Oil Heads for Weekly Decline Ahead of OPEC+ Meeting on Supply

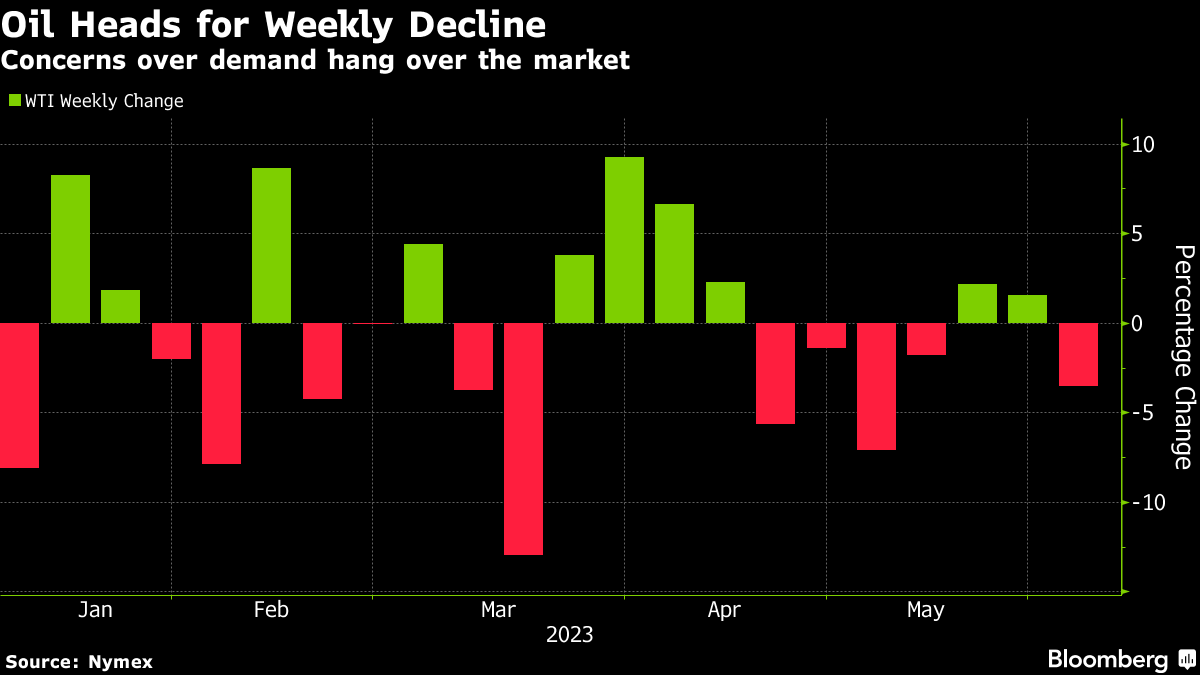

(Bloomberg) -- Oil headed for its biggest weekly loss in a month as persistent concerns about demand hang over the market ahead of an OPEC+ meeting.

While West Texas Intermediate rose toward $71 a barrel on Friday amid a risk-on tone, futures are still down around 3% for the week. OPEC+ gathers over the weekend to discuss the group’s production policy against the backdrop of a sluggish economic recovery from China, despite the end of Covid Zero.

Most market watchers expect OPEC+ to keep output levels unchanged, although the group did unveil surprise cuts in April and Saudi Arabia’s energy minister recently warned speculators to “watch out.” Crude is down around 13% this year, in part due to resilient crude exports from Russia.

Equity markets across Asia rose on Friday as concerns over further interest-rate hikes from the Federal Reserve eased, while news that Congress had passed legislation to avert a US default added to positive sentiment.

US crude stockpiles rose by about 4.5 million barrels last week, while supplies at the key storage hub at Cushing, Oklahoma, expanded for a sixth week, according to Energy Information Administration data released Thursday.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight