Oil Extends Gain for Sixth Session Ahead of Fed Chair Testimony

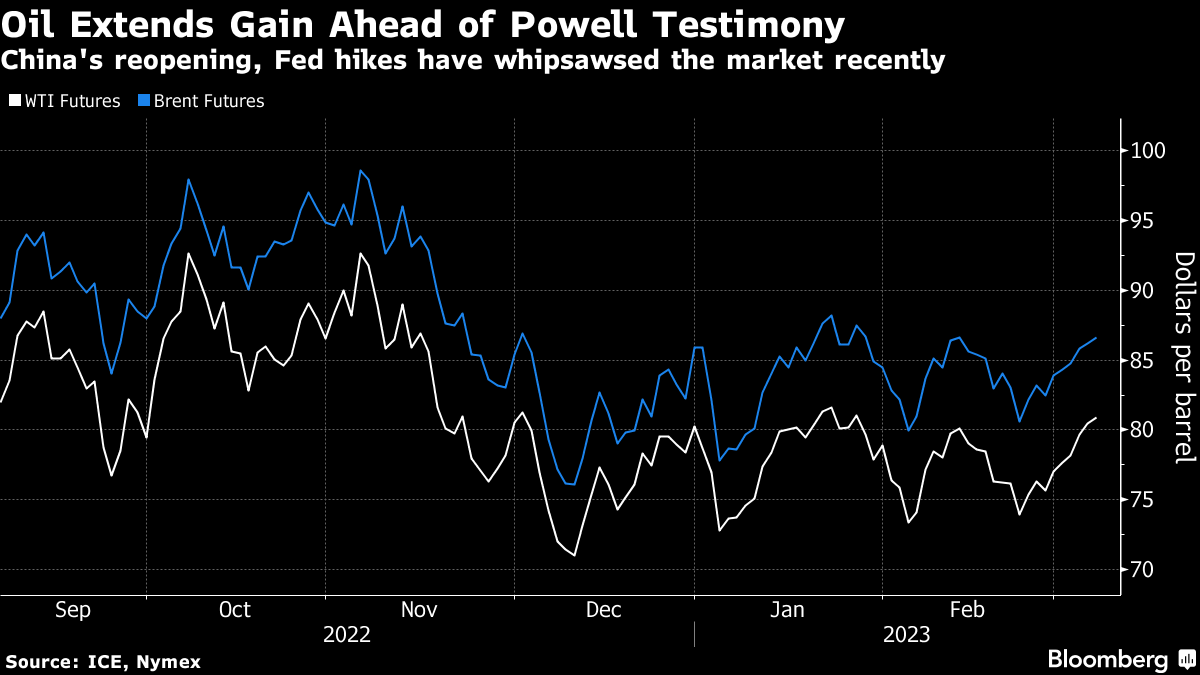

(Bloomberg) -- Oil climbed for a sixth session amid a broader rally in stocks ahead of a testimony from Federal Reserve Chair Jerome Powell that will provide clues on the path forward for monetary tightening.

West Texas Intermediate rose toward $81 a barrel after closing at a five-week high on Monday as futures advanced above the 100-day moving average, a widely-watched technical gauge. Powell will begin two days of testimony before the Senate and House committees in Washington later Tuesday.

“With oil currently finding support from its 100-day moving average, it seems that prices may head to retest the $90 level,” said Yeap Jun Rong, a market strategist at IG Asia Pte in Singapore.

Crude has endured a bumpy year, whipsawed by concerns over further interest rate hikes from the Fed and a bullish outlook for Chinese demand following the end of Covid Zero. However, the world’s top oil importer has set a cautious economic growth target this year, denting some optimism in the outlook.

Traders are also tracking Russian energy flows following sanctions for the nation’s war in Ukraine. They seem to be resilient so far, with Gunvor Group Chief Executive Officer Torbjorn Tornqvist saying Russia’s plan to cut its oil output by 500,000 barrels a day in March isn’t yet affecting its exports.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight