Oil Steady After Mixed Stockpile Data as Demand Concerns Linger

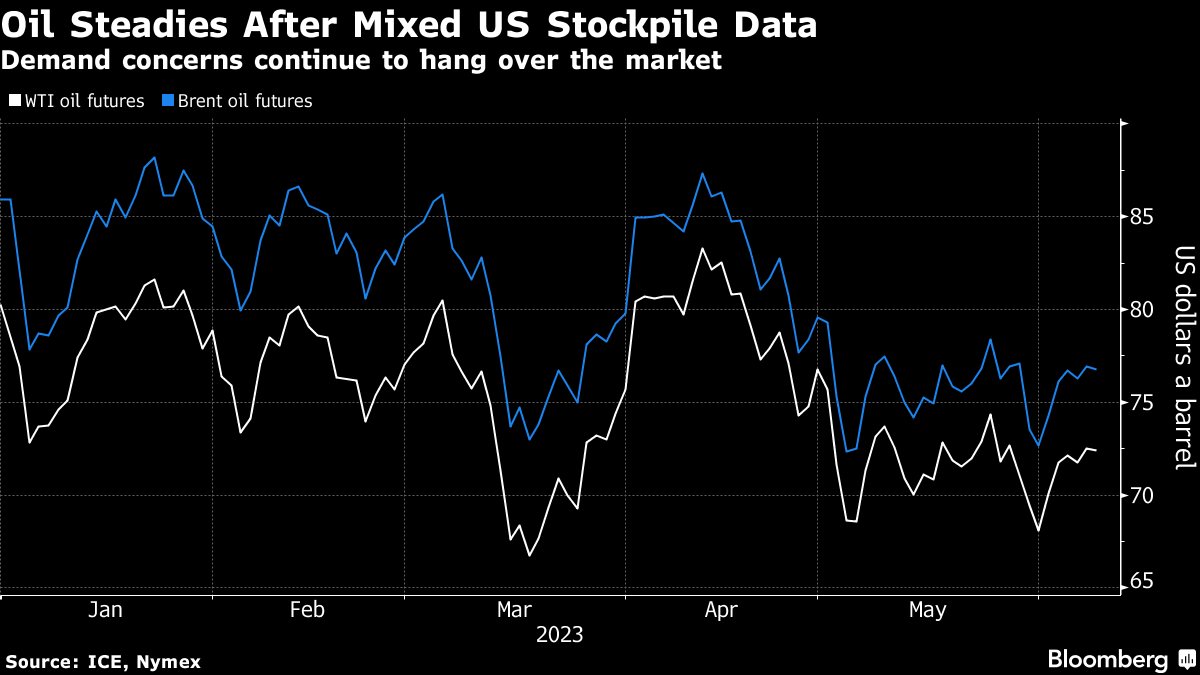

(Bloomberg) -- Oil steadied as investors weighed mixed US data on crude and petroleum stockpiles amid persistent concerns over the demand outlook.

West Texas Intermediate futures traded near $72 a barrel after gaining 1.1% Wednesday. Crude inventories at the Cushing storage hub rose for a seventh week, while gasoline stockpiles also gained, according to government figures. However, refinery utilization was at the highest level since 2019, providing some bullish sentiment for summer demand.

Oil is still down 10% this year as China’s sluggish economic recovery, interest rate hikes from the Federal Reserve and robust Russian crude flows weigh on prices. Investors will also be watching data on jobless claims later Thursday for clues on the path forward for US monetary policy.

“Hawkish tremors are being felt globally, signaling more tightening may be in the pipeline,” said Charu Chanana, market strategist for Saxo Capital Markets Pte. “Current price action is clearly reflective of broader macro concerns.”

Saudi Arabia’s pledge over the weekend to cut more supply from the market in July led to an initial surge in prices on Monday, but optimism around the curbs has quickly faded. Citigroup Inc. said the cut wouldn’t offset weak market fundamentals, with the bank bearish on the outlook for the second half.

While US gasoline stockpiles rose for the first time in five weeks, inventories are still below the five-year seasonal average, according to Energy Information Administration data. The Memorial Day weekend at the end of May is typically the start of the nation’s summer driving season.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad