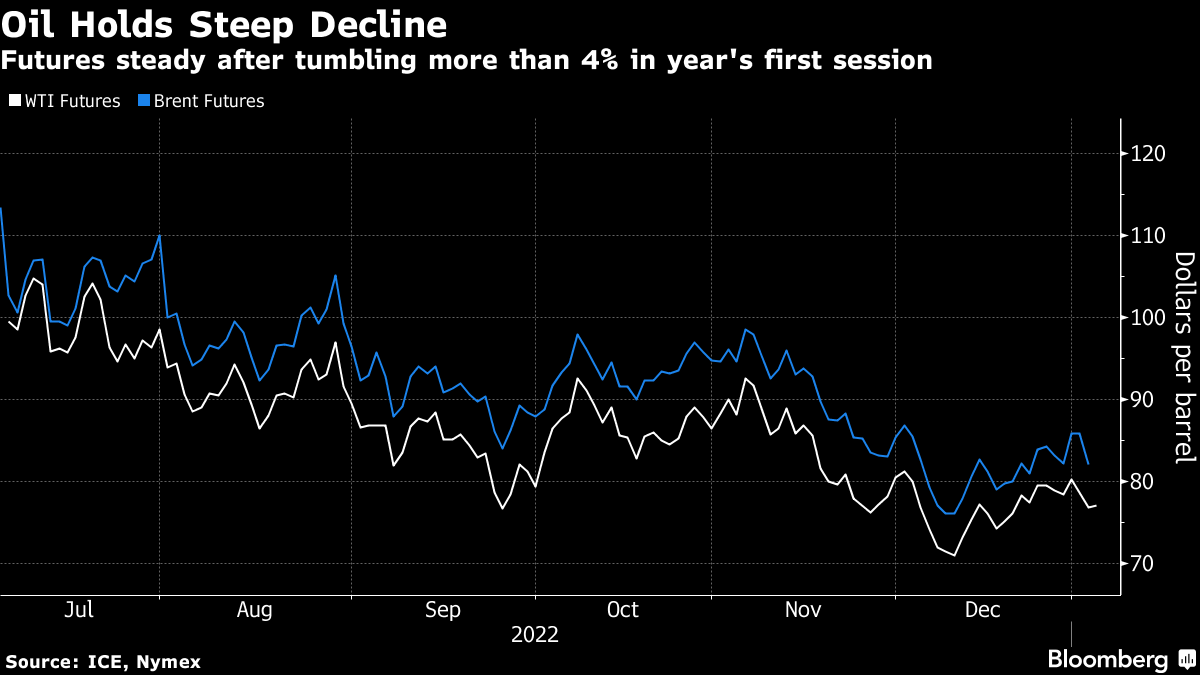

Oil Steadies After Tumbling on Worsening Demand Outlook

(Bloomberg) -- Oil steadied after a miserable start to the trading year as a deteriorating demand outlook came to the fore, buttressed by predictions for a US recession, milder winter weather, and China’s struggles with Covid-19.

West Texas Intermediate held below $77 a barrel after sinking 4.2% on Tuesday in the biggest drop since November. A rising death toll in China from the swift easing of virus curbs is overwhelming crematoriums, and there are warnings of a heavier toll heading into the Lunar New Year. Above-average temperatures in the US and Europe, meanwhile, are easing fears of an energy crunch.

With the Federal Reserve raising rates to quell inflation, a US recession is on the cards, according to former New York Fed President William Dudley, who said it probably won’t be severe. Former Fed Chair Alan Greenspan also said a recession is the “most likely outcome” for the world’s largest economy.

Crude eked out a small gain last year as thinning liquidity exacerbated volatility. After surging in the wake of Russia’s invasion of Ukraine in February, it then lost ground as concern over a global slowdown grew. Sanctions against Moscow over the conflict have dragged its oil flows to 2022 lows, and traders are tracking further possible retaliatory actions from Russia.

“Rising Chinese Covid infections could weigh on demand in the immediate term,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. However, the country’s easing of virus curbs “should be constructive for the demand outlook in the medium to longer term,” he added.

Crude output from the Organization of Petroleum Exporting Countries edged higher last month as Nigeria partially reversed a long-term slump by cracking down on oil theft. The country effectively provided the entire gain, as other members stuck to production curbs.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company