Oil Steadies With Market Expecting OPEC+ to Deliver Major Cut

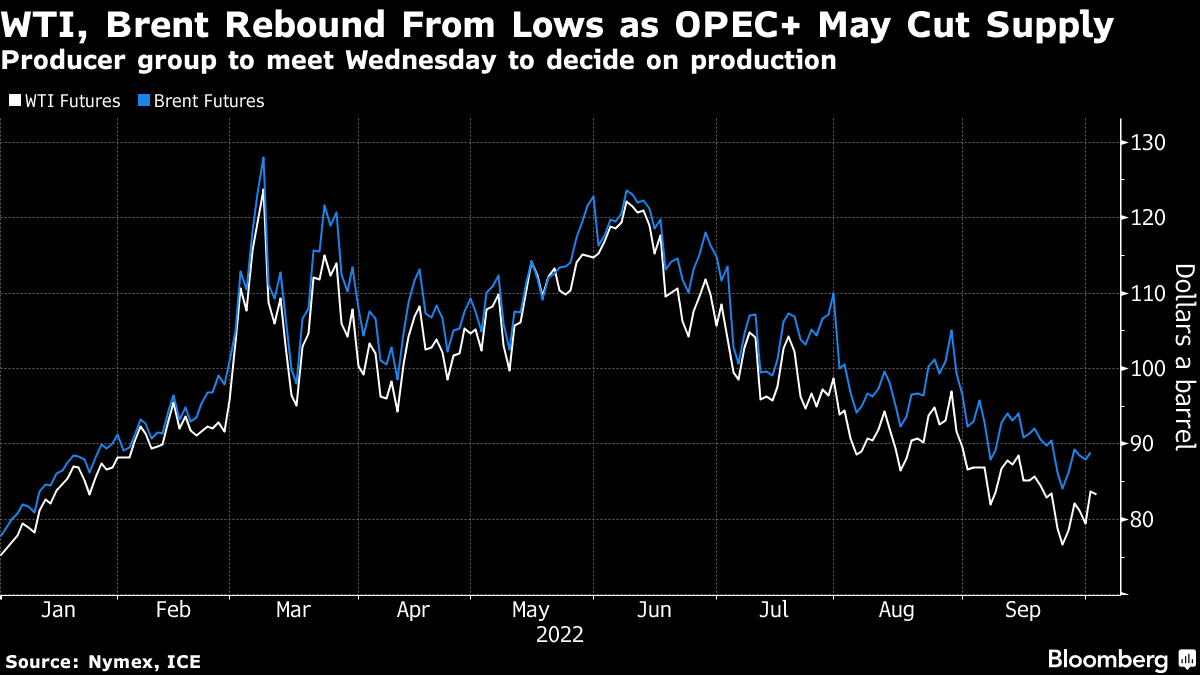

(Bloomberg) -- Oil steadied after posting the biggest one-day gain since May as the market looked to OPEC+ to deliver a substantial cut in supply.

West Texas Intermediate traded near $84 a barrel after rallying by more than 5% on Monday. The Organization of Petroleum Exporting Countries and its allies including Russia will consider reducing output by more than 1 million barrels a day when they meet on Wednesday, according to delegates.

Oil slumped 25% last quarter as central banks including the Federal Reserve raised rates aggressively to combat runaway inflation. The shift to tighter monetary policy spurred speculation of a sharp slowdown in global growth, hurting demand for commodities that were also hit by a surging dollar.

“We see a significant chance of a cut as large as 1 million barrels,” Australia & New Zealand Banking Group Ltd. analysts including Daniel Hynes said in a note. “Anything less than 500,000 barrels a day would be shrugged off.”

The OPEC+ gathering in Vienna will be the group’s first in-person meeting since the pandemic forced the group online. In addition, ministers plan to hold a press conference after their session, the first such briefing since last year.

At present, many OPEC+ nations are unable to meet their current production quotas in full given supply constraints. That means that any agreement on a headline reduction in collective output -- known as a paper cut -- would not lead to a commensurate drop in actual barrels given the mismatch.

“While we are expecting to see a large cut on paper, in reality the cut will likely be much smaller,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore. A reduction of 1 million barrels a day, would mean an actual cut of less than 400,000 barrels, he estimated.

Goldman Sachs Group Inc. said that a potential reduction by the alliance “would occur amid one of the tightest markets in recorded history,” according to an Oct. 3 note entitled “OPEC takes on the Fed”. Still, such a decision could be justified by the recent large decline in crude prices, it said.

A move by OPEC+ to rein in output would be a setback for US President Joe Biden, who’s urged the group to add barrels to counter inflation ahead of midterm elections next month. It also suggests efforts to isolate Moscow for its invasion of Ukraine aren’t working as well as the administration would like.

The prospect of less supply from the alliance has helped to widen major market timespreads, indicating an expectation for tighter conditions. WTI’s prompt spread -- the difference between its two nearest contracts -- was 94 cents a barrel in backwardation, up from 35 cents two weeks ago.

Elements, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More oil news

Enbridge Pipeline Says Wisconsin Oil Spill’s Cleanup in Progress

Wall Street Weighs ‘Hawkish Cut’ While Tech Shines: Markets Wrap

Oil Rises as Possible Iran, Russia Sanctions Temper Glut Outlook

China’s Weak Winter LNG Demand Provides Relief for Rival Buyers

Oil Edges Higher Ahead of US Inflation Figures and OPEC Report

Oil Slips as Glut Outlook Outweighs Optimism on China Stimulus

Oil Edges Higher as Traders Weigh Fallout From Syrian Upheaval

China’s Solar Industry Looks to OPEC for Guide to Survival

Five Key Charts to Watch in Global Commodity Markets This Week