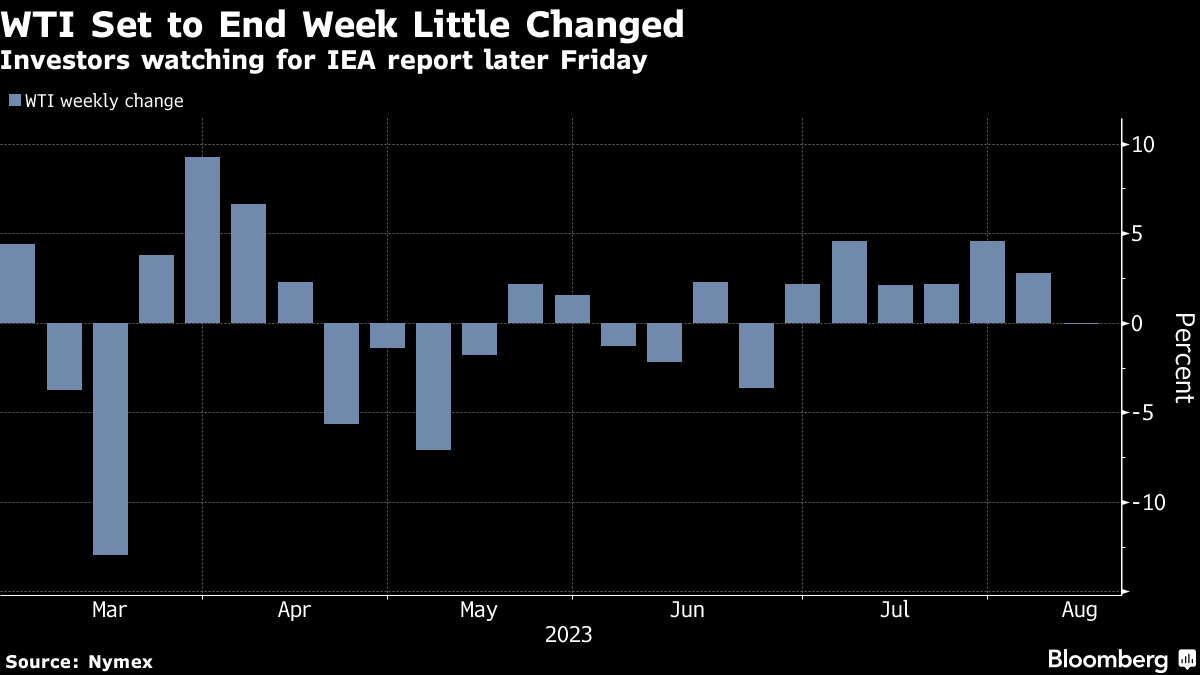

Oil’s Weekly Gain Fades as Market Watchers Wait for IEA Report

(Bloomberg) -- Oil was on track to end the week little changed ahead of a report from the International Energy Agency that will provide a snapshot of a crude market that’s tightening due to supply curbs.

West Texas Intermediate futures traded near $83 a barrel after losing almost 2% on Thursday. Global markets are heading for a sharp supply deficit of more than 2 million barrels a day this quarter as Saudi Arabia slashes output, according to a monthly report from OPEC on Thursday.

Oil has rallied since late-June on the cuts from Saudi Arabia, aided by export curbs from OPEC+ ally Russia, but China’s lackluster economic rebound still presents a significant headwind. Meanwhile, the US Federal Reserve is likely to leave interest rates unchanged after inflation showed signs of easing.

Iran has moved four US citizens from prison to house arrest, the first step of an emerging deal between Washington and Tehran that could eventually see more barrels from the OPEC producer hitting the market.

“What we anticipate is the acceleration of the trend of de minimis sanctions enforcement to enable Iranian barrels to reach the Asian market,” RBC Capital Markets LLC analysts including Helima Croft wrote in a note. “Nonetheless there remain important spoilers to watch. Congress may seek to upend this informal reset and try to mandate the enforcement of existing punitive measures.”

The tightness is flowing through to downstream fuel markets, with a type of petroleum left over from oil refining costing more than crude in Europe for the first time in decades. Prices of gasoline and diesel are also well above seasonal norms, partly as a result of refinery output curbs.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight