Oil Advances as US Debt-Talk Progress Buoys Appetite for Risk

(Bloomberg) -- Oil rose after US leaders including President Joe Biden sounded a broadly positive tone on solving the debt-limit impasse, aiding risk appetite.

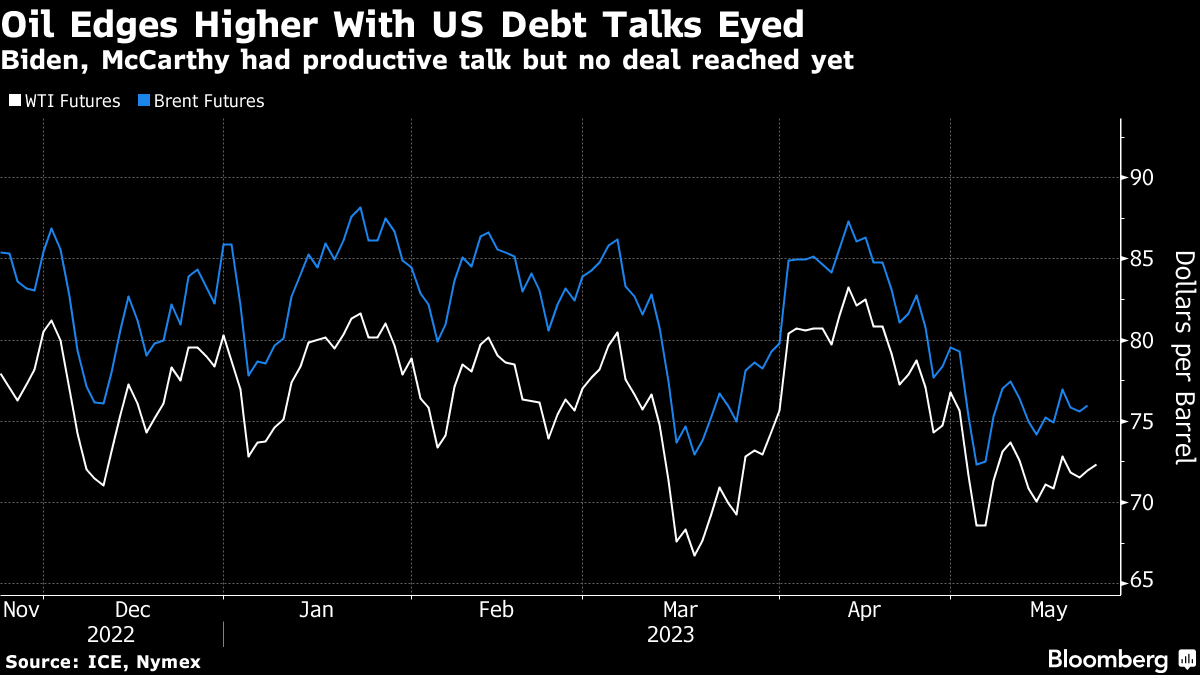

West Texas Intermediate for July gained above $72 a barrel after that contract added 0.5% on Monday. House Speaker Kevin McCarthy said he and Biden had a productive talk, although a deal to avert a default has yet to be struck. Before the meeting, Treasury Secretary Janet Yellen had warned that it was now highly likely her department would run out of sufficient cash in early June.

The showdown in Washington has dominated sentiment in commodity markets in recent days as talks go down to the wire. A US default risks catastrophic financial and economic disruption that would imperil energy demand.

Crude has retreated by about 10% for the year as China’s lackluster recovery after it abandoned Covid Zero, and the US Federal Reserve’s most aggressive monetary tightening campaign in a generation, combined to weigh on sentiment. Also, Russian oil exports have remained robust, with flows not yet showing signs of the output cuts that the country insisted it was making.

While Fed Chair Jerome Powell earlier signaled a pause in interest-rate increases in June, other central bank officials said they saw the need to raise borrowing costs even further, potentially depressing energy demand.

“Oil has managed to hold up relatively well, despite little progress in US debt-ceiling talks as well as some more hawkish comments from US Fed officials,” said Warren Patterson, head of commodities strategy at ING Groep NV. “Despite the move higher yesterday, sentiment still remains mostly negative.”

Oil traders will also be on alert for comments scheduled later Tuesday from Saudi Arabian Energy Minister Prince Abdulaziz bin Salman at the Qatar Economic Forum. Saudi Arabia, the de facto leader of the OPEC+ cartel, was among nations that surprised the global crude market recently with a supply cut that started to take effect from this month.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week