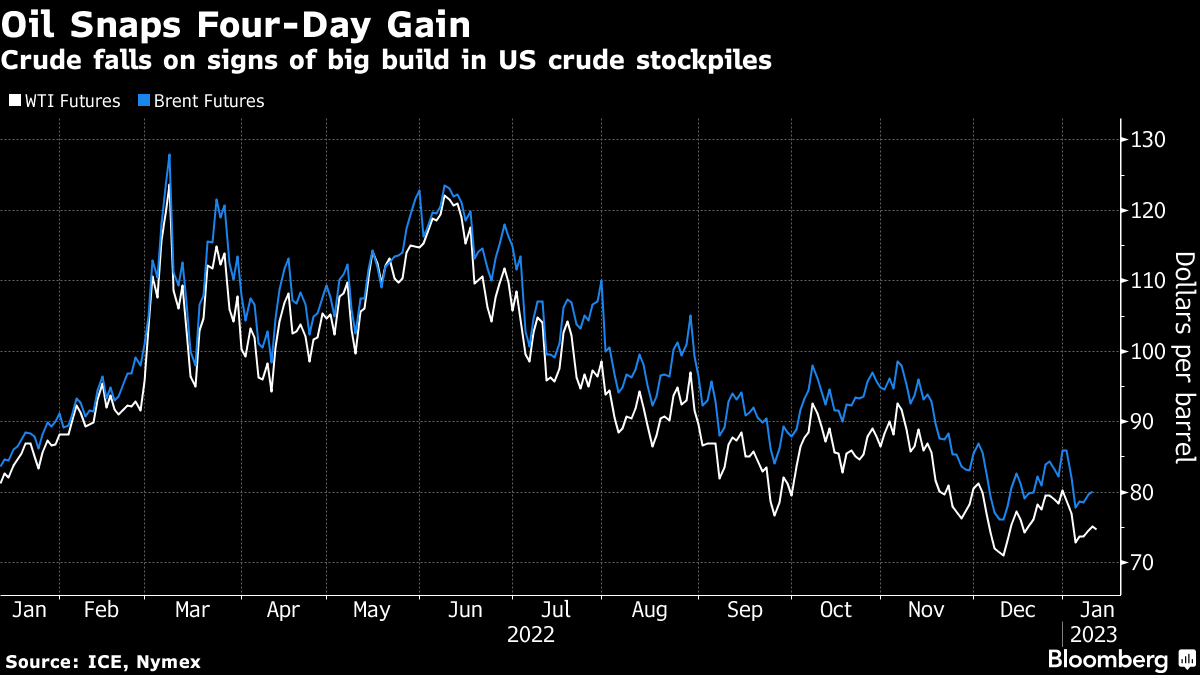

Oil Dips as Industry Data Points to Hefty Rise in US Stockpiles

(Bloomberg) -- Oil fell after an industry report showed a large build in US crude stockpiles amid a downbeat outlook for monetary policy.

West Texas Intermediate dropped below $75 a barrel after adding around 3% over the past four sessions. US crude stockpiles rose by 14.9 million barrels last week, the American Petroleum Institute reported, according to people familiar with the data. If confirmed by the Energy Information Administration later Wednesday, it would be the largest increase since February 2021.

Crude has faced a rocky start to the year, slumping almost 10% in the first two sessions on signs large parts of the global economy are heading into recession, before trending higher. Investors are keenly watching for clues on the outlook for US monetary policy, with JPMorgan Chase & Co.’s Chief Executive Officer Jamie Dimon saying rates may have to move higher than 5%.

“The impact of the bearish API will likely be transient,” said Vandana Hari, founder of Vanda Insights. The market will eventually shift its focus back to the economic outlook and moves by the Federal Reserve, she added.

Near-term time spreads are holding in a bearish contango structure, signaling ample supply. Global benchmark Brent’s prompt spread — the gap between the nearest two contracts — was 16 cents a barrel in contango.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight