South Korea Exports Extend Drop as Risks to Economy Escalate

(Bloomberg) -- South Korea’s exports continued to decline in December in a sign of cooling global demand as higher interest rates weigh on consumption.

Overseas shipments dropped 9.5% from a year earlier, compared with economists’ forecasts for a 11.1% decline, according to data released Sunday by the trade ministry. Imports fell 2.4%.

The trade shortfall was $4.7 billion in December, resulting in the first annual deficit since the global financial crisis as elevated oil prices battered many trade-dependent nations.

South Korean exports are a major barometer of global commerce and tech demand as the nation produces key items such as chips, displays and refined oil.

Trade resilience has been a key source of reassurance for the Bank of Korea that the economy could withstand higher borrowing costs even as it tightened policy over the past year. Still, the cycle of interest rate hikes is likely close to ending as the central bank becomes more concerned about growth with the world economy slowing.

For 2022, Korean exports increased 6.1% while imports rose 18.9%. The contraction in monthly shipments began in October, with weaker chip demand leading the decline.

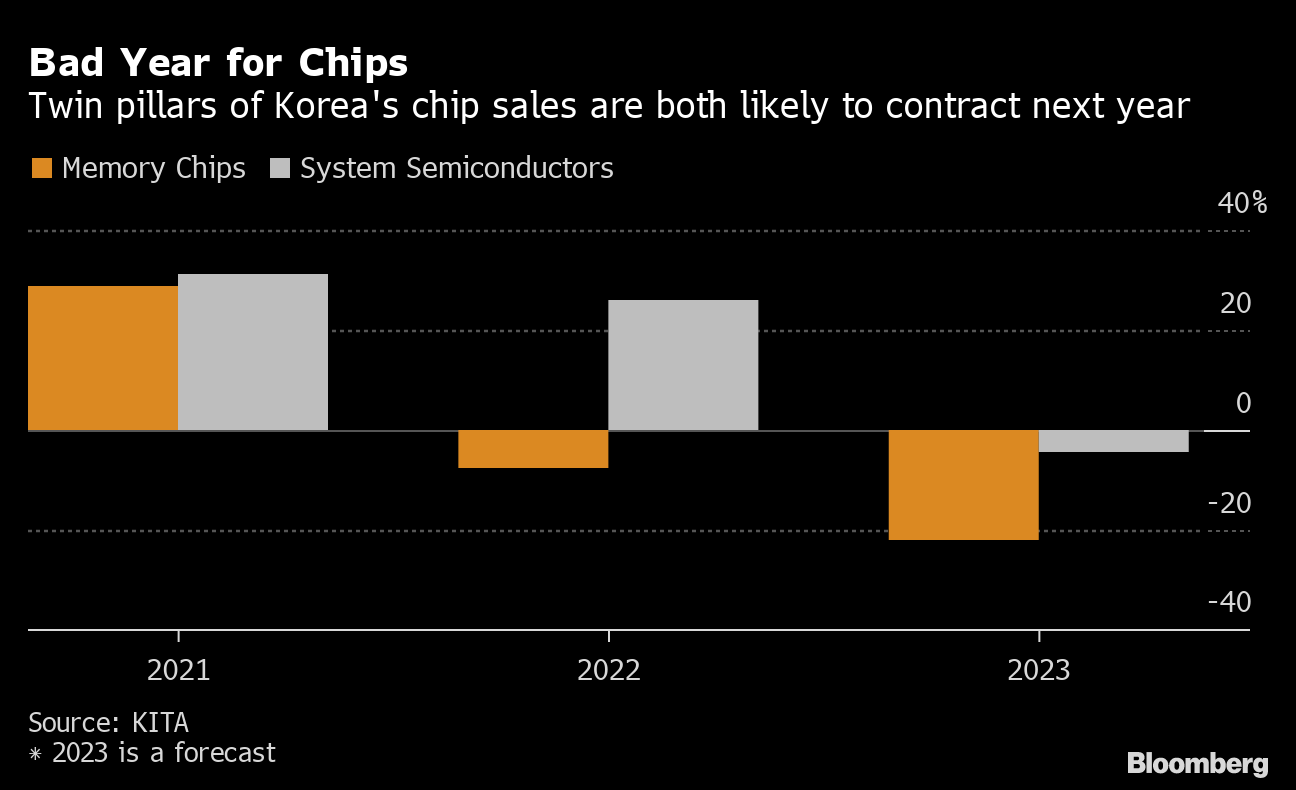

Semiconductor sales plunged 29.1% from a year earlier in December, the trade ministry said, the fifth straight monthly drop. Chipmakers are adjusting to the slackening demand, and cut production in November by the most since 2009.

Elevated inflation, China’s emergence from Covid Zero and Russia’s war on Ukraine are among other factors complicating the outlook for trade.

Labor strife is another factor that could hit the economy as workers express discontent fueled by soaring prices. A nationwide truckers’ strike weighed on South Korea’s supply chains before ending last month.

Exports will probably fall 4.5% in 2023 and imports will likely decline 6.4%, according to the finance ministry.

Rivalry between the US and China over semiconductor hegemony poses a longer-term threat to South Korea whose trade depends heavily on momentum in global memory chip sales.

China’s struggle with nationwide Covid-19 outbreaks has also disrupted South Korea’s overseas shipments. Exports to China fell 27% in December.

Shipments to the US increased 6.7%.

(Adds trade data from third paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight