Oil Extends Losses on Demand Woes as Goldman Cuts Outlook Again

(Bloomberg) -- Oil extended losses amid persistent concerns around the demand outlook as Goldman Sachs Group Inc. cut its price forecast again.

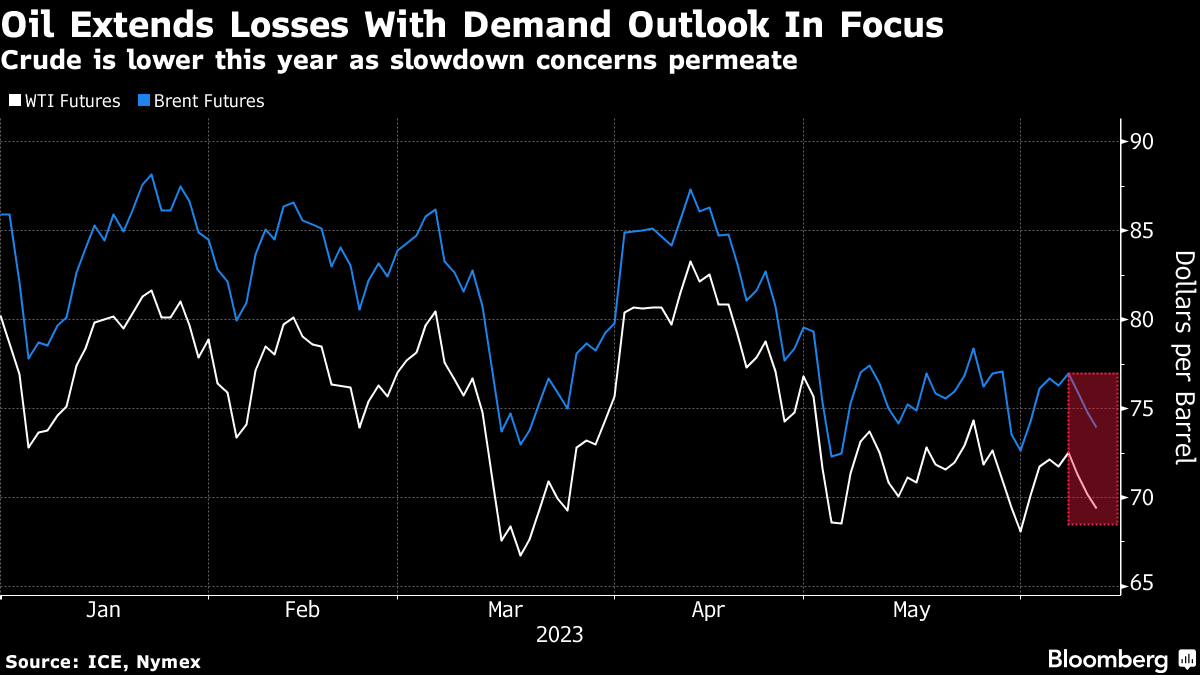

Brent futures traded near $74 a barrel after capping a 1.8% decline last week, the biggest weekly drop since early May. Goldman made its third downward price revision for the global benchmark in six months, trimming its estimate to $86 for the end of the year on rising supplies and waning demand.

Oil in London is around 14% lower this year as fears of a US slowdown, China’s anemic economic recovery and robust Russian flows weigh on the outlook. Even a recent pledge by Saudi Arabia to cut more production in July failed to keep prices elevated, with traders less and less responsive. The immediate gain after the announced curbs a week ago lasted only a day.

“We are at a juncture where markets are willing to bet that demand risks could overwhelm the Saudi’s ability to boost prices,” said Vishnu Varathan, the Asia head of economics and strategy at Mizuho Bank Ltd. Weakness in China, Europe the US are all weighing on the outlook, he added.

There are some bullish signs, however. Hedge funds boosted bullish bets on Brent and West Texas Intermediate crude in the week ended June 6. The US Federal Reserve is also expected to skip an interest-rate hike after a year of increases, a move likely to buoy energy demand.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company