Russia Ramps Up Fuel Exports, Undermining Part of OPEC+ Pledge

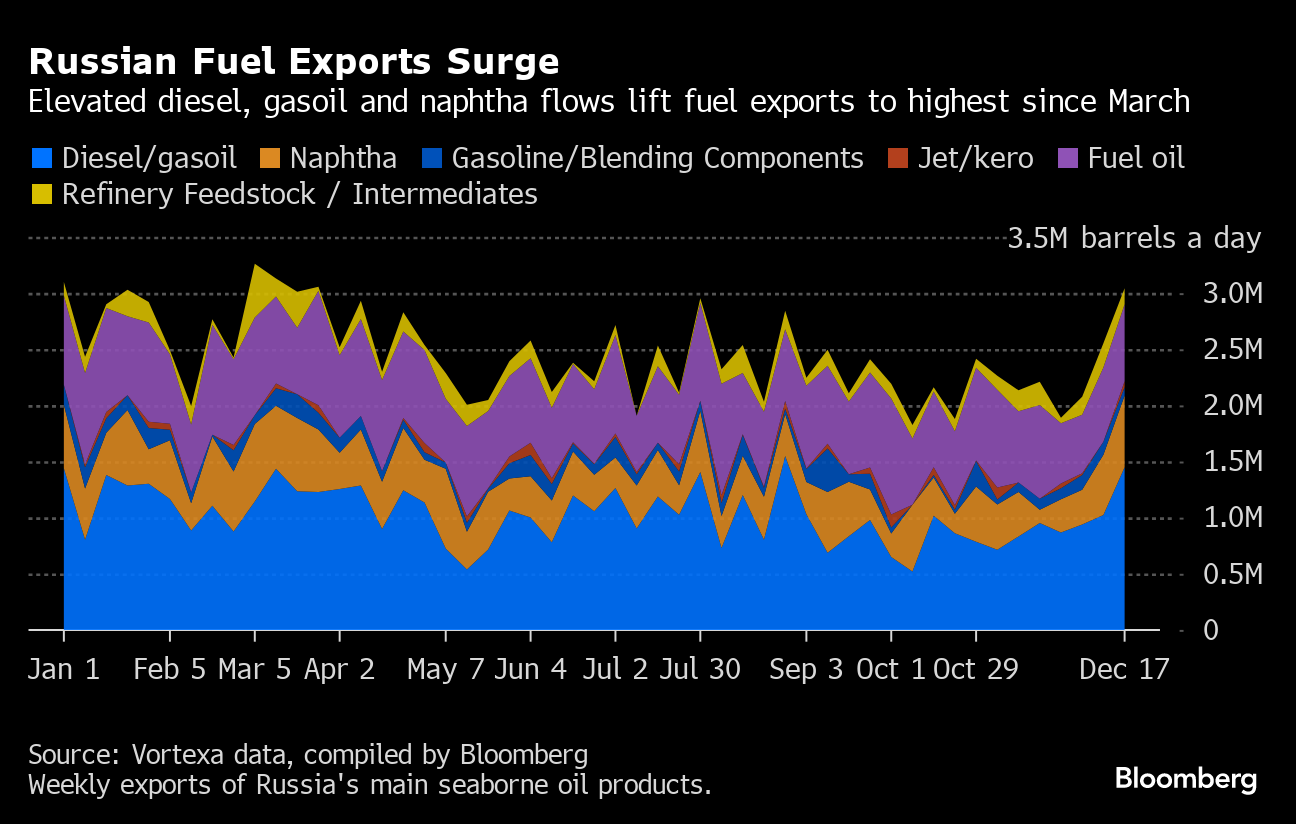

(Bloomberg) -- Russia’s oil product exports have surged this month, buoyed by higher diesel and naphtha outflows as local refiners scale up operations.

Shipments from Russia averaged 2.4 million barrels a day in the four weeks through Dec. 17, according to data compiled by Bloomberg from analytics firm Vortexa Ltd. That’s the highest volume since mid-September.

More volatile weekly flows showed exports jumping to more than 3 million barrels a day, the most since late March.

The oil market is closely watching Russian exports to gauge production volumes since Moscow stopped releasing official output data. At the latest meeting of the Organization of Petroleum Exporting Countries and its allies, the nation pledged to deepen export cuts for both crude and oil products during the first quarter of next year.

Russia’s seaborne crude flows rose to about 3.28 million barrels a day in the four weeks to Dec. 17.

Refined fuel flows are rising at a time when crude-processing at Russian refineries has jumped to the highest since April. Shipments of diesel and gasoil have steadily climbed through December on a weekly basis following the easing of export restrictions on road fuels.

Here’s a breakdown of shipments from Russian ports for the week through Dec. 17:

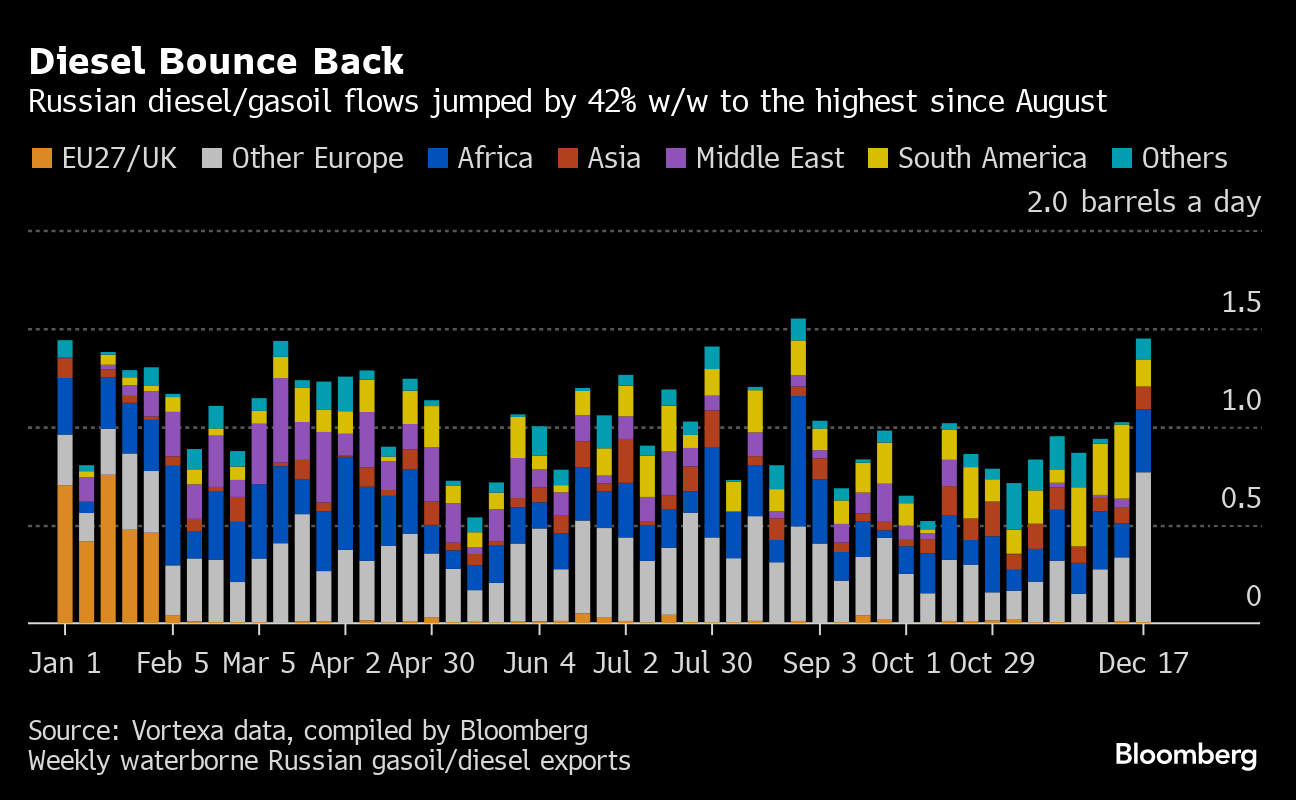

Diesel and gasoil exports soared 42% from the previous week to about 1.4 million barrels a day, the highest since late August.

Russia lifted restrictions on seaborne exports of diesel in October, provided the fuel is delivered to ports by pipeline and refiners keep at least 50% of their output at home. These limitations remain in place for winter grade diesel. More cargoes are heading toward Africa, while flows bound for South America have fallen during the period.

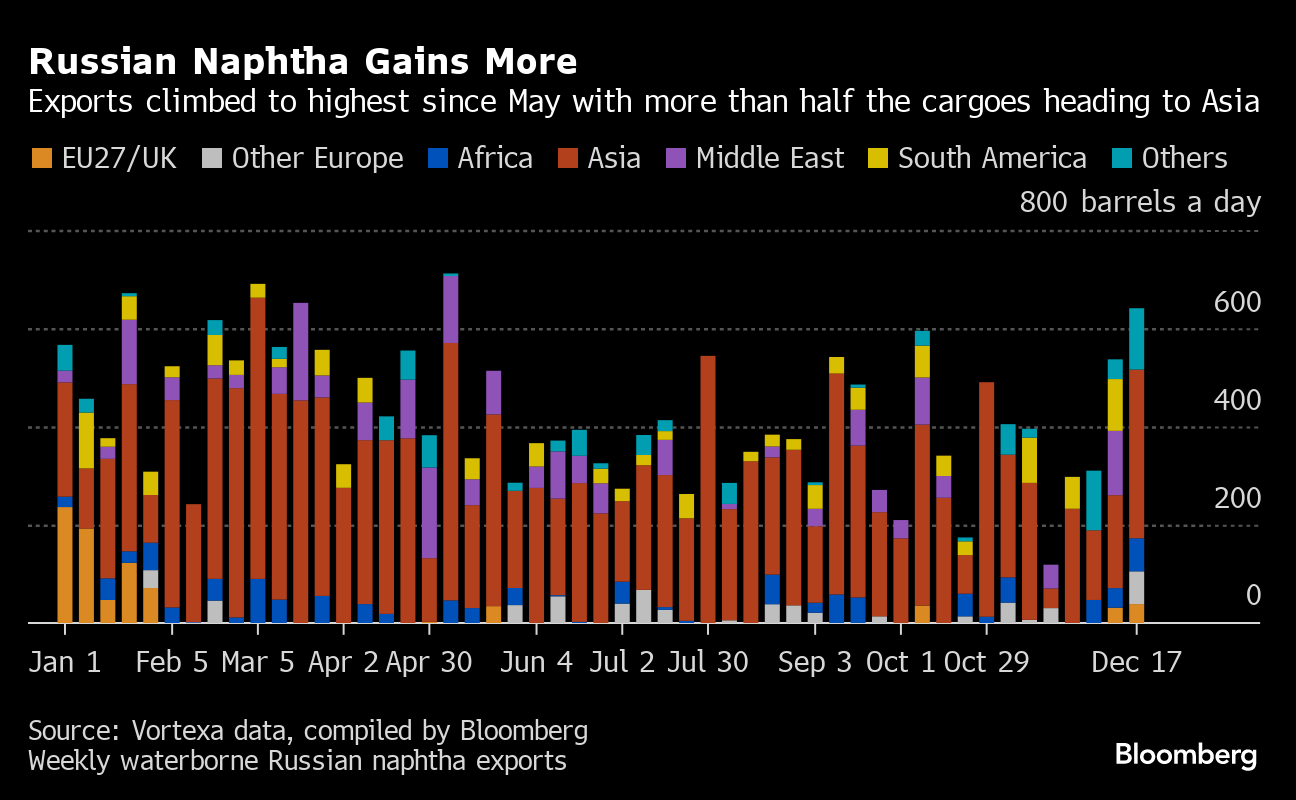

Naphtha shipments rose by 19% on a weekly basis to about 641,000 barrels a day, the highest since May. More than half of the cargoes that sailed last week are heading to Asia.

Gasoline and blending component exports plunged 37% to 73,000 barrels a day, while jet fuel shipments totaled 53,000 barrels a day.

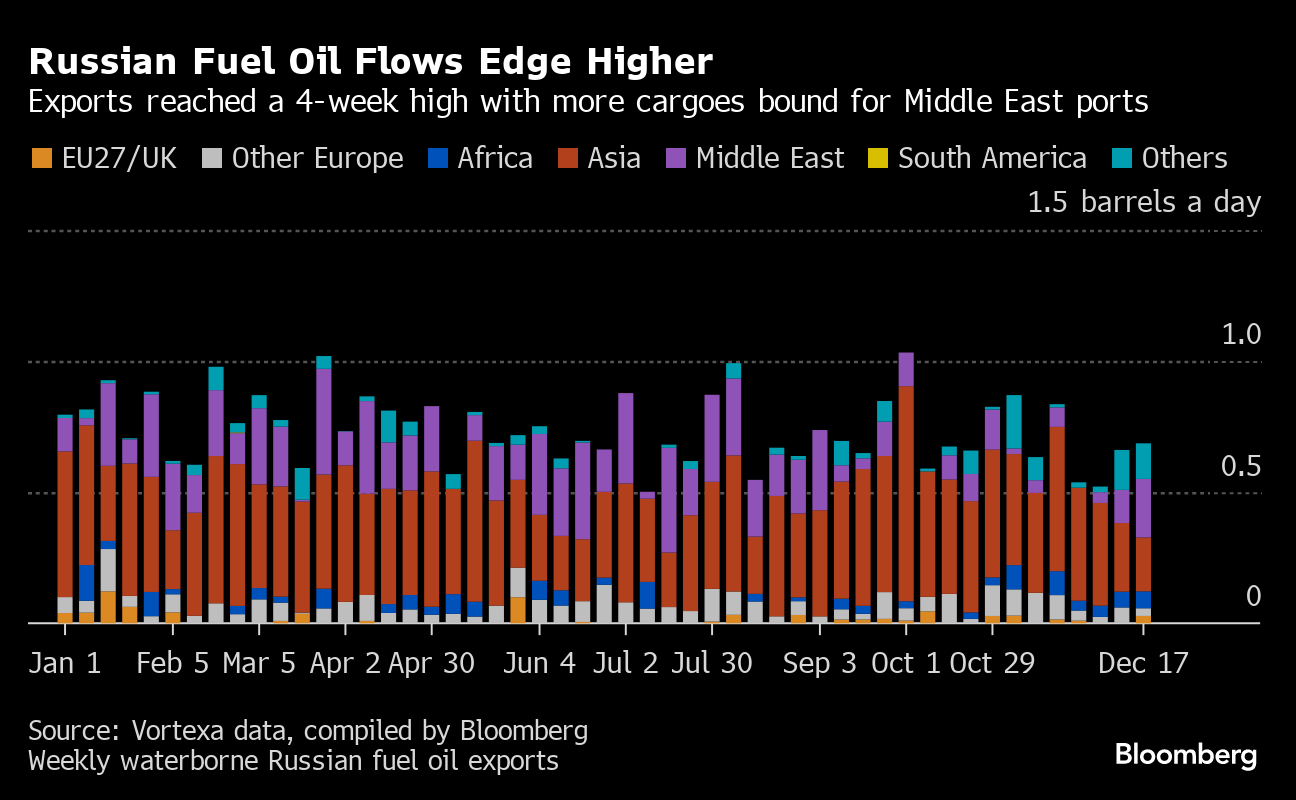

Fuel oil flows edged higher to a four-week high of about 686,000 barrels a day. A third of those cargoes are bound for destinations in the Middle East. Shipments of refinery feedstock like vacuum gasoil slumped 34% to 143,000 barrels a day.

Cargo volumes and destinations are likely to be revised if more port data or vessel information becomes available.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company