Oil Extends Decline on US Recession Concern, Inventory Build

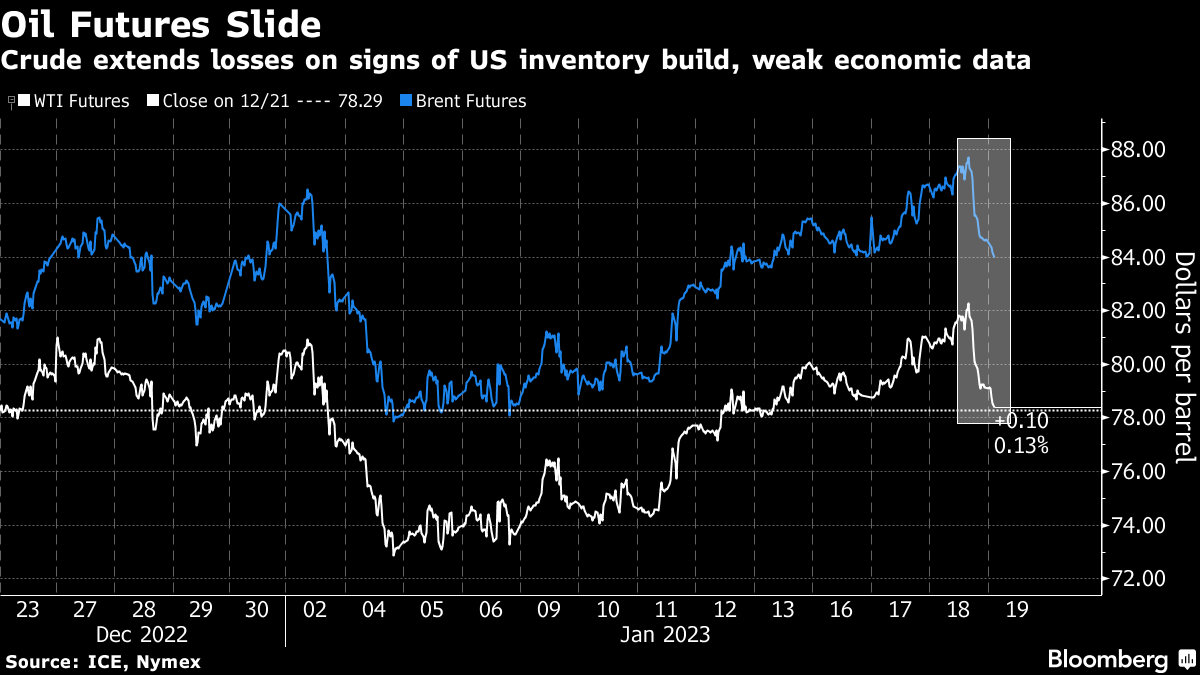

(Bloomberg) -- Oil fell for a second day as concerns over a US recession deepened and figures pointed to another build in inventories, eclipsing optimism that China’s dismantling of Covid Zero will aid demand.

West Texas Intermediate dropped below $79 a barrel after declining almost 1% on Wednesday as US retail sales slowed, stoking concern over a potential slowdown. The American Petroleum Institute reported commercial stockpiles grew by 7.6 million barrels, according to people familiar with the figures.

Crude has endured a shaky start to the year, collapsing by 10% in the opening two sessions on slowdown concerns only to rebound as the positives from China’s reopening dominated the trading narrative. Global consumption will reach a record daily average in 2023 with Asia’s largest economy leading the way, the International Energy Agency said in its latest outlook this week.

“Prices appear to have peaked for now and might be due for a small correction,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. in Singapore. “The weak US data and signs of inventory build should temper, not terrify, markets as they are being interpreted in light of a more optimistic economic environment.”

Reinforcing the IEA’s bullish outlook, Saudi Aramco said that it was optimistic that consumption will increase as China recovers and air travel rebounds. Separately, traders are also waiting for clues on Russia’s production and exports when sanctions on refined fuels take effect early next month.

Time spreads are showing a mixed picture. While global benchmark Brent’s prompt spread — the difference between its two nearest contracts — is holding in contango, longer-dated differentials, including the three-month figure, remain in the opposite bullish backwardated structure.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Asian Stocks Fall as China’s Confab Disappoints: Markets Wrap

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad