Oil Set for Weekly Gain on China Optimism, Brighter US Outlook

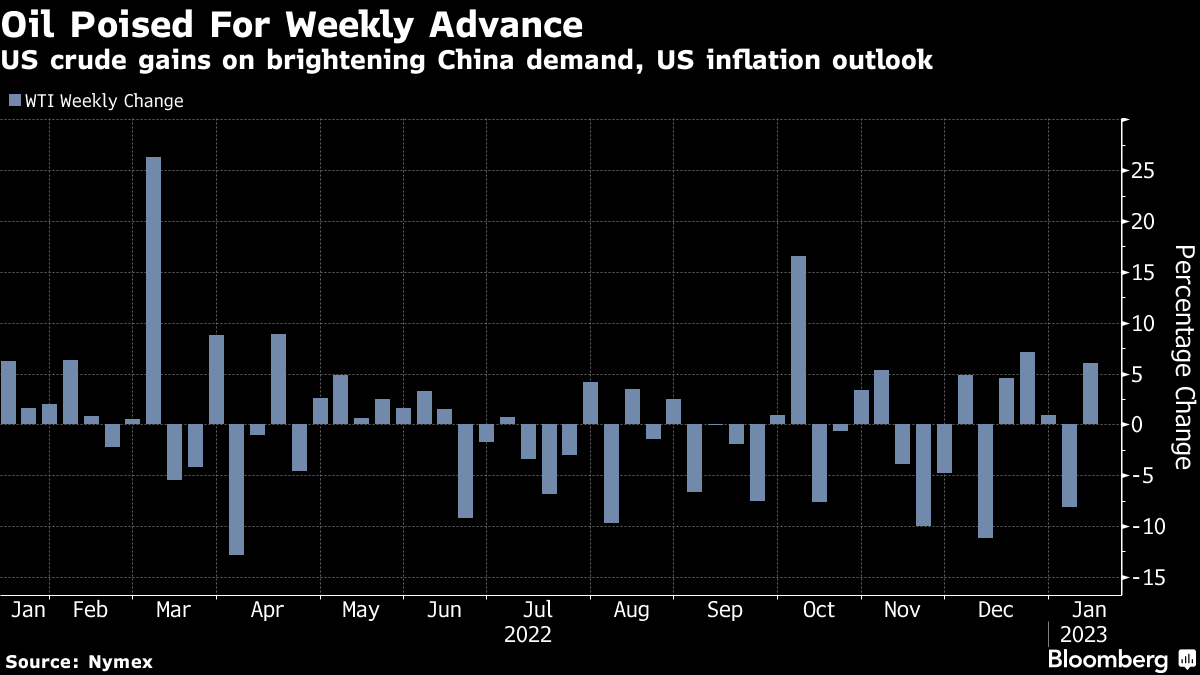

(Bloomberg) -- Oil headed for a weekly gain, rebounding from a weak start to the year, on China’s improving demand outlook and as US inflation cooled.

West Texas Intermediate was steady near $78 a barrel, up around 6% for the week. China ramped up purchases of crude this week after Beijing issued new import quota, and consumption is poised to surge to a record this year following the nation’s dismantling of Covid Zero.

US consumer prices in December posted the first monthly decline since 2020, fueling expectations that the Federal Reserve will slow the pace of interest-rate hikes, and adding some bullish sentiment across financial markets.

Oil has pushed higher after a rocky start to the year, with a raft of forecasters from Goldman Sachs Group Inc. to top hedge fund manager Pierre Andurand predicting prices will rally back above $100 a barrel in 2023. There are also tentative signs that trading activity has picked up in the new year.

“Markets are upbeat on what China is doing at the margin, but I don’t think everyone is sold on the roaring economy thesis,” said Vishnu Varathan, the Asia head of economics and strategy at Mizuho Bank Ltd. “Although a pullback from recession risks has given oil some breathing space, if prices rise too much, that could quickly scratch off the demand-side support.”

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output