Oil Edges Lower as Traders Weigh China Outlook in Sparse Trading

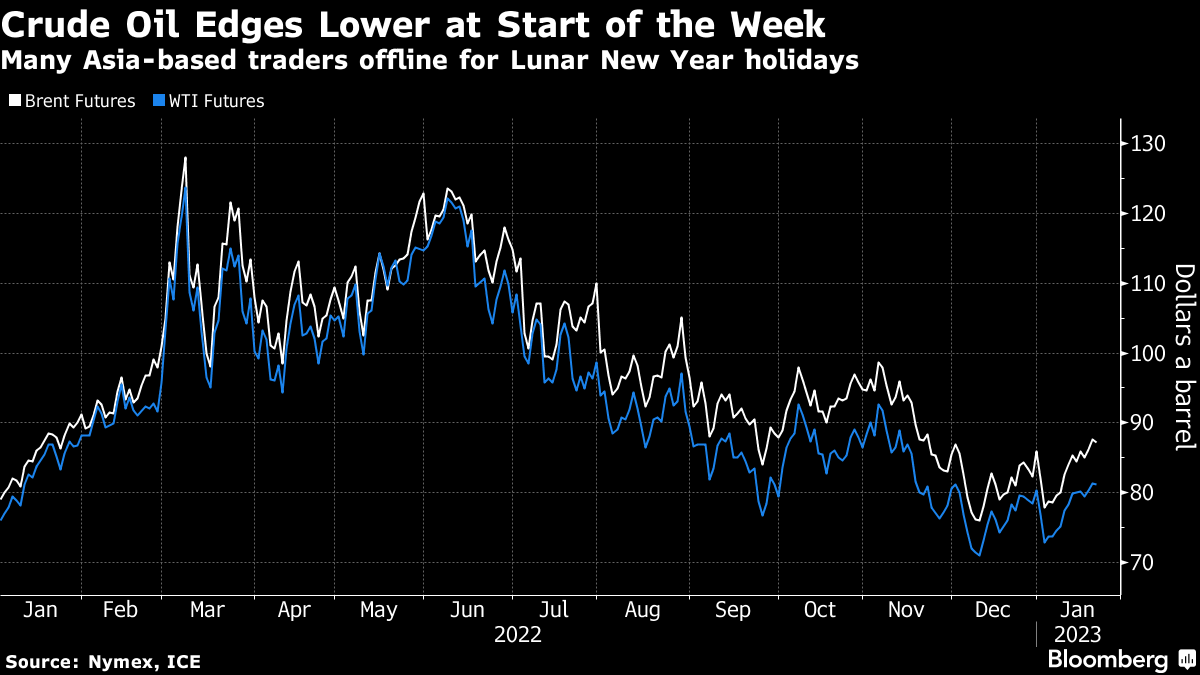

(Bloomberg) -- Oil edged lower, with many Asia-based traders offline for holidays to mark the Lunar New Year, as investors assessed the outlook for demand following China’s reopening and risks to Russian output in 2023.

West Texas Intermediate eased toward $81 a barrel following two weekly gains that saw the US benchmark close at the highest level since mid-November. Oil trading in Asian hours will be held back on Monday, with national holidays in markets including China, Hong Kong and Singapore.

China’s shift away from Covid Zero has bolstered expectations that consumption in the largest importer will expand. Following the pivot, many more Chinese people traveled back to their hometowns for the lunar festival this year, and industrial activity is expected to pick up when workers return.

Oil has shaken off a weak start to the new year to move higher as China’s outlook brightened. Additional support for crude has come from expectations that the Federal Reserve is close to ending its series of aggressive rate hikes, which has weakened the dollar. Traders are also weighing the impact of additional curbs on Russian energy flows as the war in Ukraine grinds on.

SLB, the last of the major oilfield-service providers doing business in Russia, warned last week that drilling and related work in the country will slump this year as its international isolation deepens. In its latest outlook, the International Energy Agency said Russia will shut in about 1.6 million barrels a day of production by the end of this quarter compared with pre-invasion levels.

US Treasury Secretary Janet Yellen expressed confidence at the weekend that restrictions on Russian sales of crude oil can be expanded to refined petroleum products, while acknowledging that the task will be more complicated. The next batch of restrictions is scheduled to come into force on Feb. 5.

Brent’s prompt spread — the gap between its two nearest contracts — remains in a bearish contango pattern, although the differential has narrowed in recent weeks. The spread was 5 cents a barrel in contango on Monday, compared with 58 cents a barrel a month ago.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output