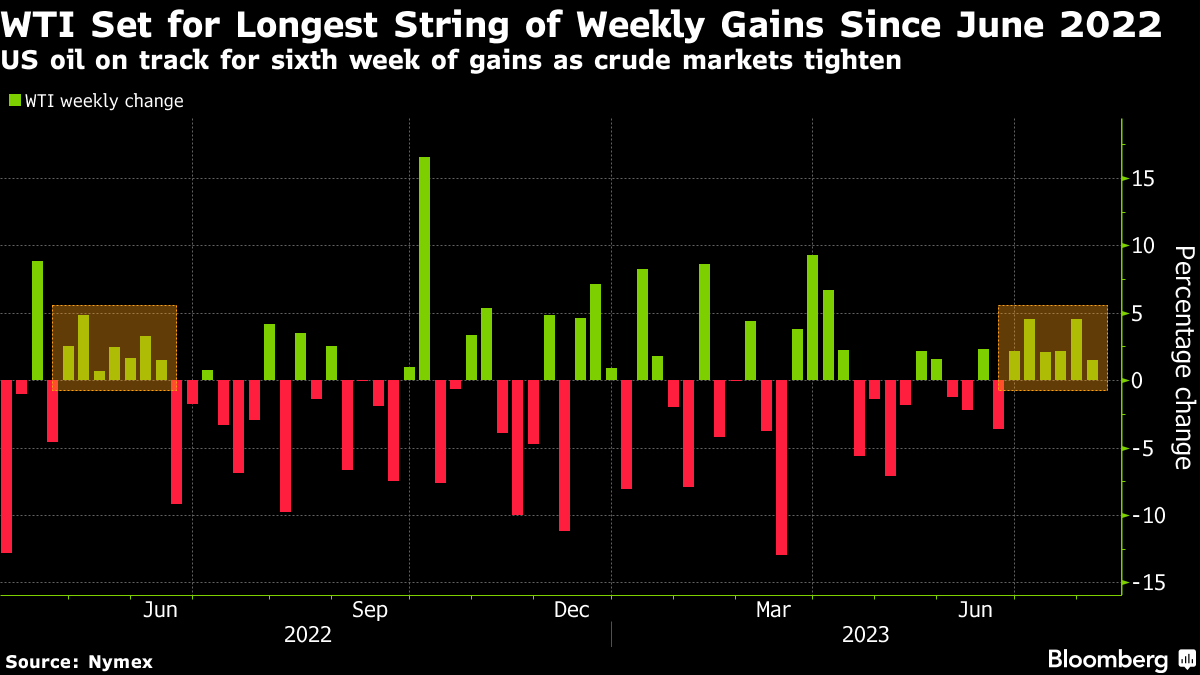

Oil Coasts to Sixth Weekly Gain After Saudis, Russia Extend Cuts

(Bloomberg) -- Oil headed for a sixth straight weekly gain, the longest winning streak in more than a year, after OPEC+ heavyweights Saudi Arabia and Russia extended production cuts into next month and US stockpiles sank by a record.

West Texas Intermediate climbed toward $82 a barrel, taking gains over the six-week span to about 18%. Saudi Arabia said Thursday it would extend its unilateral 1 million barrel a day oil output cut into September, and that the move could be prolonged further or even deepened. Russia will also extend its cut into next month, although it tapered the size of the reduction.

The conflict in Ukraine was also in focus after the Caspian Pipeline Consortium said that Russian authorities temporarily closed Novorossiysk port for marine traffic after a drone attack. Still, oil loadings on moored tankers continued, and there has been no damage to CPC infrastructure, it said.

Crude’s rally means futures in New York have now erased all their year-to-date losses after the Organization of Petroleum Exporting Countries and its allies delivered a collective reduction in supply, which Saudi Arabia and Russia augmented with the additional voluntary cuts that have just been extended. Later Friday, an OPEC+ committee is due to review the market.

“These supply cuts are finally tightening the oil market, especially at the time of peak summer demand,” said Charu Chanana, market strategist at Saxo Capital Markets Pte, referring to the OPEC+ curbs.

US data this week showed the largest-ever drawdown of crude inventories as holdings plunged by more than 17 million barrels, providing further evidence of a tightening market. That helped WTI’s timespreads to strengthen, with the gap between the two nearest December contracts rising above $5.50 a barrel in backwardation from about $3 a month ago.

Goldman Sachs Group Inc. estimated this week that global oil consumption swelled to a record in July, outpacing supplies and putting the market in a deficit. ANZ Group Holdings Ltd., meanwhile, said supply cuts were tightening the market and Brent could rally to $100 a barrel by year-end.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight