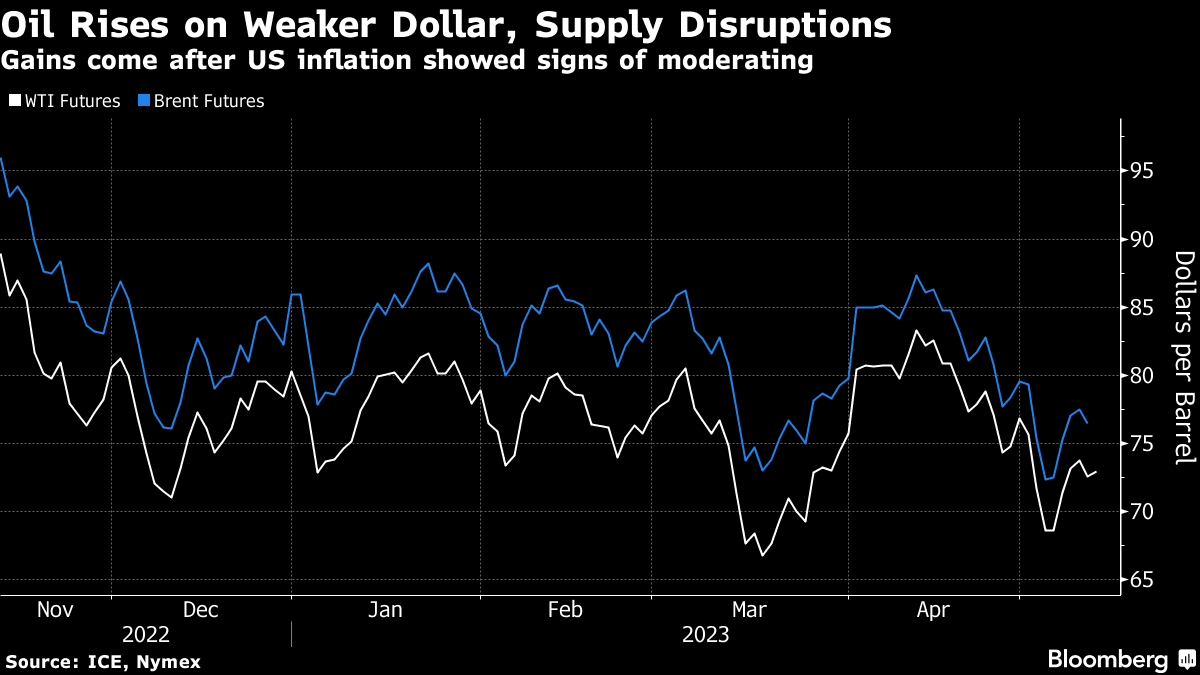

(Bloomberg) -- Oil advanced for the fourth session in five as easing US inflation weakened the dollar and traders assessed interruptions to supplies.

West Texas Intermediate rose above $73 a barrel, after losing 1.6% on Wednesday. US inflation showed signs of moderating in April, giving the Federal Reserve room to pause its aggressive monetary tightening campaign. That’s undermining the US dollar, aiding commodities that are priced in the currency.

Crude supplies from Canada have been hit by a spate of wildfires across Alberta. In the Middle East, Iraq said that it’s still waiting for Turkey to restart exports via Ceyhan port as a protracted stoppage drags on.

Crude has lost about 9% this year as worries over Fed tightening and a potential US recession outweighed the boosts from a surprise output cut by the Organization of Petroleum Exporting Countries and its allies, as well as a US plan to refill strategic reserves. Later Thursday, OPEC will issue its monthly outlook offering insights into how the market may shape up in the second half.

“China’s latest inflation data showed signs of uneven recovery,” said Ravindra Rao, head commodity research at Kotak Securities Ltd., referring to figures issued Thursday that showed price increases in the key crude importer running at the weakest pace in two years. Despite that, the “ongoing supply disruptions from Iraq and Canada provided a floor for prices,” he said.

A US crude market report on Wednesday offered a mixed picture on supplies. Nationwide commercial crude stockpiles rose by nearly 3 million barrels last week, with inventories at the key Cushing, Oklahoma, hub also expanding. Still, gasoline and distillate stockpiles contracted, according to Energy Information Administration data.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output