Oil Rises for Third Day as Tighter Market Vies With Demand Risks

(Bloomberg) -- Oil rose for a third day as signs the physical market is tightening and a stall in the dollar’s rally offset growing demand risks in China and the US.

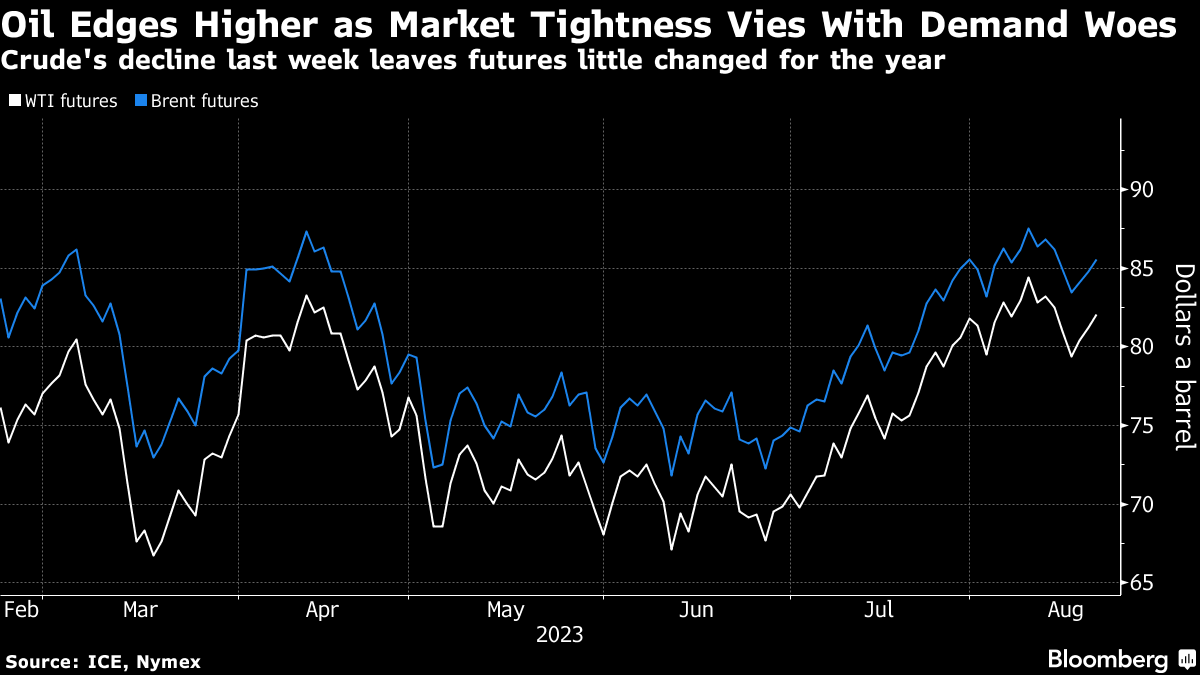

Global benchmark Brent traded above $85 a barrel, and is up more than 2% since last Wednesday’s close. Supply curbs from OPEC+ linchpins Russia and Saudi Arabia have driven a rally since late June, while US crude stockpiles have shrunk to the least since January.

The dollar was steady Monday following declines in the previous two sessions, making commodities that are priced in the currency cheaper for many buyers. That came after the greenback had been strengthening from mid-July.

A stall in the dollar rally over the past few sessions is aiding oil, said Yeap Jun Rong, a market strategist for IG Asia Pte. “All eyes will be on whether China will be able to pull off a recovery through the rest of the year to provide further conviction for oil prices to continue higher.”

Economic malaise in China — ranging from downbeat consumers to struggling exports — and stubbornly persistent inflation risks in the US saw oil fall last week. Chinese banks made a smaller-than-expected cut to their benchmark lending rate Monday and avoided trimming the reference rate for mortgages, despite the central bank putting pressure on lenders to boost loans.

The annual Jackson Hole symposium in Wyoming on Thursday and Friday, which features speakers including Federal Reserve Chair Jerome Powell, may provide clues on the direction of interest rates. More increases in borrowing costs may be coming in the US after minutes of the Fed’s July meeting showed officials remained concerned about the inflationary threat.

Meanwhile, some refined products such as diesel — the workhorse fuel of the global economy — have started pricing in scarcity this winter, boosting their premium to the oil from which they are made. Gasoline futures in New York have risen by 15% this year, also outpacing crude.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight