Oil Set for Weekly Loss as Fed Tightening Fears Pummel Markets

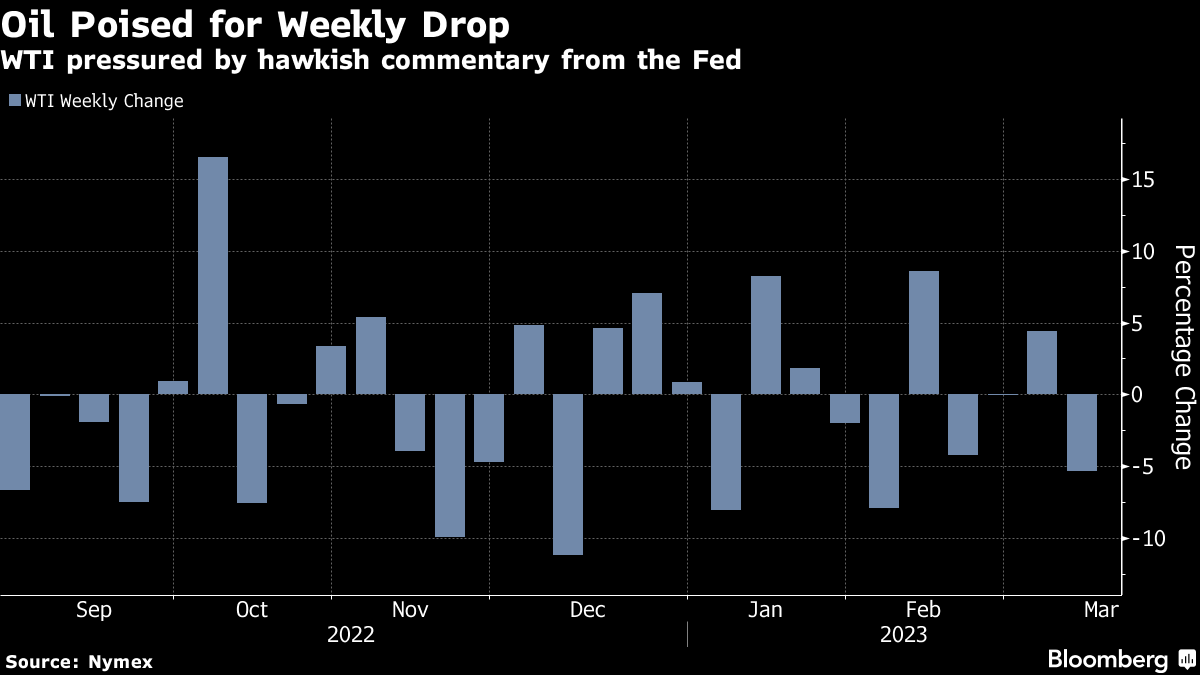

(Bloomberg) -- Oil headed for the biggest weekly loss since early February as the prospect of further and potentially faster interest-rate hikes from the Federal Reserve weighed on the outlook for energy demand.

West Texas Intermediate futures fell for a fourth session, toward $75 a barrel, and are down more than 5% this week. A hawkish tone from Fed Chair Jerome Powell this week has rippled across markets, with investors keenly anticipating jobs data later Friday for further clues on the path for monetary tightening.

“A strong report would likely intensify expectations of a more hawkish Fed,” said Warren Patterson, head of commodities strategy for ING Groep NV. Weaker stocks have added further pressure to the oil market, he added.

Bearish sentiment around more rate hikes has overshadowed optimism over China’s recovery after the end of Covid Zero. The country’s revival is already increasing the cost of shipping crude, while Shell Plc sees higher oil prices over the coming months as China underpins record global demand.

Oil has had a bumpy year so far, whipsawed by the opposing drivers of global slowdown concerns and China’s rebound. Traders are also monitoring energy flows from Russia, with indications the nation’s exports are holding up more strongly than initially expected, even in the face of sanctions.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output