OPEC Haggles Over Possible Output Cuts After Day One of Meeting

(Bloomberg) -- OPEC was haggling over whether to make fresh production cuts, with little clarity on the size of the potential curbs or whether there would actually be a deal after the first day of talks in Vienna.

Oil ministers spent Saturday shuttling between hotel suites and the OPEC headquarters, saying little publicly about the nature of their talks beyond confirmation that a final agreement wouldn’t come until Sunday, when non-members including Russia join the conference.

The Organization of Petroleum Exporting Countries and its allies are meeting against an uncomfortable backdrop of uncertain demand and volatile oil prices. Privately, delegates from the group said additional supply curbs were the focus of discussions, but their scale was unclear.

In part, that was because the United Arab Emirates was seeking to change the basis for measuring its own production cuts. That became a point of contention for some African countries because a more generous output limit for the Gulf state could come at their expense, delegates said.

Further talks were necessary before any agreement could be reached, one delegate said, asking not to be named because the information was private.

The official talks at OPEC headquarters on Saturday didn’t address production policy and focused instead on internal matters, delegates said. But Gulf members held a separate meeting on the sidelines, and African ministers also spoke to Saudi Energy Minister Prince Abdulaziz bin Salman, the group’s de facto leader.

“Everything is on the table,” Iran’s OPEC Governor Amir Zamaninia told reporters in the Austrian capital. The final outcome of the meeting was still wide open, delegates said, including the possibility that the meeting will end without a deal on further production cuts.

As ministers continued their discussions, delegates said the UAE was using the opportunity to push to raise the baseline against which its curbs are measured, delegates said. This has been a longstanding claim from the Gulf state, which invested heavily in new production capacity only to see it sit idle for years due to its OPEC+ commitments.

There were also talks about the quotas of several African states, where long-term decline has pushed output well below official OPEC+ limits. Saudi Arabia was pressuring these countries to accept baseline adjustments that would effectively allocate some of their unused production quotas to the UAE, delegates said.

Bearish Speculators

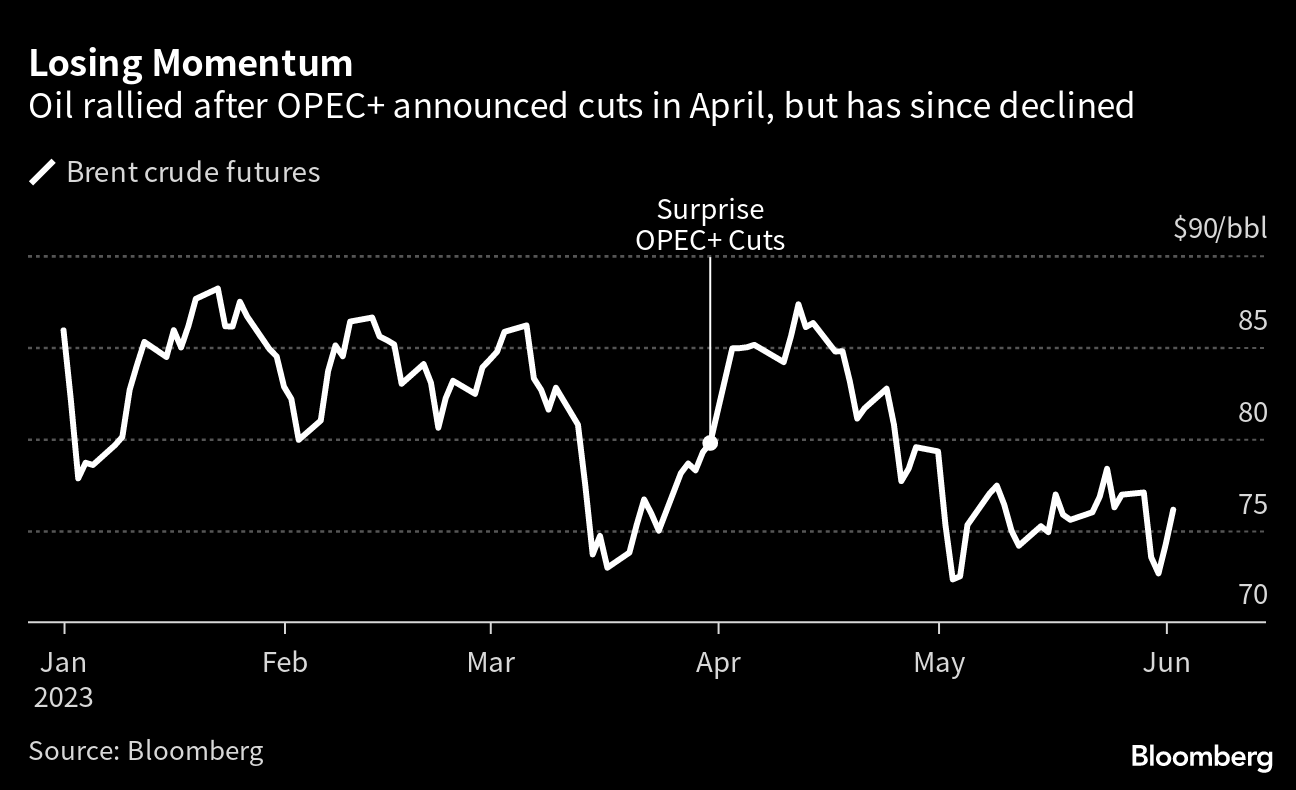

OPEC+ is considering fresh production cuts only a month into its most recent round of supply reductions. Those surprise curbs caused a brief price rally after they were announced in April, but oil traders have since amassed short positions in crude futures as the slowly global economy threatened demand. Prices fell by 11% in New York in May, ending the month at about $68 a barrel.

Even with the recovery in the first two days of June, crude was about 14% below its mid-April peak as concern about the Chinese economy weighs on sentiment. When asked about this bearish trend last week, Saudi Energy Minister Prince Abdulaziz bin Salman, who has sought to hurt short sellers with previous rounds of cuts, told speculators to “watch out.”

That message wasn’t enough to shift sentiment though, particularly after Russia’s Deputy Prime Minister Alexander Novak told Izvestia that the group was unlikely to take “any new steps.” He later moderated that statement, saying the group could decide to take any action that’s necessary.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output