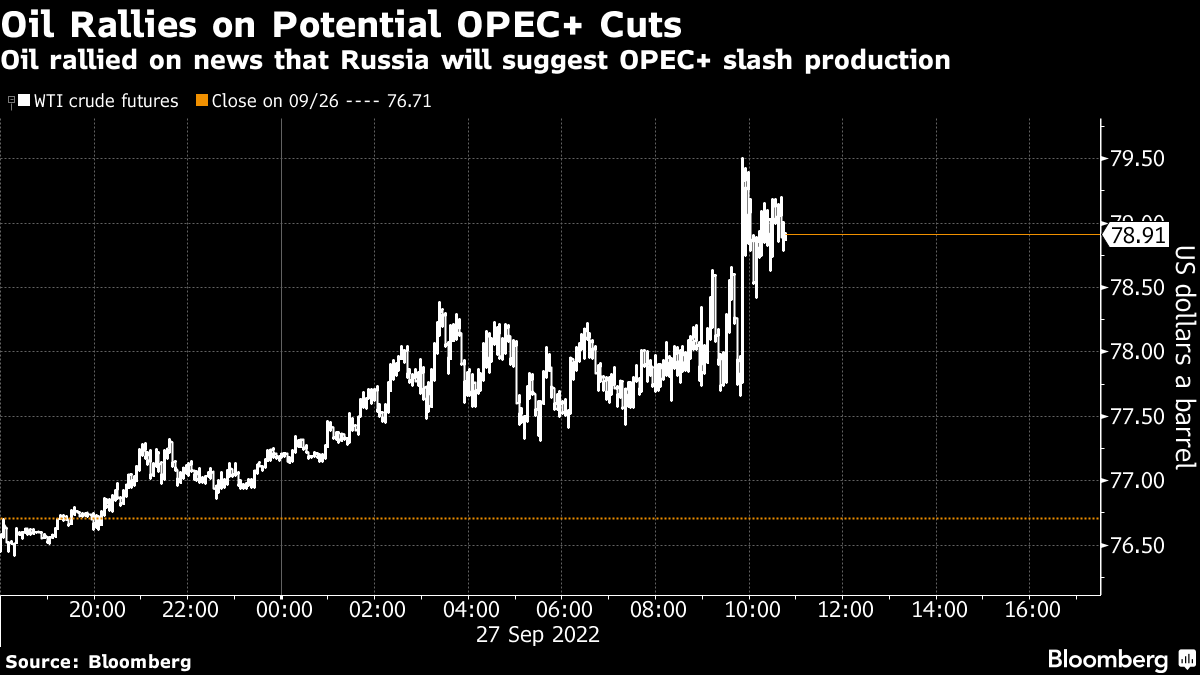

Oil Rallies on Reports of Russia Pushing OPEC+ to Slash Output

(Bloomberg) -- Oil rebounded after a report that Russia will advocate for OPEC+ nations to cut production, heightening supply concerns as deadlines to implement Russian fuel bans approach.

West Texas Intermediate rose as much as 3.7% to trade near $79 a barrel, reversing declines of more than 8% over the previous two sessions. Russia is likely to propose that OPEC and its allies reduced output by 1 million barrels a day at the next meeting in October, Reuters reported. Last week, Nigeria’s oil minister said in an interview with Bloomberg the production cartel would cut production if prices fell much further.

“Russia’s potential recommendation for OPEC+ to reduce output by 1 million bpd is a reminder that the oil producing cartel will do whatever it takes to keep this market tight,” said Ed Moya, senior market analyst at Oanda.

Crude’s rally is gaining support from technical gauges indicating that WTI hit oversold territory yesterday as it fell below $77. Additionally, the market is keeping an eye out for potential disruptions in the Gulf of Mexico as operators shut platforms ahead of Hurricane Ian.

Notwithstanding the day’s rally, the US oil benchmark remains on track for its first quarterly loss in more than two years on concern that energy consumption will fall, as an aggressive round of central bank rate hikes menace global growth. Some analysts have said the slump may spur the Organization of Petroleum Exporting Countries and allies to consider paring supply.

UBS and JPMorgan Chase & Co. are among those in the industry that have called on OPEC+ to make supply cuts, which would help stabilize oil markets. Meanwhile. Goldman Sachs Group Inc. slashed its oil forecasts as markets price in a major hit to the global economy.

“A strong USD and falling demand expectations will remain powerful headwinds to prices into year-end,” Goldman analysts including Damien Courvalin wrote in a report. “Yet, the structurally bullish set-up -- due to the lack of investment, low spare capacity and inventories -- has only grown stronger, inevitably requiring much higher prices.

Top traders have also indicated wariness about the recent price pullback. Trafigura Group’s chief economist said commodity markets are potentially moving from cycles to a world of price spikes instead amid sustained underinvestment and a lack of spare capacity.

However, a parade of Federal Reserve policy makers signaled on Monday that further rate increases are in store, with the need to tame inflation coming at the cost of a slowdown. Among them, Fed Bank of Cleveland President Loretta Mester said that officials will need to keep restrictive policy in place for longer.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week