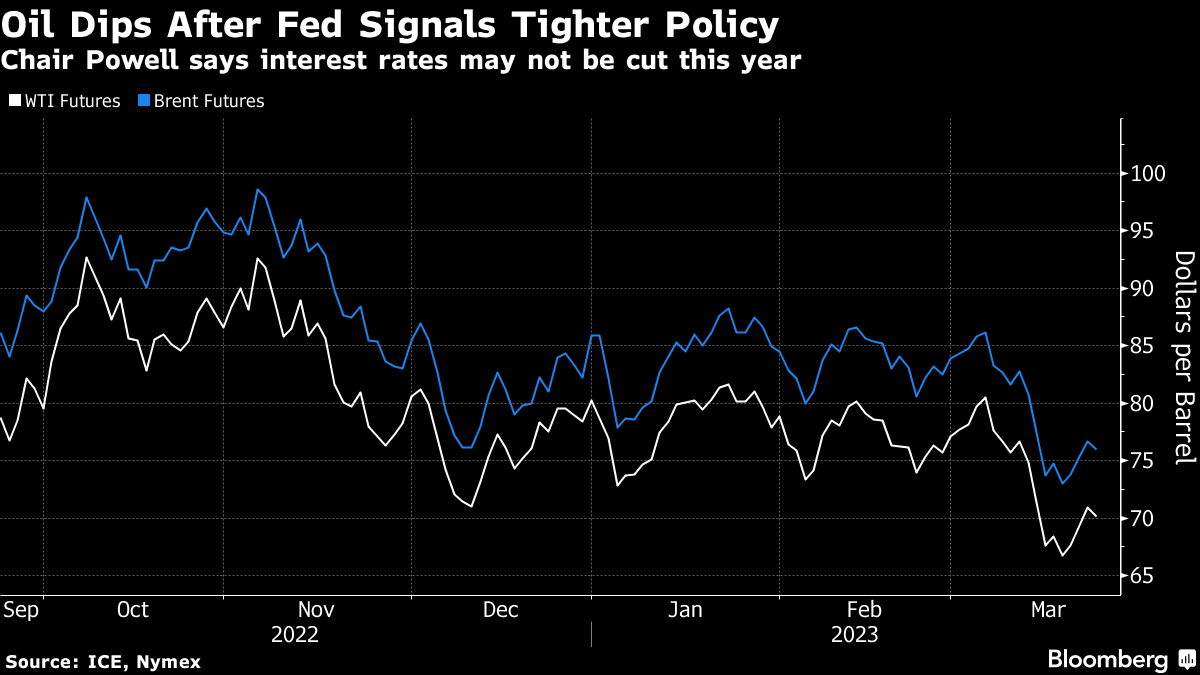

Crude Oil Snaps Three-Day Advance as Traders Digest Fed Outlook

(Bloomberg) -- Oil fell as investors weighed the Federal Reserve policy outlook after another hike and digested a mixed snapshot of US supply and demand.

West Texas Intermediate futures for May dipped toward $70 a barrel after rising about 6% in the first three days of the week. Fed Chair Jerome Powell advised that more tightening may be in store after Wednesday’s 25 basis-point rise, and added that rates won’t be cut this year. The comments came less than two weeks after the most severe banking crisis since 2008.

The appeal of risk assets including commodities was also bruised after Treasury Secretary Janet Yellen said regulators weren’t looking to provide “blanket” deposit insurance to stabilize the banking system without working with lawmakers, putting the focus back on the fragility of financial institutions.

“Clearly, macro will remain the key driver for price direction in the short term,” said Warren Patterson, head of commodities strategy for ING Groep NV. “Comments from Yellen related to a blanket deposit insurance appear to have put some renewed pressure on risk assets, including oil.”

Crude is headed for the steepest first-quarter drop since 2020, when the pandemic hammered demand. The slump has been driven by concerns about a potential US recession, robust Russian flows despite Western sanctions, and the banking turmoil. Still, there are signs of strong demand in Asia as China recovers after the nation ditched its Covid Zero policy late last year.

US nationwide crude stockpiles expanded to the highest level since May 2021 after strong builds on the Gulf Coast outweighed a decline at the Cushing, Oklahoma, storage hub, Energy Information Administration data showed. Still, oil exports jumped to a record, and gasoline holdings shrank again.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad