Global Stocks Hit Six-Week Low on Fed, China Risks: Markets Wrap

(Bloomberg) -- Stocks fell with US equity futures Thursday on a hawkish drumbeat from central banks and risks from China, pushing up the dollar as investors sought a haven from the volatility in global markets.

Tech firms contributed to a near 2% drop in an Asian share index, while S&P 500 and Nasdaq 100 contracts slid, the latter in part on a tumble in chipmaker Nvidia Corp. over a sales warning.

China’s move to lock down the metropolis of Chengdu from Thursday to tackle Covid also hurt sentiment. It’s the biggest Chinese city to face such curbs since Shanghai’s bruising two-month crisis earlier this year.

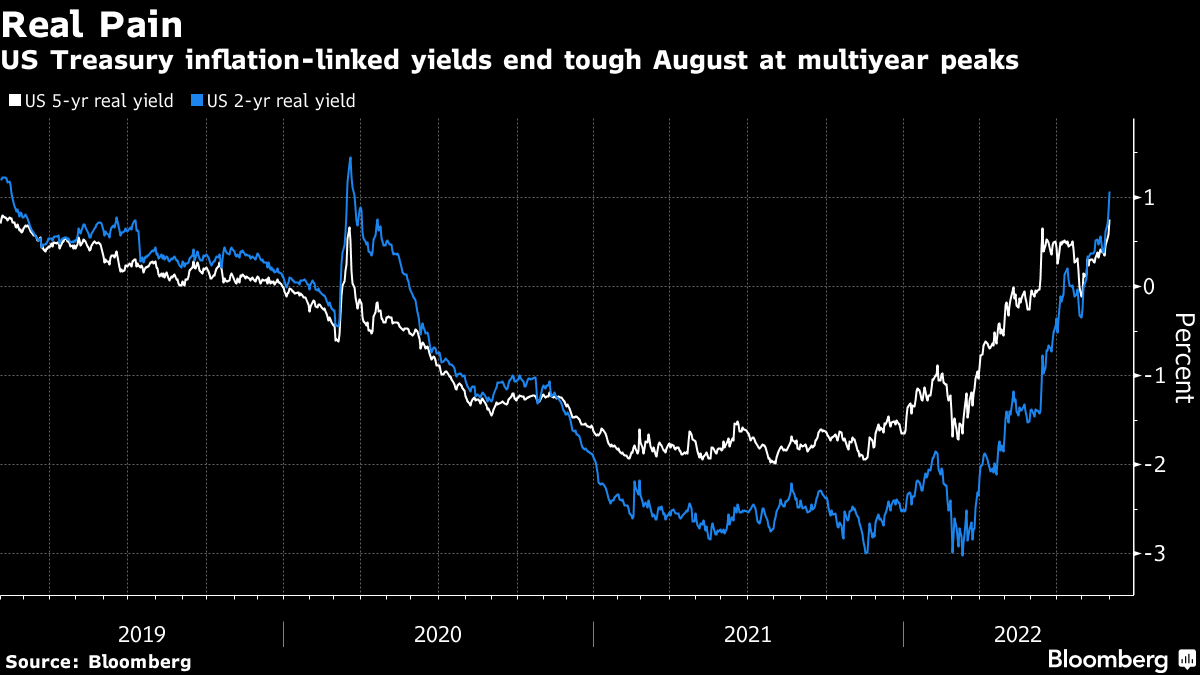

The jitters come after the worst month since June for US shares, reflecting fears of an economic downturn alongside restrictive monetary policy to curb inflation. The two-year Treasury yield touched 3.50% for the first time since 2007 amid a bond selloff that also buffeted Australian and New Zealand debt.

Commodity-linked and Group-of-10 currencies weakened, while the yen fell to a fresh 24-year low -- heading closer to the 140 per-dollar level.

Stocks are entering a month that is often poor for returns after an August of losses across asset classes. A global share gauge is down to a six-week low as the Federal Reserve pushes back against bets on tempered rate hikes. Global bonds, meanwhile, are near their first bear market in a generation.

The market is getting the message that the US central bank is going to fight inflation at all costs, Frances Stacy, director of strategy at Optimal Capital Advisors, said on Bloomberg Radio. “I don’t think we’ve seen the bottom for this year,” she added.

No Cuts

Cleveland Fed President Loretta Mester reiterated the central bank needs to raise its benchmark rate above 4% by early next year. She said she doesn’t anticipate rate cuts in 2023.

Elsewhere, oil was on the back foot, sliding to about $89 a barrel. Aggressive Fed tightening and China’s slowdown are dimming the demand outlook. Bitcoin weakened, hovering around the closely watched $20,000 level.

The latest economic data underlined a parlous outlook for China. A private survey suggested factory activity contracted in August, sapped by power shortages and Covid-linked curbs.

Here are some key events to watch this week:

- ECB Governing Council members due to speak at event Tuesday through Sept. 2

- US nonfarm payrolls, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

Will Chinese sovereign bonds outperform Treasuries? China is the theme of this week’s MLIV Pulse survey. Click here to participate anonymously.

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.7% as of 1:05 p.m. in Tokyo. The S&P 500 fell 0.8%

- Nasdaq 100 futures fell 1.2%. The Nasdaq 100 fell 0.6%

- Japan’s Topix index slid 1.4%

- South Korea’s Kospi index dropped 1.9%

- Australia’s S&P/ASX 200 Index lost 1.9%

- Hong Kong’s Hang Seng Index slid 1.5%

- China’s Shanghai Composite Index rose 0.2%

- Euro Stoxx 50 futures declined 0.9%

Currencies

- The Bloomberg Dollar Spot Index was up 0.4%

- The euro was at $1.0015, down 0.4%

- The Japanese yen was at 139.49 per dollar, down 0.4%

- The offshore yuan was at 6.9167 per dollar, down 0.1%

Bonds

- The yield on 10-year Treasuries was at 3.19%

- Australia’s 10-year yield increased 10 basis points to 3.69%

Commodities

- West Texas Intermediate crude fell 0.3% to $89.31 a barrel

- Gold was at $1,706.45 an ounce, down 0.4%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight