Stocks Dip as Dollar Gauge Hovers Near Record High: Markets Wrap

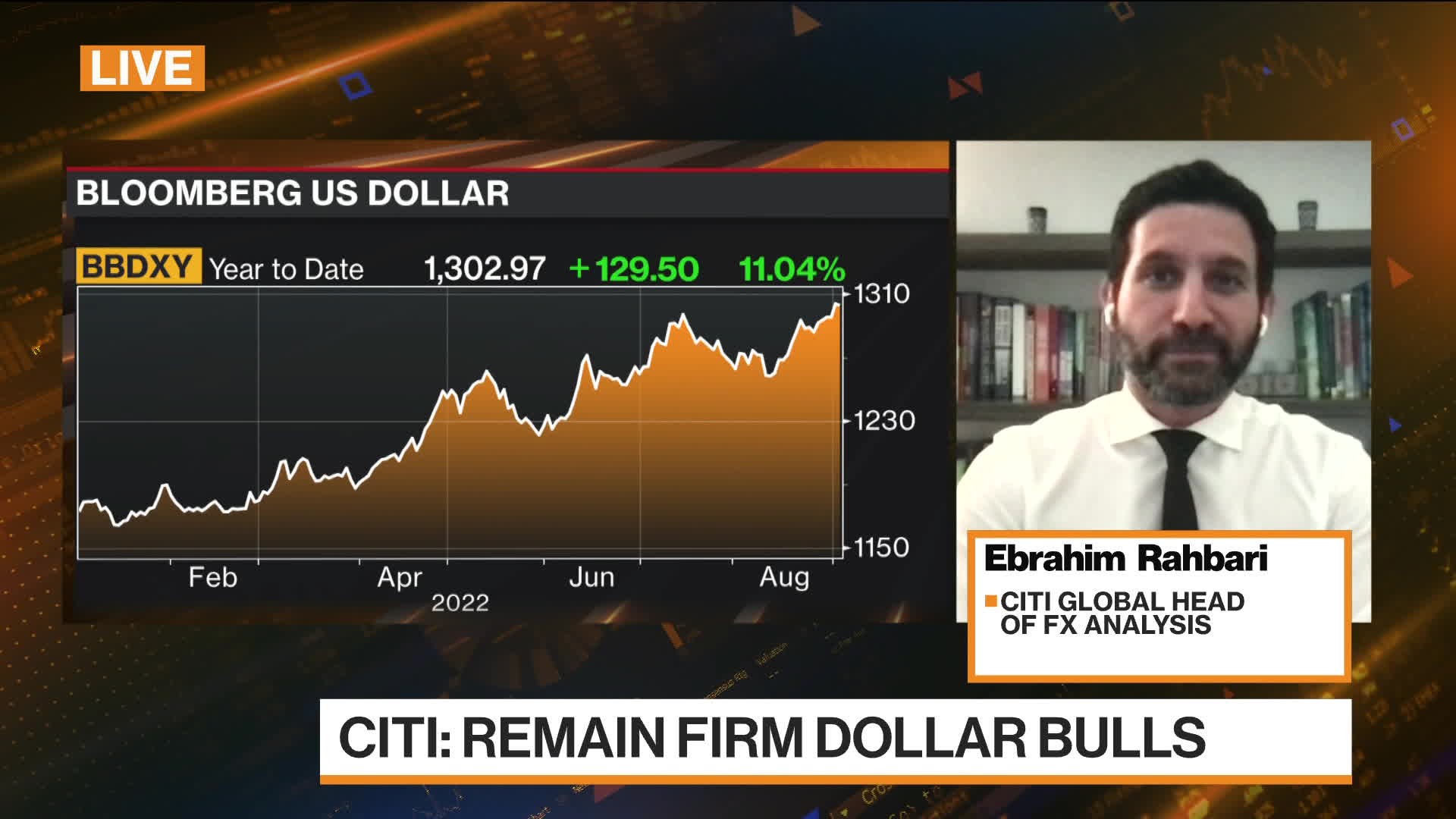

(Bloomberg) -- An Asian stock index fell Friday and a dollar gauge hovered near a record high ahead of key US jobs data that could stir expectations for another sharp Federal Reserve interest-rate hike.

Drops in Japan and Hong Kong weighed on the region-wide equity index, while China’s bourses were mixed. US futures wavered after Wall Street snapped a four-day losing streak to eke out modest gains.

The jobs update Friday is expected to show healthy payrolls growth and follows a stronger-than-expected US manufacturing report. Traders increasingly anticipate another large 75 basis points Fed rate rise to cool inflation.

The two-year Treasury yield was close to the highest since 2007 against that backdrop, while the Bloomberg Dollar Spot Index inched back but remained in sight of the unprecedented level hit Thursday. The euro strengthened.

Global bonds as a whole slumped into their first bear market in a generation: the Bloomberg Global Aggregate Total Return Index of government and investment-grade corporate bonds is down more than 20% from a 2021 peak.

A gauge of world shares is set for its worst week since June, roiled by ebbing bets on tempered Fed tightening after US central bank officials made it clear that they see the need for restrictive monetary settings for some time.

“We don’t have a lot of reasons to be bullish in this type of environment for the next couple of weeks and months,” Meera Pandit, global market strategist at JPMorgan Asset Management, said on Bloomberg Television. “Yet when we think about the longer term perspective and the longer term investor, these are the types of level that can be fruitful in the long run.”

US data showed manufacturing growth steadied in August and that a measure of materials costs fell for a fifth month in a sign of easing inflation pressures.

The payrolls report later Friday is projected to show a 298,000 gain and solid wage growth. Federal Reserve Bank of Atlanta President Raphael Bostic said there’s still some work to do to contain price pressures.

Elsewhere, oil bounced above $88 a barrel, undoing much of the losses sparked by China’s move to lock down the metropolis of Chengdu to curb Covid. The latter step had amplified worries about the commodity demand outlook.

Gold struggled to break above $1,700 an ounce, while Bitcoin held the $20,000 mark -- the crypto version of the line in the sand.

Here are some key events to watch this week:

- ECB Governing Council members due to speak at event Tuesday through Sept. 2

- US nonfarm payrolls, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

Will Chinese sovereign bonds outperform Treasuries? China is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

Some of the main moves in markets:

Stocks

- S&P 500 futures were steady as of 1:45 p.m. in Tokyo. The S&P 500 rose 0.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 was little changed

- Japan’s Topix index dropped 0.3%

- Australia’s S&P/ASX 200 index was steady

- South Korea’s Kospi index added 0.3%

- China’s Shanghai Composite index rose 0.3%

- Hong Kong’s Hang Seng index lost 0.6%

- Euro Stoxx 50 futures rose 1%

Currencies

- The Bloomberg Dollar Spot Index was steady

- The euro was at $0.9963, up 0.2%

- The Japanese yen was at 140.29 per dollar

- The offshore yuan was at 6.9088 per dollar, up 0.1%

Bonds

- The yield on 10-year Treasuries was at 3.25%

- Australia’s 10-year bond yield was at 3.68%

Commodities

- West Texas Intermediate crude rose 2% to $88.30 a barrel

- Gold was at $1,699.13 an ounce, up 0.1%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week