Oil Advances With Equities as Traders Wait for Clues From EIA

(Bloomberg) -- Oil rose as traders looked ahead to a slew of market data that’ll shed light on supply-demand trends after OPEC+ cut production.

West Texas Intermediate advanced above $80 a barrel, gaining along with equities while the dollar fell. In the US, the Energy Information Administration unveils its short-term outlook later Tuesday, while OPEC and the International Energy Agency are also scheduled to issue monthly reports this week.

Crude has rebounded from a 15-month low hit in March as a concerns over a banking crisis faded, US stockpiles fell, and the Organization of Petroleum Exporting Countries and its allies cut output. In addition, there have been disruptions to supply, including a halt to pipeline flows from Iraq to Turkey.

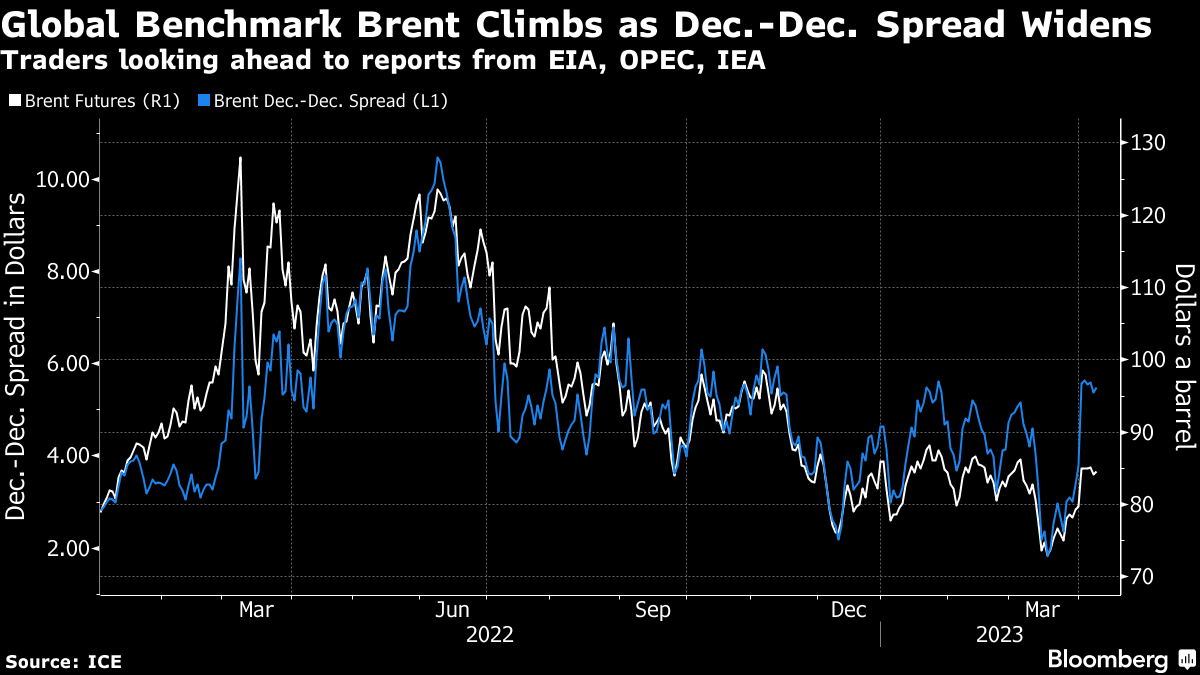

Key metrics suggest tighter conditions. Brent’s December-December spread — the difference between futures for the final month this year and in 2024 — widened to $5.50 a barrel. That compares with $2.53 a barrel three weeks ago.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight

Shell and Equinor to create the UK’s largest independent oil and gas company