Energy Woes Cast Pall Over Europe Futures, Stocks: Markets Wrap

(Bloomberg) -- European equity futures sank 3% and the euro fell Monday as the region’s worsening energy crisis added to concerns about a global economy already facing high inflation and a wave of monetary tightening.

An Asian equity index was also in the red, paced by losses in Hong Kong, where tech shares slid as traders weighed the risk of US curbs on investment. US contracts wavered after the worst week for world shares since June.

The dollar was firm as commodity-linked currencies joined the euro’s retreat. Oil jumped past $88 a barrel before an OPEC+ meeting on supply. Cash Treasuries and US stocks are closed because of the Labor Day day holiday.

Russia’s Gazprom PJSC last week again halted its key European gas pipeline indefinitely after Group of Seven leaders agreed to implement a price cap on Russian oil as the Kremlin continues its war in Ukraine. Natural gas prices are set to test records, and Europe could roll out special steps to rein in power costs. Germany plans a $65 billion package to shield consumers.

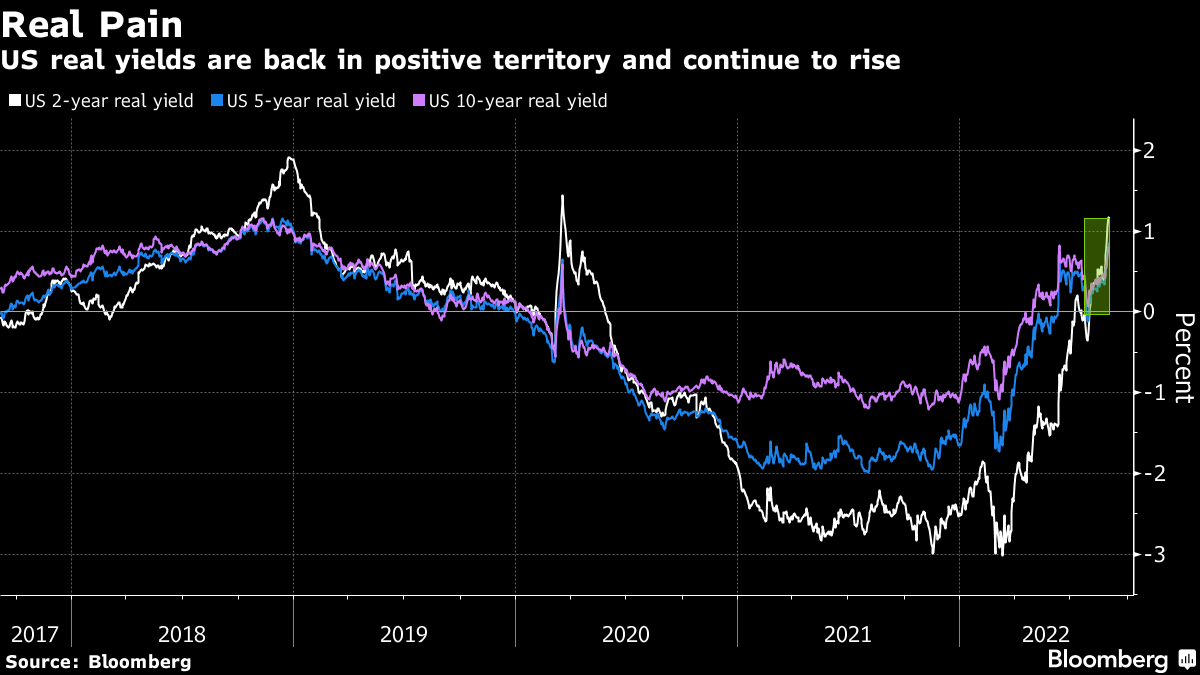

Monetary authorities including Europe’s central bank are set to keep hiking interest rates this week to fight inflation despite the darkening global economic outlook due to risks such power shortages and China’s Covid curbs. An attendant advance in real yields -- seen as the true cost of money for borrowers -- poses an obstacle to a variety of risk assets.

“The EU energy situation highlights the very challenging environment for central banks as they normalize policy settings and continue to hike,” said Su-Lin Ong, head of Australian economic and fixed-income strategy at Royal Bank of Canada.

Markets also face more uncertainty from US-China tension. The Biden administration is considering moves to curb US investment in Chinese technology firms and will allow Trump-era merchandise import tariffs to continue while the levies are reviewed.

Separately, China extended its lockdown in districts of the megacity Chengdu and ordered more mass testing there as it tries to contain a Covid outbreak.

In the UK, Conservative Party members are expected to name Liz Truss as their leader, clearing her way to become prime minister. Her plan to “turbo-charge” the economy by slashing taxes is already worrying investors amid double-digit inflation. The British pound weakened against the greenback.

Elsewhere, Bitcoin hovered near the $20,000 level. Gold was little changed.

What to watch this week:

- UK prime minister to be announced, Monday

- OPEC+ meeting on supply, Monday

- Australia rate decision, Tuesday

- Apple event due to feature new iPhones, watches, Wednesday

- Bank of England Governor Andrew Bailey at Treasury Committee, Wednesday

- Fed’s Beige Book of regional economic activity, Wednesday

- Cleveland Fed President Loretta Mester due to speak, Wednesday

- European Central Bank rate decision, Thursday

- Fed Chair Jerome Powell speaks at a Cato Institute conference in Washington, Thursday

- Reserve Bank of Australia Governor Philip Lowe speaks at event, Thursday

- China PPI, aggregate financing, money supply, new yuan loans, Friday

- EU energy ministers extraordinary meeting on emergency intervention in electricity markets, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 12:50 p.m. in Tokyo. The S&P 500 fell 1.1%

- Nasdaq 100 futures were steady. The Nasdaq 100 fell 1.4%

- Japan’s Topix index was steady.

- Australia’s S&P/ASX 200 index added 0.2%

- South Korea’s Kospi index fell 0.2%

- China’s Shanghai Composite index added 0.1%

- Hong Kong’s Hang Seng index shed 1.3%

- Euro Stoxx 50 futures sank 3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.4% to $0.9915

- The Japanese yen was at 140.32 per dollar, down 0.1%

- The offshore yuan fell 0.4% to 6.9411 per dollar

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.19% on Friday

- Australia’s 10-year bond yield was at 3.64%

Commodities

- West Texas Intermediate crude rose 2% to $88.61 a barrel

- Gold was at $1,712.30 an ounce

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week

Oil Steadies as OPEC+ Opts Again to Delay Plan to Restore Output

NMDC LTS to acquire 70% equity stake in Emdad

Oil Holds Drop as OPEC+ Decision on Supply Takes the Spotlight