Canadian Stock Payouts Hit Record Levels Versus US, CIBC Says

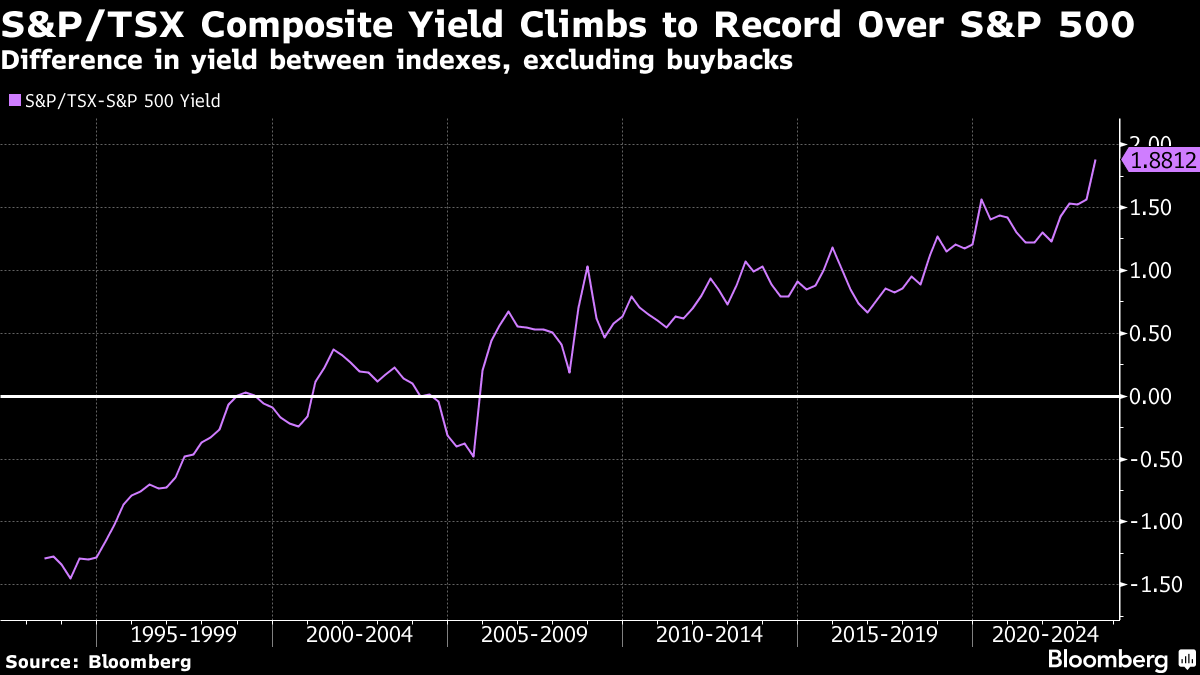

(Bloomberg) -- The S&P/TSX Composite Index is offering the biggest payout ever relative to the S&P 500 Index as high commodity prices spur a record surge in Canadian buybacks and dividends.

“This is the most attractive relative yield the TSX has ever had vis-a-vis the S&P 500,” Canadian Imperial Bank of Commerce head of portfolio strategy Ian de Verteuil said by phone, Friday. “Outside of the last three or four years, the TSX has never had a payout yield close to the S&P 500.”

S&P/TSX Composite-listed stocks are currently offering a 5.4% payout yield on a combination of “ratcheted up dividends” and a “buyback craze,” de Verteuil wrote in a note to clients. That’s more than 100 basis points higher than the yield on the S&P 500 — a record divergence between the two stock indexes, CIBC says.

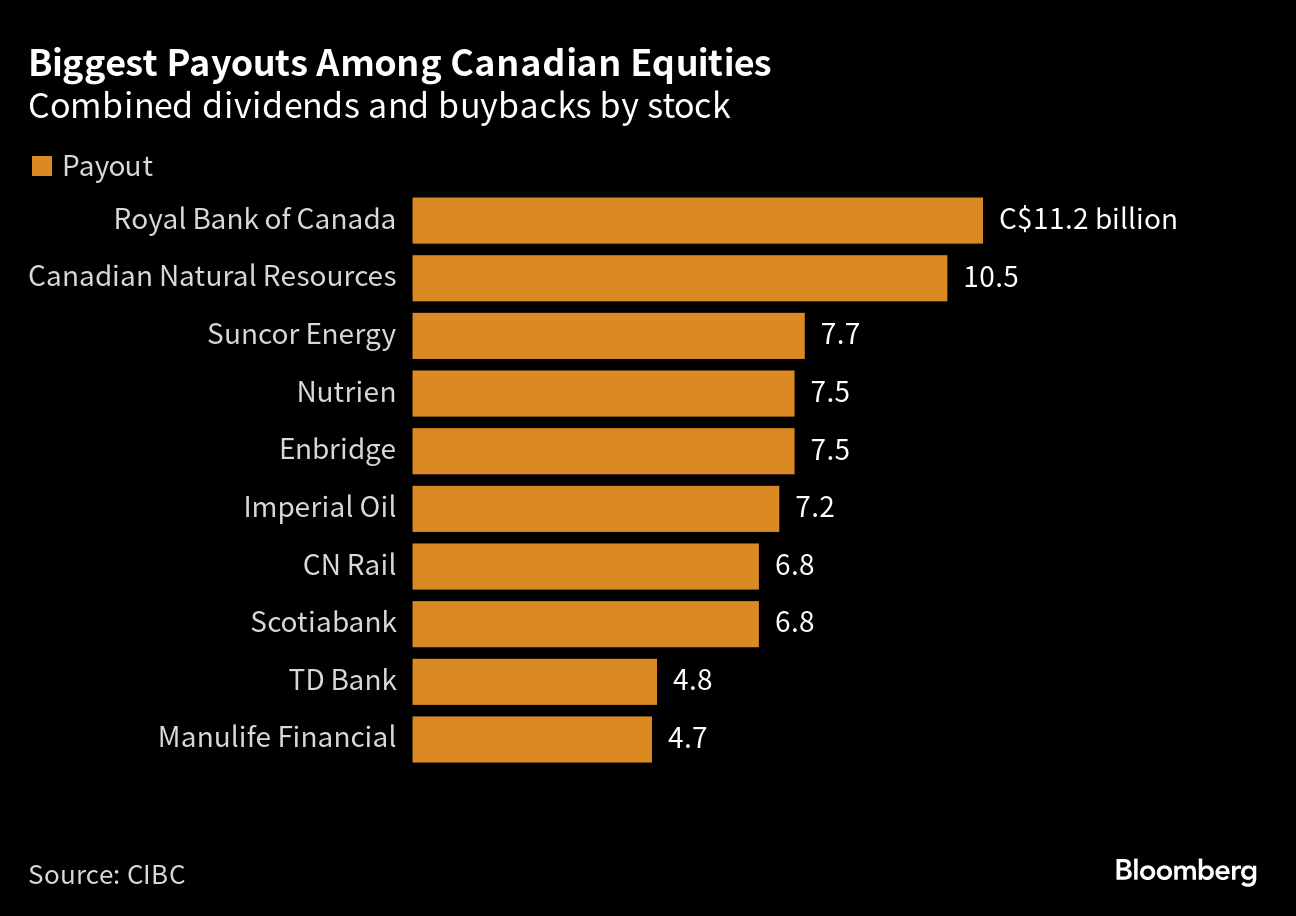

Boosted by higher energy, fertilizer and metals prices, total payouts including dividends and buybacks by S&P/TSX-listed firms reached a record C$170 billion over the last 12 months, CIBC calculated.

Stocks in Toronto have offered heftier dividend yields since 2005, according to data compiled by Bloomberg. The US market, by contrast, has consistently offered investors bigger returns via share buybacks.

But now, buybacks are surging in Canada, partly due to an incoming 2% tax on them, CIBC notes, pushing the yield advantage in Canadian stocks to record levels.

To be sure, de Verteuil sees “the current extravagant buyback level” as unsustainable, especially as oil prices fall amid recession concerns and flagging demand from China. CIBC expects the total S&P/TSX-listed firms payout in dividends and buybacks to fall to C$140 billion over the next year, bringing the payout yield down to 4.4%.

That would still be above levels in the US, according to CIBC, which would mark a historic divergence as the S&P 500 yield has surpassed that of the S&P/TSX Composite for most of the last 25 years.

“We believe Canadian investors should still expect payouts to remain above 4%, unless a severe recession develops,” he said.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output