Oil Heads for Fourth Weekly Advance as Global Market Tightens Up

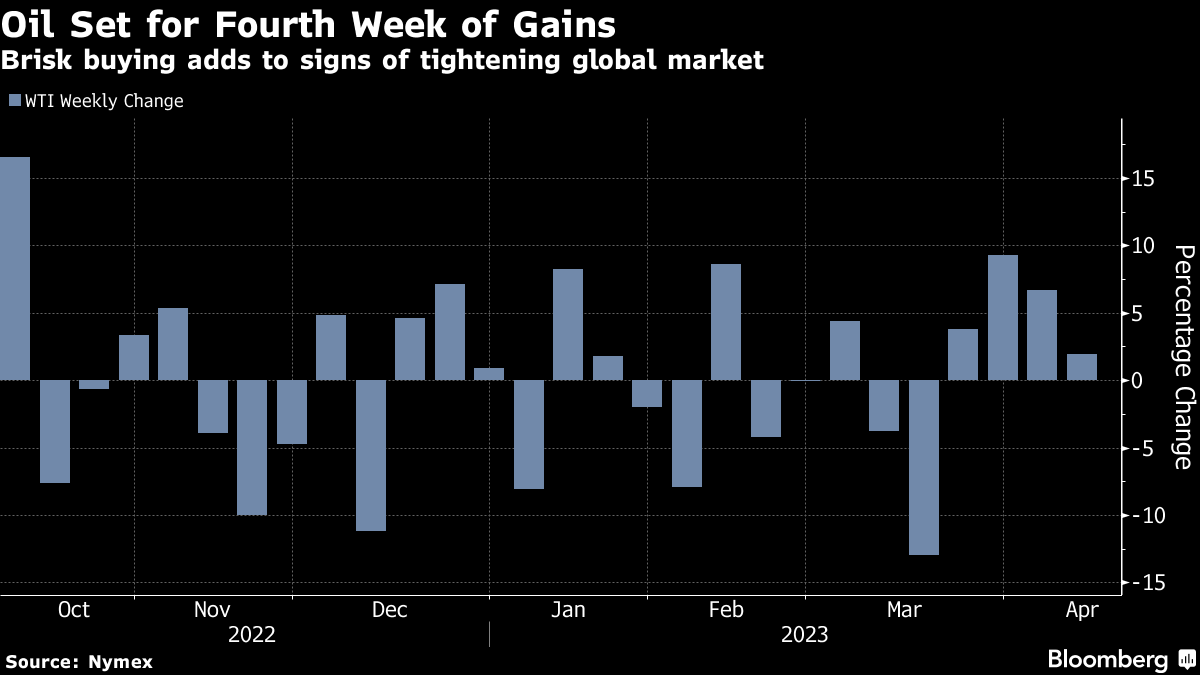

(Bloomberg) -- Oil headed for a fourth straight week of gains, supported by signs of a tightening global market and weaker dollar.

West Texas Intermediate rose toward $83 a barrel, taking its weekly advance to about 2% and the longest winning run since June. The rally had been driven by improving fundamentals after OPEC+ cut supplies, with brisk buying seen in both Europe and Asia. Key market timespreads signal firmer conditions.

The Organization of Petroleum Exporting Countries said Thursday the market was set for a hefty supply deficit that’ll widen as the year progresses. Earlier this week, Fatih Birol, head of the International Energy Agency, said demand may top supply in the second half. The IEA monthly outlook is due later Friday.

Crude has rebounded strongly since hitting a 15-month low in March as OPEC and its allies surprised the market with a significant output cut. The move lifted prices by the most in a year, punishing speculators betting oil would fall. The gains have also been driven by declining US stockpiles, weaker flows from Russia, and interruptions to pipeline supplies from Iraqi Kurdistan.

The dollar is on course for a fifth consecutive weekly decline — the longest losing streak in almost three years — amid speculation that the Federal Reserve is close to ending its rate-hike campaign. A weaker greenback makes commodities priced in the US currency cheaper for many buyers.

“Oil prices have managed to deliver a new, higher high this week, reflecting buyers in control,” said Yeap Jun Rong, market strategist for IG Asia Pte. Tighter supply, a weaker US dollar, and optimism about the outlook for Chinese demand were serving as support for crude, he said.

In China, the world’s largest crude importer, data this week showed oil imports in March swelled to the most in almost three years, underpinned by record Russian flows. On Friday, People’s Bank of China Governor Yi Gang said that the nation’s economy is expected to achieve about 5% growth this year.

WTI’s prompt spread — the difference between its two nearest contracts — was 11 cents a barrel in backwardation, a bullish pattern. That’s compares with 16 cents a barrel in contango, the opposite structure, a month ago.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output